Better Artificial Intelligence (AI) Stock: Palantir vs. Nvidia

These two companies represent different sides of the AI investment trend.

The artificial intelligence (AI) megatrend has dominated the stock market over the past three years, and with massive AI spending projections stretching out through 2030 and beyond, that doesn’t look likely to change anytime soon. Two of the most successful stock picks in that part of the tech sector in recent years have been Palantir (PLTR 0.11%) and Nvidia (NVDA 0.86%). They aren’t competitors, as they operate on different sides of the AI value chain. Nvidia is a largely hardware provider, while Palantir makes software.

Both have made their long-term investors a ton of money, but the question is, which one provides the better investment opportunity from here? Let’s break that question down and consider it by category.

Business model

Nvidia makes the world’s leading graphics processing units (GPUs), and its wares are by far the most popular parallel-processor chips for powering and training AI models. Nvidia has enjoyed solid market dominance over the past few years, but rising competition from AMD (NASDAQ: AMD) and Broadcom (NASDAQ: AVGO) could challenge that. Additionally, the AI infrastructure buildout won’t last forever. There will eventually be a time when companies aren’t racing to add high volumes of computing capacity, but instead mostly replacing processors as they reach the end of their useful lifespans.

Palantir sells its customers artificial intelligence-powered data analytics platforms, and it has a large client base in both the commercial and government spaces. Palantir’s software enables those with decision-making authority to act quickly and with the most up-to-date information possible. Furthermore, it also offers automation tools that can task AI agents with jobs that humans have traditionally done, freeing up employees to do work that requires original thinking.

Even after the initial stages of the AI revolution are over, the use cases for AI will continue to grow. Palantir’s software is also a subscription service, so for customers to continue using it, they must pay their Palantir bills every year, while data center operators may be able to put off replacing their Nvidia GPUs for a while. This makes Palantir’s business model more sustainable, giving it the edge here.

Winner: Palantir

Growth rates

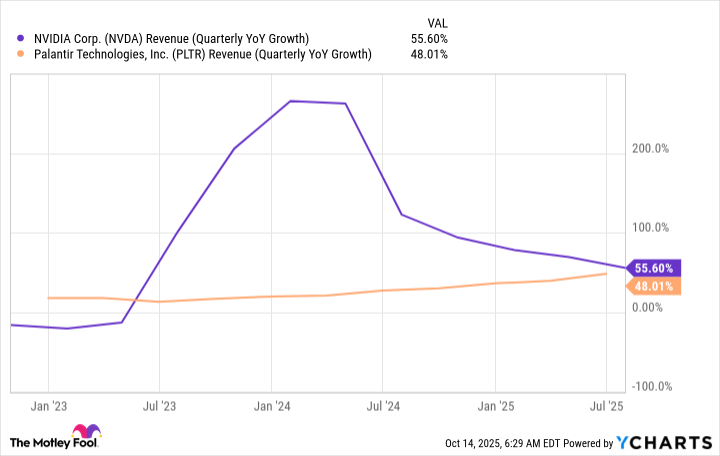

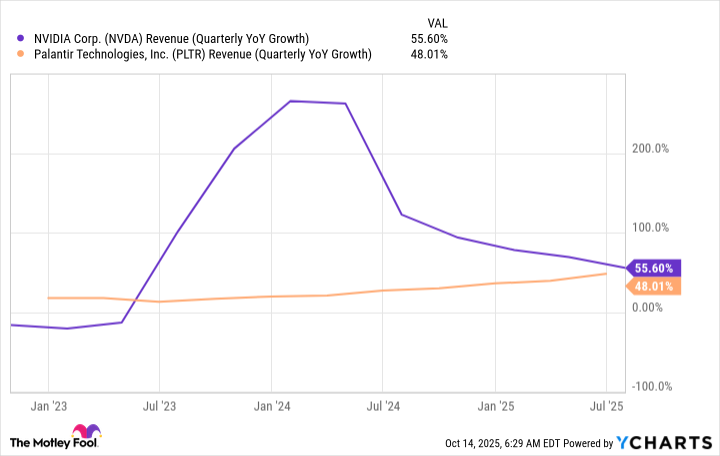

Both companies are growing at similar rates, although Nvidia’s sales have decelerated on a percentage basis, while Palantir’s continue to gradually accelerate.

NVDA Revenue (Quarterly YoY Growth) data by YCharts.

Whether Palantir will take the lead on growth or not, only time will tell, but with massive demand for AI services still out there, each will likely maintain a relatively rapid growth rate for the foreseeable future, leading me to view them as fairly evenly matched by this criterion.

