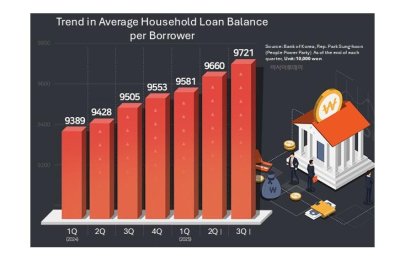

A graphic shows South Korea’s household loan trends. /Bank of Korea, Rep. Park Sung-hoon (People Power Party) graphic by Asia Today and translated by UPI

Jan. 12 (Asia Today) — The average outstanding loan balance per household borrower in South Korea exceeded 97 million won (about $75,000), the highest since related statistics began in 2012, central bank data showed Monday.

Data submitted by the Bank of Korea to ruling People Power Party lawmaker Park Sung-hoon showed the average loan balance per household borrower stood at 97.21 million won (about $75,000) as of the end of the third quarter of 2025.

The per-borrower figure has risen for nine consecutive quarters since the second quarter of 2023, the data showed. It was up more than 2 million won (about $1,500) from 95.05 million won (about $73,000) a year earlier.

The increase came even as the number of borrowers fell. After edging up to 19.71 million at the end of the first quarter of 2025, the borrower count held steady in the second quarter before slipping to 19.68 million by the end of the third quarter, the lowest level since late 2020, the data showed.

Overall household lending continued to expand. Total household loan balances rose to 1,913 trillion won (about $1.47 trillion) by the end of the third quarter of 2025 after topping 1,900 trillion won (about $1.46 trillion) for the first time in the second quarter, according to the data.

By age group, the average bank loan balance for borrowers in their 40s reached a record 114.67 million won (about $88,000) at the end of the third quarter. Borrowers in their 50s averaged 93.37 million won (about $72,000) and those 30 and under averaged 76.98 million won (about $59,000), both record highs. Borrowers 60 and older averaged 76.75 million won (about $59,000), down slightly from the prior quarter, the data showed.

Average non-bank loan balances were 39.51 million won (about $30,000) for borrowers 30 and under, 48.37 million won (about $37,000) for those in their 40s, 45.15 million won (about $35,000) for those in their 50s and 55.14 million won (about $42,000) for those 60 and older.

Park said household debt burdens are weighing on consumer sentiment, citing constraints on monetary policy amid factors such as a weak won and arguing that the pressure is showing up in softer consumption and sluggish sales among the self-employed. He called for a longer-term strategy to improve financial structure and manage debt risks systematically.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.