Social Security’s 2026 Cost-of-Living Adjustment (COLA) Won’t Be Announced Today — but Another Change Is Guaranteed in the New Year

One of Social Security’s biggest changes in the coming year is no secret.

Today was supposed to be a banner day for Social Security’s more than 70 million traditional beneficiaries.

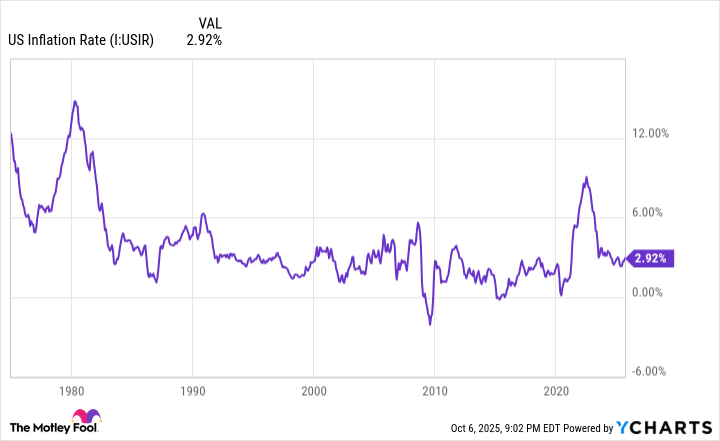

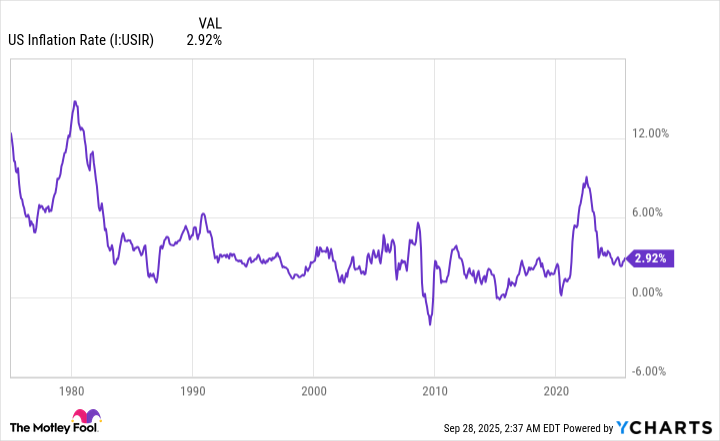

Between the 10th and 15th of every month, the U.S. Bureau of Labor Statistics (BLS) releases the previous month’s inflation data. This information is used by the Social Security Administration (SSA) to calculate the annual cost-of-living adjustment (COLA).

The BLS was slated to release the September inflation report — the final piece of data needed to unveil the 2026 COLA — at 08:30 a.m. ET on Oct. 15. But due to the federal government shutdown, the most-anticipated announcement of the year has been pushed back.

While there are some things we can speculate about with regard to the 2026 COLA, there’s one Social Security change in the upcoming year that’s a concrete certainty.

Image source: Getty Images.

Social Security’s 2026 COLA reveal will occur on Oct. 24

In its simplest form, Social Security’s COLA is the near-annual “raise” passed along to beneficiaries to offset the impact of inflation (rising prices). If benefits weren’t adjusted for the effects of inflation, Social Security recipients would see their income lose buying power most years.

For the last half-century, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has served as Social Security’s inflation measuring stick. With more than 200 different spending categories, each with its own unique percentage weightings, the CPI-W can be reported as a single figure by the BLS each month.

The quirk with Social Security’s COLA calculation is that only the months of July, August, and September (the third quarter) matter. The other nine months of the year can be helpful in spotting trends, but they aren’t used in the COLA calculation.

With CPI-W readings from July and August already known, the only puzzle piece missing is September. Unfortunately, most economic data reports from federal agencies are delayed indefinitely during government shutdowns.

However, some BLS staffers are going back to work and will be releasing the September inflation report on Friday, Oct. 24, at 08:30 a.m. ET, according to information provided to CNBC. The SSA will announce the 2026 COLA on Oct. 24, as well.

If you don’t want to wait for the SSA to release its annual Fact Sheet, you, the reader, will have the ability to easily calculate Social Security’s 2026 cost-of-living adjustment on your own once the September CPI-W is known. I walked through the steps of this straightforward COLA calculation earlier this week, which ensures you won’t have to wait for the SSA to make its announcement.

Based on estimates from nonpartisan senior advocacy group The Senior Citizens League and independent Social Security and Medicare policy analyst Mary Johnson, next year’s COLA is forecast to come in at 2.7% or 2.8%, respectively. This would work out to an extra $54 to $56 per month for the typical retired-worker beneficiary, and $43 to $44 extra each month for the average worker with disabilities and survivor beneficiary.

While little is set in stone — other than the expectation of the BLS reporting the last piece of data needed to calculate the 2026 COLA on Oct. 24 — retirees are very likely getting the short end of the stick with next year’s raise. COLAs have consistently come up short for retirees, and a projected 11.5% increase in the 2026 Medicare Part B premium isn’t going to help.

Image source: Getty Images.

No speculating here! This is the one guaranteed Social Security change for 2026

Though the government shutdown has delayed the release of key pieces of information, such as next year’s COLA, the maximum taxable earnings cap, the maximum monthly payout at full retirement age, and the withholding thresholds tied to the retirement earnings test, there is one Social Security change that’s guaranteed to take place in 2026. However, you’ll have to go to the state level to see it.

Firstly, yes, Social Security benefits may be taxable at the federal and state levels.

Individuals whose provisional income — adjusted gross income (AGI) + tax-free interest + one-half benefits — tops $25,000, or $32,000 for couples filing jointly, can have some of their Social Security income exposed to federal taxation.

Meanwhile, nine states currently tax Social Security income to some degree. Listed in alphabetical order, these states are:

- Colorado

- Connecticut

- Minnesota

- Montana

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

When the calendar flips to Jan. 1, 2026, West Virginia will officially become one of 42 states that don’t tax Social Security income.

In the 2022 tax year, West Virginia made Social Security income exempt from state-level taxation for individuals and jointly filing couples with respective AGIs of $50,000 or less and $100,000 or less.

In March 2024, West Virginia’s legislature passed, and its governor signed, a new law that phases out the taxation of Social Security benefits over a three-year period for those folks who didn’t qualify for this previous AGI adjustment.

Beginning in the 2024 tax year, West Virginians who received Social Security benefits and generated more than $50,000 in AGI (or $100,000 in AGI, if filing jointly) saw 35% of their Social Security benefits exempted from state-level taxation. In 2025, this exemption increased to 65% of Social Security income. In 2026, 100% of Social Security income will be exempted at the state level.

West Virginia will join Kansas, Missouri, Nebraska, and North Dakota as states that have shelved the taxation of Social Security benefits since this decade began.

While this has been anything but a normal COLA announcement month for Social Security, the one thing we do know is that Social Security recipients in West Virginia will be all smiles when the new year arrives.