What soaring government borrowing means for YOUR wallet from higher taxes to mortgage rates – what you can do now

HOUSEHOLDS across the country are being warned to brace for a financial squeeze as the cost of government borrowing skyrockets to levels not seen since 1998.

This now directly threatens to push up mortgage rates and could usher in a new wave of tax hikes.

The pound has tumbled in response to the growing unease, highlighting investor concern over the UK’s economic stability.

At the heart of the issue are government bonds, known as “gilts,” which the government issues to borrow money.

These bonds offer investors a return, referred to as the “yield.”

In recent weeks, gilt yields have been rising rapidly, making it more expensive for the government to borrow.

This morning, yields soared further, with 30-year gilts reaching 5.72% – the highest level in nearly 30 years – while 10-year gilts climbed to 4.85%.

This spike signals that investors are nervous.

They are demanding a higher return to lend to the UK, worried about stubborn inflation and a gaping £51billion hole in the nation’s finances.

The rise in government borrowing costs is putting serious pressure on household budgets in two key ways

Firstly, it’s driving up mortgage rates.

The link between government gilt yields and mortgage rates is direct and unavoidable.

Lenders use “swap rates,” which closely track gilt yields, to set the prices of fixed-rate mortgage deals.

As these rates climb, fixed mortgages become more expensive.

Since August 1, two-year swaps have risen from 3.56% to 3.74%, while five-year swaps have gone from 3.63% to 3.83%.

Major lenders like Barclays have already started increasing rates, and even a small rise can add significantly to monthly payments on a typical £200,000 mortgage.

With swap rates continuing to rise in recent weeks, experts warn that mortgage rates are likely to increase further.

Separately, Chancellor Rachel Reeves faces a difficult challenge in her Autumn Budget, scheduled for November.

Higher borrowing costs are eating into public funds, and many economists believe tax increases will be necessary to fill the financial gap.

Although the government has promised not to raise income tax, national insurance, or VAT for “working people,” other tax measures are reportedly being considered.

One proposal is applying National Insurance to rental income, which critics fear could result in landlords passing on the cost to tenants through higher rents.

Another idea being debated is replacing stamp duty with an annual property tax, which could affect homeowners.

There are also rumours of reducing pension tax relief or cutting the tax-free lump sum, moves that could generate billions but might hurt savers.

Plus, there’s speculation about lowering the VAT threshold, which would bring more small businesses into the tax system.

This could increase their costs and potentially lead to higher prices for consumers.

Reeves is expected to make economic growth the centrepiece of her next Budget, warning that Britain’s economy is “stuck” and in need of bold solutions.

What can you do about it?

None of the proposed changes have been confirmed yet, and the government hasn’t ruled them out either.

However, any new measures won’t take effect until after the Budget in November.

It’s important not to make rash decisions based on speculation.

If changes are announced, you’ll have time to act and protect your finances before they come into effect.

For instance, if stamp duty is replaced by an annual property tax from a certain date, you could move house before the deadline to avoid the extra cost.

Similarly, if the government introduces capital gains tax on high-value properties, you might consider downsizing to a smaller home before the change is implemented.

Rob Morgan, chief analyst at Charles Stanley, said: “Taking pre-emptive action can outright backfire.

“Last year some people were concerned about restrictions around taking tax free cash from pension and took withdrawals they wouldn’t have otherwise made.

“This removed the money from a tax-efficient environment and potentially stored up tax issues that will come back to haunt them.

“Instead, it’s best to wait to see what happens, consider the consequences, and take advice as required before acting.”

Most of the proposed measures are likely to affect only the very wealthy, so you may not be impacted at all.

If you’re concerned, there are steps you can take to prepare and safeguard your finances.

Check your financial health

If you are worried about your finances then you should speak to a financial adviser.

They will be able to offer you advice about your situation and explain if any of the measures will affect you.

You can find one using unbiased.co.uk – but remember, you will pay a fee.

It’s good practice to sit down and take stock of your finances every six months and work out a plan.

Work out all your bills and outgoings and what income you have and factor in any changes, such as bills going up or new income streams.

Think about what you need to do to make the most of your money. For example, do you need to prioritise paying off debts or saving for a house deposit.

Our guide to paying less tax legally could help you avoid giving away more cash to the tax man than necessary.

