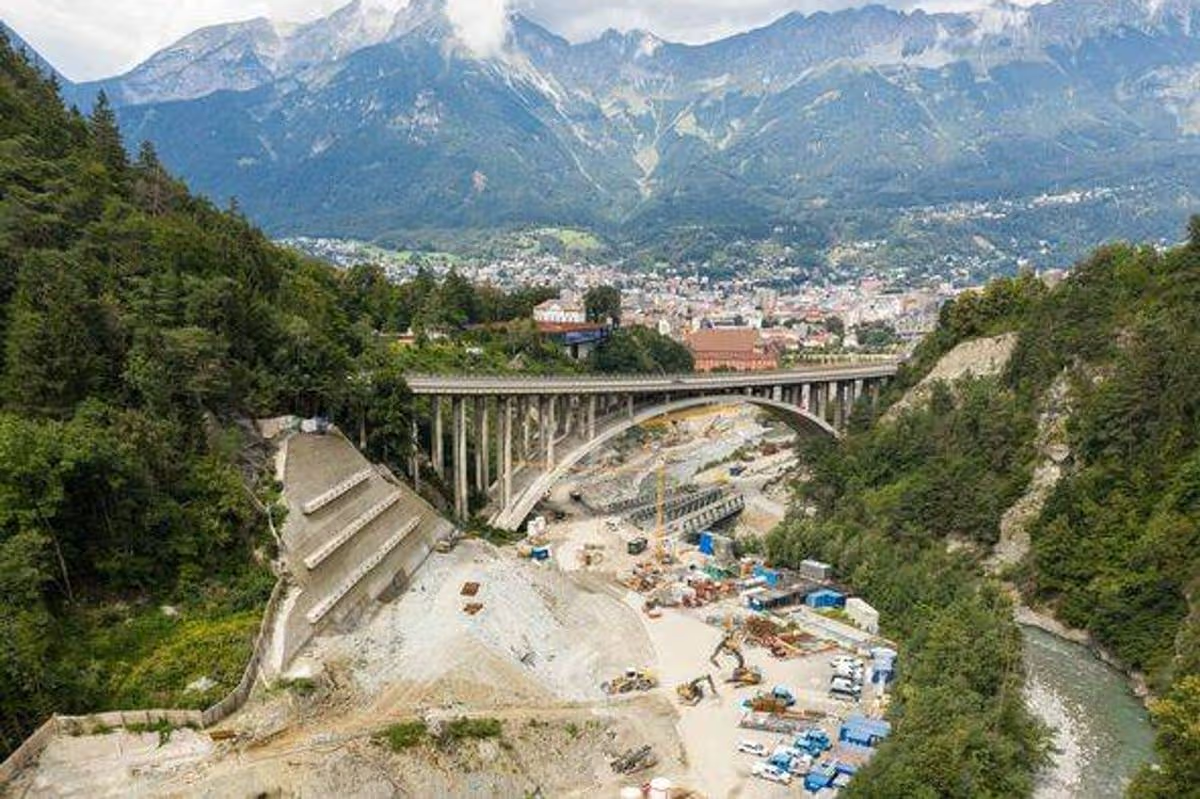

The tunnel will become the world’s longest underground railway connection at 64km long when it opens

The Brenner Base Tunnel is presently being built to link Austria and Italy. This remarkable tunnel, destined to become the world’s longest, is due to open in 2032.

The railway tunnel will join the Austrian city of Innsbruck with Franzensfeste/Fortezza in Italy, connecting two nations across different time zones. Construction expenses are projected at 8.54billion euros (£7.4billion). The extraordinary BBT will stretch for 55km (34 miles) as a cutting-edge railway tunnel.

BBT explained: “In May 1994, a railway bypass was opened south of Innsbruck, known as the Inn valley tunnel. This 12.7 km tunnel links to the Brenner Base Tunnel.

“Passenger and freight trains along this stretch will therefore not only travel through the Brenner Base Tunnel, but for a few kilometres, through the Inn valley tunnel as well. This line, totalling 64 kilometres, will become the longest underground railway connection in the world.”

An unusual characteristic of the Brenner Base Tunnel is the “exploratory tunnel running from one end to the other”.

“This tunnel lies between the two main tunnels and about 12m below them and with a diameter of 5m is noticeably smaller than the main tubes.

“The excavations currently underway on the exploratory tunnel should provide information on the rock mass and thereby reduce construction costs and times to a minimum.

“The exploratory tunnel will be essential for drainage when the BBT becomes operational.”

Additional remarkable railway projects include the globe’s lengthiest train route, which links three nations spanning eight time zones.