President Trump struck an unusual deal with Nvidia and Advanced Micro Devices that allows the companies to sell certain chips to China in exchange for giving the U.S. government a 15% cut of those sales.

But the unprecedented agreement also has raised concerns from politicians and legal experts over whether the deal is legal and would pose a national security threat.

Questions also linger about exactly how the deal, which was announced Monday, would work because the U.S. Constitution bars taxes on exports, although some experts said Trump could find a workaround.

The U.S. government might receive $3 billion from the revenue split if China’s demand for Nvidia’s H20 chip — which is less powerful than the company’s highest-end artificial intelligence chip — reaches $20 billion, according to a note from Bernstein Research.

“It ties the fate of this chip manufacturer in a very particular way to this administration that is quite rare,” said Julia Powles, a professor and executive director of the UCLA Institute for Technology, Law & Policy.

Trump’s agreement with the world’s most valuable company could put pressure on other tech companies and major exporters to strike similar deals with the U.S. government, but it’s still unclear what the implications will be internationally, she said.

The deal is the latest example of how tech companies are seeking to curry favor with the Trump administration, which has threatened to impose tariffs on semiconductor companies that don’t commit to investing in the United States.

Apple faced potential tariffs as well, but committed to investing $100 billion more in U.S. manufacturing after Trump criticized the company for expanding iPhone production in India.

Trump also placed restrictions in April around the export of certain AI chips, including Nvidia’s H20 and AMD’s MI308, over national security concerns.

He’s called for the resignation of Intel Chief Executive Lip-Bu Tan, who has faced scrutiny over his reported investments in Chinese companies, but changed his tune after meeting the executive this week.

Democratic and Republican lawmakers have criticized the idea that tech companies should split their sales with the U.S. government in exchange for export licenses that allow them to resume chip sales in China.

“Export controls are a frontline defense in protecting our national security, and we should not set a precedent that incentivizes the Government to grant licenses to sell China technology that will enhance its AI capabilities,” Rep. John Moolenaar (R-Mich.), the chair of the House Select Committee on China, said in a statement.

Rep. Raja Krishnamoorthi, (D-Ill.), a ranking member of that committee, said in a statement that the deal raises questions about its legality and how the funds will be used.

“The administration cannot simultaneously treat semiconductor exports as both a national security threat and a revenue opportunity,” he said. “By putting a price on our security concerns, we signal to China and our allies that American national security principles are negotiable for the right fee.”

The White House didn’t answer questions about the agreement. White House Press Secretary Karoline Leavitt told reporters Tuesday that “the legality of it, the mechanics of it, is still being ironed out by the Department of Commerce.”

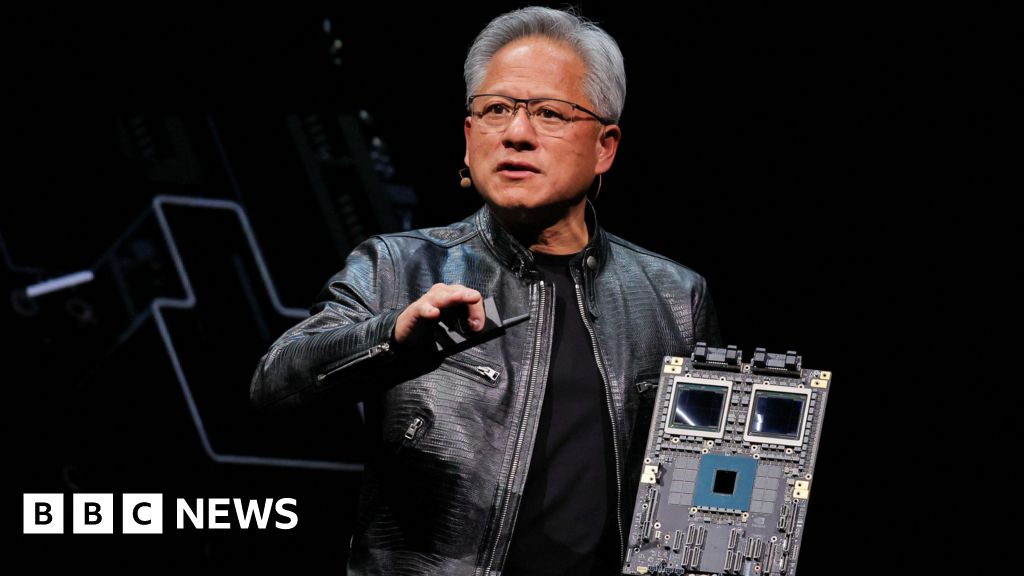

On Monday, Trump defended the deal with Nvidia, stating that the H20 chips are “obsolete” and less powerful than the company’s more high-end Blackwell chip. At a news conference, Trump said he met with Nvidia CEO Jensen Huang and initially asked for a 20% revenue split but they came down to 15%.

“We negotiate a little deal,” Trump said. “So he’s selling a essentially old chip.” Trump’s remarks came after a report from the Financial Times over the weekend that Nvidia and AMD would pay 15% of their China chip revenue to the U.S. government. AMD didn’t respond to a request for comment.

An Nvidia spokesperson said in a statement that the company hasn’t shipped H20 chips to China for months but it hopes that easing export restrictions will “let America compete in China and worldwide.”

“America cannot repeat 5G and lose telecommunication leadership. America’s AI tech stack can be the world’s standard if we race.”

For Nvidia, the stakes are high. Huang said in a May interview with Stratechery, a newsletter and podcast, that the Chinese market is about $50 billion a year. Restricting H20 chip sales means that the company is walking away from profits that could be used to compete with China in the race to dominate AI.

Taylar Rajic, an associate fellow at the Center for Strategic and International Studies, said she’s skeptical that legal concerns would halt the arrangement because it’s unclear who would sue.

“I can’t identify who would bring that suit forward,” she said. “It wouldn’t be Nvidia because they’re the ones who negotiated this deal.”

Meanwhile, Chinese officials have their own fears that Nvidia’s chips could have location tracking or remote shutdown capabilities, though the company has denied those accusations.

“China obviously has its own concerns and its own national security considerations that it wants to take into account,” Rajic said. “It just depends on whether or not they want to buy it from us too.”