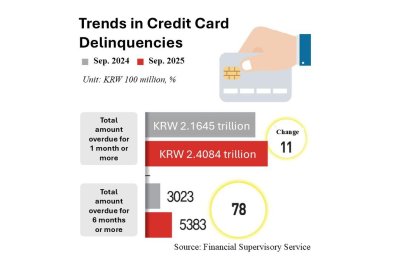

Trends in South Korea’s credit card delinquencies show rising overdue balances, with long-term arrears of six months or more jumping sharply between September 2024 and September 2025, according to the Financial Supervisory Service. Graphic by Asia Today and translated by UPI.

Jan. 6 (Asia Today) — South Korea’s credit card delinquencies have climbed to near 2.5 trillion won ($1.7 billion), with hard-to-collect arrears of six months or more jumping 78% from a year earlier, raising concerns about card issuers’ earnings and asset quality.

Data from the Financial Supervisory Service’s financial statistics system showed overdue payments of one month or more at eight major card companies totaled 2.4084 trillion won ($1.66 billion) as of the end of September 2025, up about 11% from a year earlier, the report said. The total peaked at 2.5845 trillion won ($1.79 billion) at the end of March 2025 before edging lower.

The sharper risk signal was in longer-term delinquencies. Overdue balances of six months or more totaled 538.3 billion won ($372 million), up 78% year-on-year, the report said. Such debts are often treated as effectively uncollectible, and analysts said a rapid increase can drive higher bad-debt costs and volatility in card companies’ performance.

Long-term delinquencies accounted for 22.3% of total delinquencies, up from about 11% at the start of 2025, the report said.

By issuer, Lotte Card posted the steepest increase in six-month-plus delinquencies, up 306% to 194.8 billion won ($135 million), the largest among the eight firms. The report attributed the rise to the reflection of delinquent debts linked to Homeplus entering corporate rehabilitation last March.

Other issuers’ six-month-plus delinquency balances were listed as BC Card at 41.7 billion won ($28.8 million), Shinhan Card at 98.5 billion won ($68.1 million), Hana Card at 77.7 billion won ($53.7 million), Hyundai Card at 27.5 billion won ($19.0 million), KB Kookmin Card at 30.1 billion won ($20.8 million), Samsung Card at 23.6 billion won ($16.3 million) and Woori Card at 40.9 billion won ($28.3 million), the report said.

Analysts linked the trend to heavier repayment burdens for vulnerable borrowers amid a slowing economy, high inflation and high interest rates. They also warned that rising card delinquencies can be an early risk indicator for household debt more broadly, since card loans and cash advances often serve as emergency funding for lower-income households.

An industry official said the rise suggests household finances have not fully recovered, but added that not all long-term overdue balances are uncollectible and that firms are managing receivables with recovery rates in mind.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.