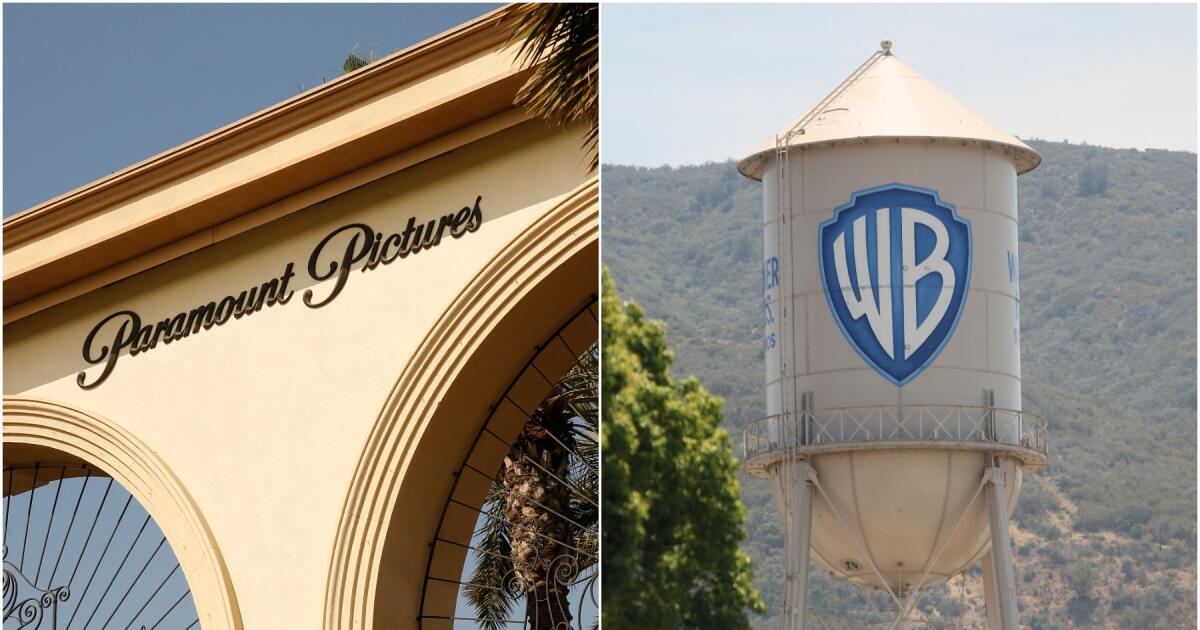

Paramount ups bid for Warner Bros. as sale veers into politics

As Paramount moved Monday to sweeten its bid for Warner Bros. Discovery, a high-stakes political battle is playing out behind the scenes.

Paramount’s latest offer enhanced its earlier $30-a-share bid, valued at $108 billion, said a person familiar with the process who was not authorized to comment publicly. Details of the revised proposal, first reported by Bloomberg, were not immediately available.

The firm is leveraging both the dynastic wealth of Larry Ellison’s empire and his ties to the Trump administration to dismantle Netflix’s rival $82.7-billion deal for Warner, which owns CNN, HBO and the premier Hollywood film and television studios, according to people close to the auction.

Over the weekend, President Trump turned up the heat, demanding that Netflix “IMMEDIATELY” fire Susan Rice — a former Obama and Biden administration official — who serves on Netflix’s 13-member board or “pay the consequences.”

Trump, in a Saturday night social media post, called the former ambassador “deranged … She’s got no talent or skills — Purely a political hack!”

Trump previously said he would not get involved in the pivotal Warner Bros. auction, instead leaving the matter to the Department of Justice, which is investigating whether a Netflix takeover, or Paramount’s alternative bid, would harm competition. Trump has been an outspoken critic of CNN and many of its on-air hosts.

Netflix won the bidding for the storied studio and HBO in December, prompting the spurned Paramount executives to launch a multipronged strategy to scuttle the Netflix deal.

Netflix co-Chief Executive Ted Sarandos sought to downplay the latest controversy, saying during a BBC interview Monday: “This is a business deal, it’s not a political deal.”

But Paramount, which declined to comment for this article, has not been shy about playing its political cards.

Warner Bros. Studio in Burbank.

(Myung J. Chun/Los Angeles Times)

The company, overseen by Larry Ellison’s son, David, is trying to convince Justice Department regulators and Warner Bros. shareholders that the Netflix deal is too dicey and that they should instead side with Paramount, said sources who were not authorized to comment publicly.

Paramount has attempted numerous maneuvers to gain the upper hand.

“This deal was never going to be decided on the merits of the offer or rigid antitrust considerations,” said Gabriel Kahn, a professor at the USC Annenberg School for Communication and Journalism. “This was a classic Trump administration deal where proximity to the president counts a lot more than financial terms.”

Trump’s Saturday night outburst came after Rice, during a podcast interview last week, said that “it is not going to end well” for corporations, media outlets and law firms that “bent the knee” to Trump should Democrats regain control in Washington.