Review your mortgage deal

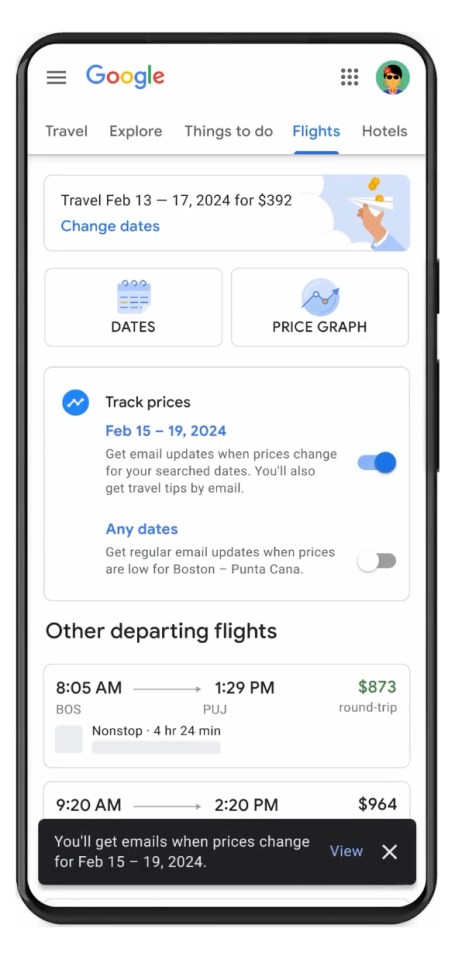

If your mortgage deal is coming to an end soon, act now.

Locking in a fixed rate could shield you from rising rates and market uncertainty.

Aaron Strutt, of mortgage broker Trinity Financial, said “For the moment there have not been significant price hikes but it’s probably worth locking in a mortgage rate if you are buying somewhere or due to remortgage, to try and keep away from any market turbulence.”

If you are coming to the end of a fixed deal, most lenders let you lock in a new rate up to six months beforehand, which can be worth doing.

If rates fall after you agree a new deal, some lenders will let you sign a new one at a lower rate.

How to get the best deal on your mortgage

IF you’re looking for a traditional type of mortgage, getting the best rates depends entirely on what’s available at any given time.

There are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you’re remortgaging and your loan-to-value ratio (LTV) has changed, you’ll get access to better rates than before.

Your LTV will go down if your outstanding mortgage is lower and/or your home’s value is higher.

A change to your credit score or a better salary could also help you access better rates.

And if you’re nearing the end of a fixed deal soon it’s worth looking for new deals now.

You can lock in current deals sometimes up to six months before your current deal ends.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

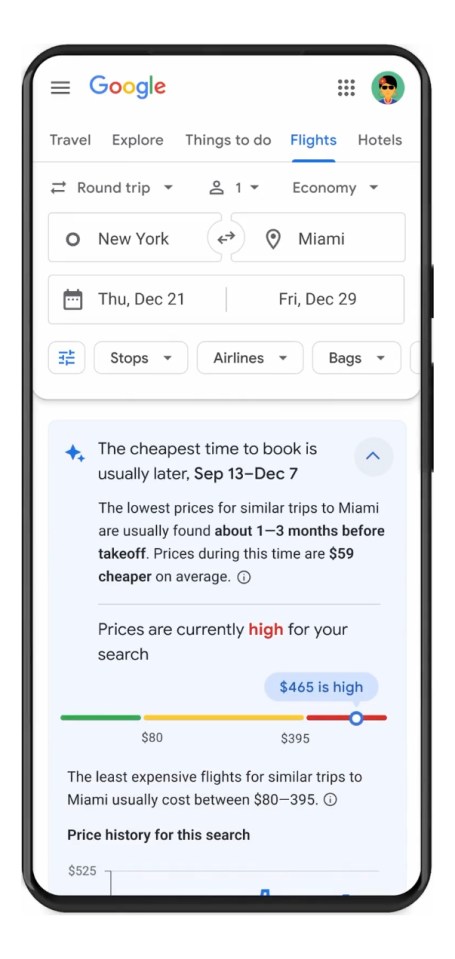

To find the best deal use a mortgage comparison tool to see what’s available.

You can also go to a mortgage broker who can compare a much larger range of deals for you.

Some will charge an extra fee but there are plenty who give advice for free and get paid only on commission from the lender.

