The California Public Utilities Commission is expected to allow Southern California Edison to hike customer bills by nearly 10% next month, and there may be more increases to come.

Edison’s plan would boost the average residential bill by $17 a month or about $200 a year, the commission said. The monthly bill for a customer using 500 kilowatts would jump from $171 to $188 on Oct. 1.

The five commissioners are scheduled to vote Thursday on the PUC administrative law judge’s proposal. It’s just one of multiple rate hikes Edison has asked the commission to approve in the coming year.

Scores of angry customers have written to the commission since Edison proposed the hike, asking the panel to deny it.

Some customers have pointed out that even as Edison has charged more for tree trimming and equipment upgrades meant to make its system safer and more reliable, its electric lines continue to spark fires.

The company now faces dozens of lawsuits from victims of the Jan. 7 Eaton fire, which killed at least 19 people and destroyed thousands of homes in Altadena. Video captured the fire igniting under an Edison transmission tower. The investigation into the fire’s cause is continuing.

“Please, do not let SCE pass their damages on to their customers,” Sara Green, a Crestline resident, wrote to the commission. “Let them cut executive salaries and forgo dividends, rather than pass this on unilaterally to every customer.”

Other customers have complained about increasing outages, including the preventative blackouts the company uses to try to stop its equipment from sparking fires in hot, windy weather.

William Pilling, a resident of Rovana, a small unincorporated community near Bishop, told the commission last month that he and his neighbors were experiencing “highly frequent service interruptions.”

“This is the very definition of unreliable service,” Pilling wrote. ”We are now being asked to pay more per unit for a lower quality good.”

David Eisenhauer, an Edison spokesman, said in an interview that the company was sensitive to concerns about rising rates. “We know that rate changes are challenging for customers,” he said.

“The cost of action is high, but the cost of inaction is higher,” Eisenhauer said. The increases, he said, were needed to support “a reliable and resilient electric grid that is ready to enable the clean energy transition.”

The proposed 10% hike is the result of what the commission calls a general rate case, where the agency allows utilities to propose how much they need to spend to operate and maintain the electrical grid for the next four years.

After months of hearings and debate, an administrative law judge recommended that the commission allow Edison to spend $9.8 billion on those costs this year — 13.7% more than the amount authorized for last year, according to the release. The proposal is less than the nearly $10.5 billion that Edison had initially requested.

Under the plan, Edison will get additional increases for inflation — and customers will see corresponding hikes — for each year through 2028, the commission said.

Edison says it has increased its spending aimed at preventing wildfires, including by undergrounding lines, installing new insulated wires and increasing equipment inspections in areas with high fire risk. The company has also increased the trimming of trees and other vegetation growing near its equipment.

Eisenhauer said that since 2019 wildfire-related investments have helped drive up rates.

He added that demand for electricity is “growing faster than it has in decades” leading to higher costs. In addition, he said, “threats to grid safety and reliability are becoming more frequent and more costly.”

Since 2014, Edison’s rates have risen by 80% — more than twice the rate of inflation, the commission’s public advocates office said in a May report.

More than 860,000 Edison customers — or 19% of the total — are behind in paying their electric bills, the report said. The average unpaid balance was $957.

The proposed 10% hike is one of several increases Edison has asked the commission to approve, or that state officials have already greenlighted.

In November, customers who use little electricity, like those living in small apartments or those owning solar panels, will see higher bills when the company begins adding a $24 monthly fixed charge, according to a recent Edison release.

In return, the price per kilowatt hour will fall, leading to possible savings for those using more power. For example, a residential customer using 1,000 kilowatts per month — double the average — will see their bill decline to $355 from $380, according to the release.

The commission designed the new monthly charge, which applies to customers of the state’s three largest for-profit electric companies, so that revenue increases from the new fees match the loss from the lower price per kilowatt hour.