The comments of Rice, a Netflix director for eight years, came as Paramount-owned CBS was involved in a headline-grabbing dust-up with late-night talk-show host, Stephen Colbert, over Trump’s Federal Communications Commission chair‘s threat to modify a rule requiring that broadcasters to give political candidates equal time. Colbert has accused his company of kowtowing to Trump, which CBS has denied.

Netflix’s Sarandos and Paramount’s David Ellison have made separate treks to the White House.

In October, Paramount hired a former Trump administration official, Makan Delrahim, who oversaw the Justice Department’s antitrust division during Trump’s first term, to quarterback Paramount’s campaign to win over regulators and politicians.

A formidable ally — Sen. Ted Cruz (R-Texas) — recently visited Delrahim on Paramount’s Melrose Avenue lot in Los Angeles. While there, Cruz said he was a fan of the CBS show “NCIS,” which prompted Paramount executives to put together an impromptu tour of the “NCIS Origins” soundstages, according to a person familiar with the visit.

In December, Delrahim made a tactical move to apply for Justice Department approval of Paramount’s deal — despite the absence of a signed agreement with the Warner Bros. board and the consent of its shareholders. The gambit was meant to speed the agency’s approval should the Netflix deal crumble. Warner stockholders are expected to vote March 20.

Last week, Paramount announced that a major deadline had passed without pushback from the Justice Department. “There is no statutory impediment in the U.S. to closing Paramount’s proposed acquisition of WBD,” Paramount said in a regulatory filing.

Paramount faces a separate deadline late Monday to improve the finances of its proposed takeover to shake the support of Warner Bros. Discovery’s board members for the Netflix deal.

Paramount wants to buy all of Warner Bros. Discovery, including CNN.

Netflix, in contrast, does not want the bulk of cable TV channels beyond HBO, and has offered $27.75 a share. It has the right to match any improved Paramount proposal.

Warner is planning to spin off the bulk of its channel portfolio, including HGTV, TBS and Cartoon Network, in a separate company. Its shareholders will receive stock in that entity, slated to be called Discovery Global.

Concerns over Netflix’s deal have been mounting.

Department of Justice regulators have sent inquiries to the three companies, according to one senior executive who was not authorized to speak publicly. The department is said to be looking at Netflix’s historic business strategy of steering most of its film releases to its streaming platform, often bypassing movie theaters. Sarandos has promised to maintain a 45-day theatrical window for Warner Bros. films.

Bloomberg has reported that regulators also are trying to determine whether Netflix has exerted leverage over creators in negotiations when acquiring programming to build its catalog.

This month, Republican lawmakers blasted Sarandos during a Senate Judiciary Subcommittee on Antitrust, Competition Policy, and Consumer Rights hearing to explore antitrust implications of the Warner Bros. sale. Sen. Mike Lee (R-Utah) sent Netflix a series of pointed follow-up questions, including: “If allowed to proceed, what effect will the merger have on future competition?”

Ted Sarandos, left, and David Zaslav at the 2026 Golden Globes.

(Allen J. Schaben / Los Angeles Times)

The hearing also veered into culture wars, with Sen. Josh Hawley (R-Mo.) suggesting Netflix was promoting a “transgender ideology” to children, which Sarandos denied.

Another Missouri Republican, Sen. Eric Schmitt, accused Netflix of making some of “the wokest content in the history of the world.”

“Netflix has no political agenda of any kind,” Sarandos told the lawmakers.

David Ellison also was invited to appear at the Feb. 3 hearing, but he declined — which raised the eyebrows of some members of the panel.

Skydance Media founder and Chief Executive David Ellison, who leads Paramount, is shown in 2023 in New York.

(Evan Agostini / Invision / Associated Press)

Sen. Cory Booker (D-N.J.) challenged Ellison for failing to answer lawmakers’ questions under oath, including about his dealings with the president.

Ellison instead responded with a statement but Booker and other lawmakers wrote back, saying Ellison’s statement “failed to address” the issues raised by Booker.

“The pattern of evasion, combined with Paramount’s apparent confidence that a politically sensitive transaction will clear without difficulty warrants serious scrutiny,” Booker, Senate Minority Leader Chuck Schumer and others wrote in the Feb. 19 letter.

The Democrats instructed Ellison “to preserve records related to the proposed Paramount-Warner Bros. Discovery transaction.”

The move came days after Gail Slater, the Justice Department’s antitrust chief, was bounced from her job, reportedly after becoming a thorn in the side of some business interests. Slater’s former top deputy, who also left the Justice Department, publicly warned that antitrust decisions are being influenced by corporate lobbyists — not in the interest of ordinary Americans.

“We see this happen again and again,” USC’s Kahn said.

“Let’s not forget that Larry Ellison’s Oracle was part of the consortium that purchased the U.S. operations of TikTok. Repeated complaints from the FCC about content at CBS have been heeded by the Ellison regime,” Kahn said, adding: “This is the reality of trying to do any business in the Trump administration: It’s about payoffs and proximity.”