Winner: Tie

Valuation

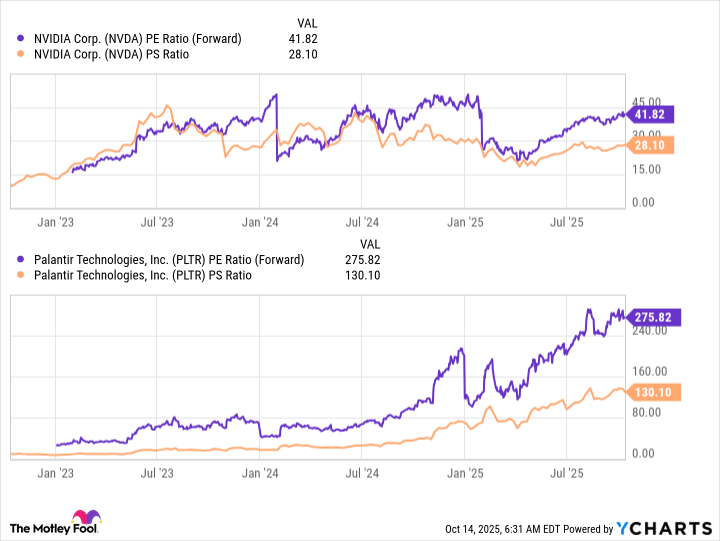

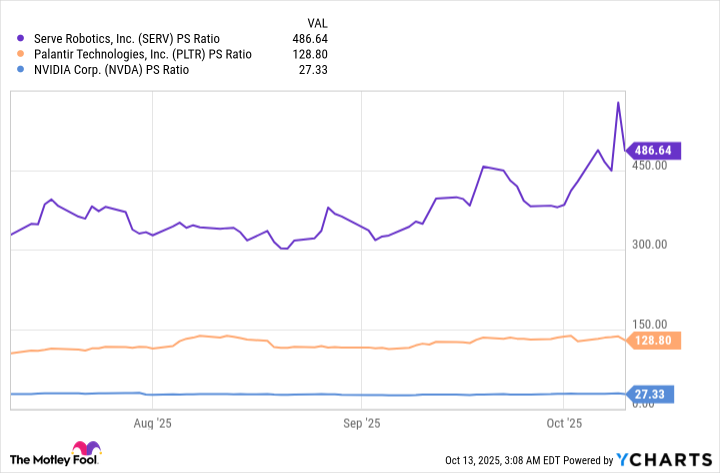

From a valuation standpoint, the comparison isn’t particularly close. Palantir’s stock has delivered incredible returns alongside Nvidia, but a large chunk of Palantir’s share price gains has come from its valuations rising to outsized levels, and that condition is not sustainable.

NVDA PE Ratio (Forward) data by YCharts.

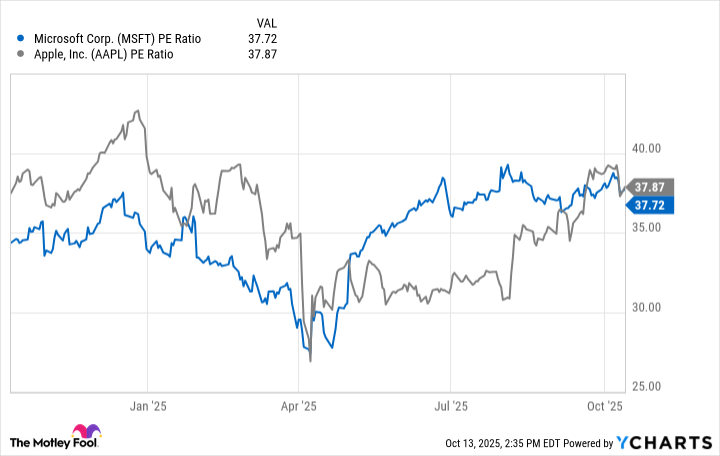

Nvidia trades at a comparatively cheap 42 times forward expected earnings, while Palantir’s ratio tops 275. For comparison, if Nvidia had the same forward P/E as Palantir, it would be worth over $30 trillion, versus the $4.6 trillion it’s actually worth.

This shows that Palantir is overvalued. It will have to deliver years of sales and earnings growth to return the stock to a more reasonable level, even if it simply moves sideways from here. If we set Nvidia’s current valuation of 42 times forward earnings as that “more reasonable” level, and Palantir’s revenue rises at a 50% compound annual growth rate while it maintains a 35% profit margin, it would take over five years’ worth of growth to bring its P/E down to the target. And again, that assumes the stock doesn’t rise during those five years.

That means that Nvidia has basically a five-year head start on Palantir’s long-term stock performance. Given that AI spending is projected to grow rapidly over the next five years, Nvidia shares should easily outperform Palantir moving forward, as Palantir will spend most of the next five years growing into its already expensive valuation. Which is why, despite the two companies’ similar growth rates and Palantir’s more attractive business model, it’s not the AI stock I’d suggest buying now.

Overall winner: Nvidia

Keithen Drury has positions in Broadcom and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Palantir Technologies. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.