You’ll also need to factor in fees for the mortgage, though some have no fees at all.

You can add the fee – sometimes more than £1,000 – to the cost of the mortgage, but be aware that means you’ll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember you’ll have to pass the lender’s strict eligibility criteria too, which will include affordability checks and looking at your credit file.

You may also need to provide documents such as utility bills, proof of benefits, your last three month’s payslips, passports and bank statements.

Think when investing

Gold prices surged to a record high of $3,546.99 per ounce (£2,643.82) on Wednesday, marking its seventh consecutive daily rise.

Investors are flocking to the precious metal as a safe haven amid inflation fears and fiscal uncertainty.

However, financial advisers suggest maintaining a balanced and diverse investment portfolio as a better strategy for managing market volatility.

A small allocation to gold (5-10%) can be useful, but it shouldn’t be the core of your investment plan, according to Charles Stanley.

Don’t forget a will

If you’re concerned about potential changes to inheritance tax, it’s essential to have a will in place.

Without a will, your estate will be subject to intestacy rules, which could result in a higher inheritance tax bill.

This is especially important for unmarried couples, as they won’t automatically inherit from each other, even if they’ve lived together for years.

Check how to make one in our guide.

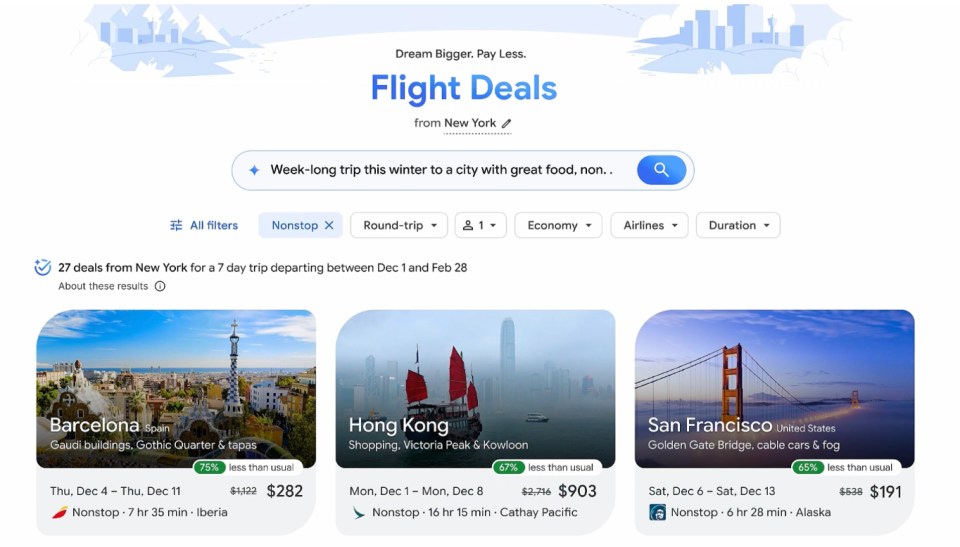

Make your savings work harder

More than 31million bank customers have £186billion in savings accounts earning just 1.5% interest, according to banking app Spring.

These accounts generate £2.3billion a year in interest, but savers could earn over three times more by switching to accounts offering up to 5% interest, The Sun can reveal.

The average bank customer has around £10,000 in savings, according to Raisin.

If that £10,000 is kept in an easy access account earning 1.5% interest, it would generate just £150 in interest each year.

But switching to Cahoot’s 5% easy access account would boost that to £500, earning you an extra £350.

If your savings account pays less than the current inflation rate of 3.8%, it’s time to look for a better deal.

How can I find the best savings rates?