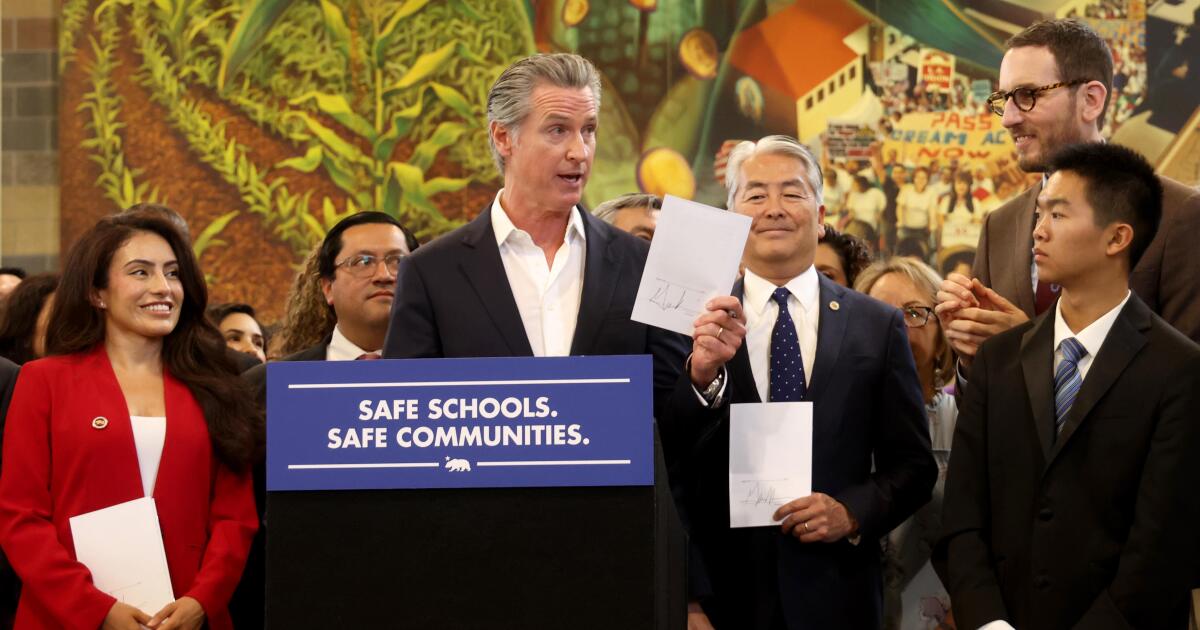

The new fee was created under a bill pushed through the state Legislature in 2022 by Gov. Gavin Newsom. The utilities asked for the change in how electricity was billed to encourage Californians to switch to electric-powered vehicles and home appliances.

Edison also expects to raise rates for the damages from two catastrophic wildfires that investigators found the utility’s equipment sparked.

It has asked the commission for a nearly 2% increase to cover $5.4 billion in damages from the 2018 Woolsey fire, which killed three people and destroyed more than 1,600 homes and other structures in Malibu and nearby communities.

Earlier this year, the commission agreed Edison could increase rates by less than 1% to collect $1.6 billion from customers for damages from the 2017 Thomas fire. The blaze burned more than 280,000 acres in Ventura and Santa Barbara counties and left barren hillsides that helped set off mudslides in Montecito that killed 23 people. The commission must still sign off on final approval of the hike.

Eisenhauer said that under state law utilities are allowed to shift fire damages to customers if they have operated their system prudently and reasonably. He said the two fires were “largely driven by unprecedented and extreme weather events and other factors outside SCE’s control.”

In another proposal, Edison has asked the commission to raise customer bills by 2.1% to increase profits going to its investors, according to its customer notice. The plan would increase its cost of capital — the rate that helps determine how much profit it earns when it builds electric lines and other infrastructure.

The utility asked for the increase in investor profits after its stock price plummeted in January when lawyers claimed its transmission line had ignited the Eaton fire. The company told the commission that because of California’s high risk of wildfire, it needed to earn higher profits to encourage investors to continue holding its stock and to bolster its credit rating.

Despite Edison’s rapidly rising spending on insulated wires, tree trimming and other fire prevention work, its equipment sparked 178 fires last year — up from 90 in 2023.

Company executives said most of those ignitions were small fires that did not spread. The number of fires each year, they said, depends on the weather. Last year, heavy rain and then hot weather, they said, left more dried vegetation.

Edison has said its increased fire prevention work will decrease the number of times that it must shut off power to communities in hot, windy weather to stop lines from sparking fires.

Yet the company said at an Aug. 19 meeting that it expects the number of days of preventative power shutoffs to increase by 20% to 40% this year and that the number of customers subject to them could be twice as high.

Eisenhauer explained that the number of preventative shutoffs was expected to rise because the utility recently lowered the wind speed thresholds that trigger them. The company also added 47,000 more customers to areas believed to have high fire risk, which are subject to the preventative shutoffs, he said.

At the August meeting, Edison executives touted the success of the company’s fire prevention work.

In a presentation, Timothy O’Toole, an Edison board member and head of its safety and operations committee, noted the devastation the January fires caused in and around Los Angeles.

“Nonetheless, we remain very proud and confident in the progress we’ve made,” he said.

O’Toole said the utility’s fire prevention work had “created ever greater protection for our communities and our customers.”

Later in the meeting, Caroline Thomas Jacobs, director of the state Office of Energy Infrastructure Safety, questioned O’Toole’s repeated praise of the company’s work to prevent fires.

“Your tone sounded defensive and justifying the progress that’s made as opposed to acknowledging the humility of what an event like the January fires I would think would bring,” she said to O’Toole.

The public can comment on the proposed hike at the meeting on Thursday or in the docket for the case.