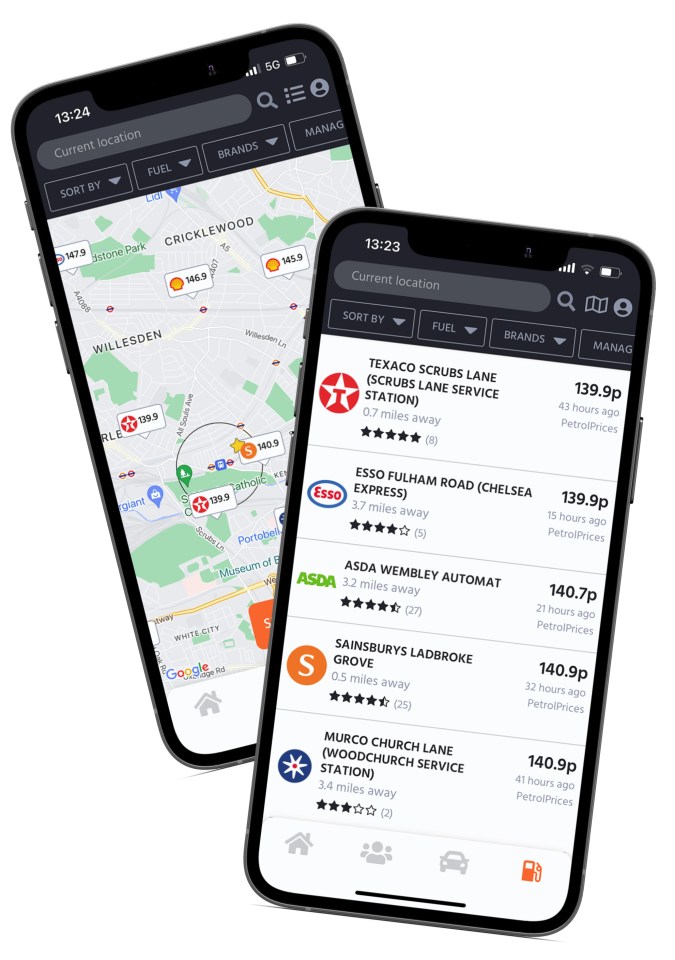

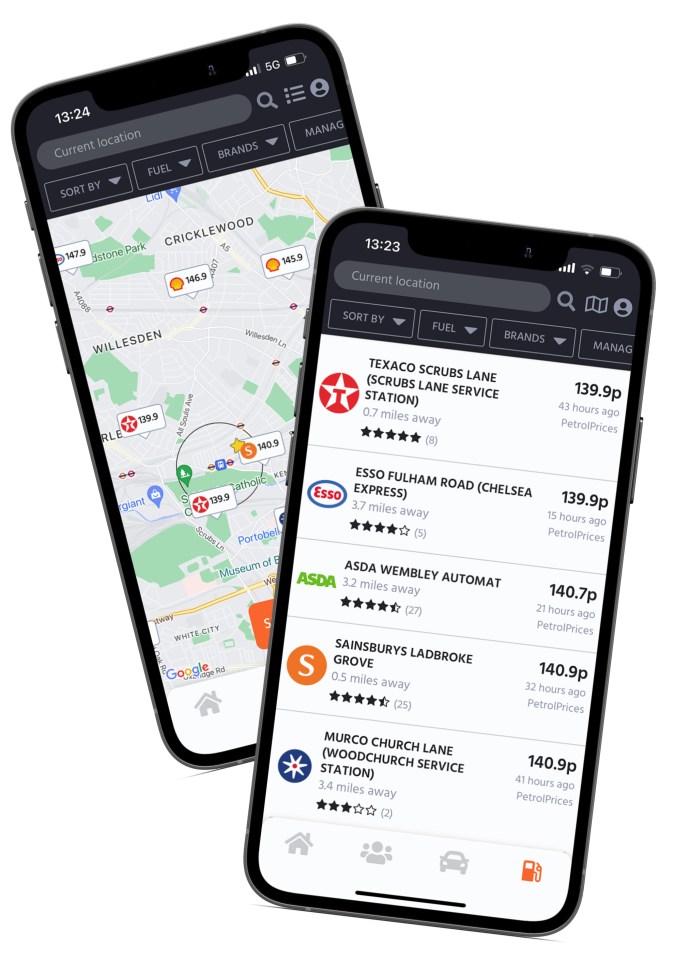

WITH your current savings rates in mind, don’t waste time looking at individual banking sites to compare rates – it’ll take you an eternity.

Research price comparison websites such as Compare the Market, Go.Compare and MoneySupermarket.

These will help you save you time and show you the best rates available.

They also let you tailor your searches to an account type that suits you.

As a benchmark, you’ll want to consider any account that currently pays more interest than the current level of inflation – 3.4%.

It’s always wise to have some money stashed inside an easy-access savings account to ensure you have quick access to cash to deal with any emergencies like a boiler repair, for example.

If you’re saving for a long-term goal, then consider locking some of your savings inside a fixed bond, as these usually come with the highest savings rates.