Warner Music Group announces layoffs, larger restructuring plan

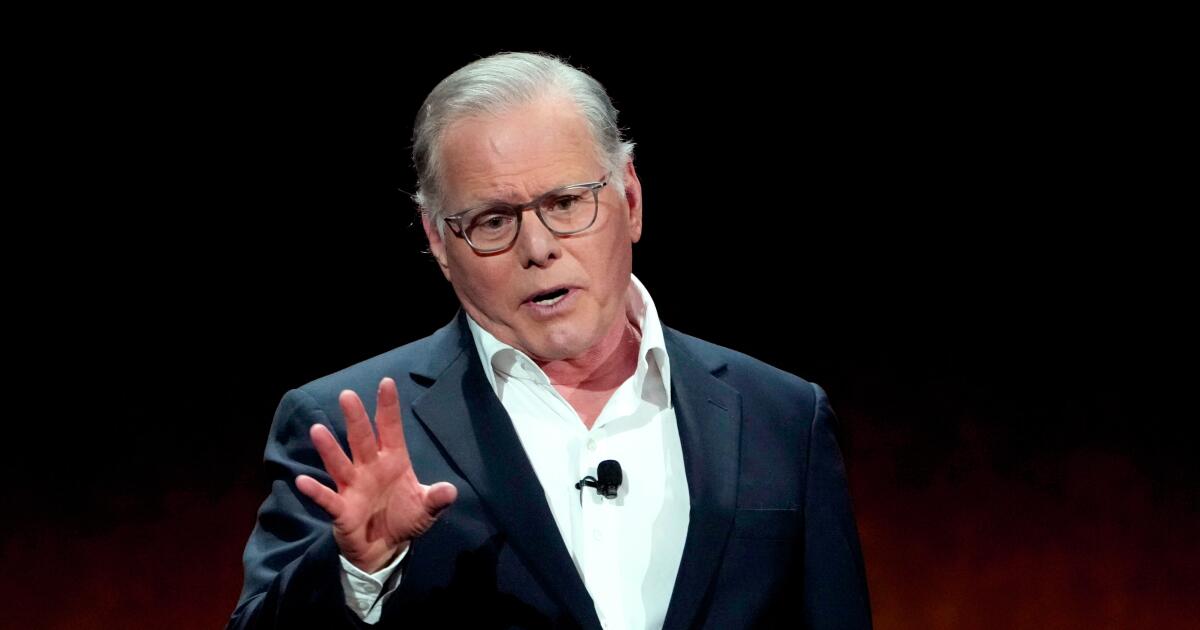

Warner Music Group will lay off an unspecified number of employees as part of a months-long restructuring plan to cut costs, Chief Executive Robert Kyncl said in a memo to staff Tuesday.

Kyncl said in the memo that the plan to “future-proof” the company includes reducing annual costs by roughly $300 million, with $170 million of that coming from “headcount rightsizing for agility and impact.” The additional $130 million in costs will come from administrative and real estate expenses, he said.

The cuts are the “remaining steps” of a period of significant change at the company, Kyncl said, with previous rounds of layoffs and leadership switch-ups happening in the last two years as he worked to “transform” the company.

“I know that this news is tough and unsettling, and you will have many questions. The Executive Leadership Team has spent a lot of time thinking about our future state and how to put us on the best path forward,” Kyncl said in the internal memo that was reviewed by The Times. “These decisions are not being made lightly, it will be difficult to say goodbye to talented people, and we’re committed to acting with empathy and integrity.”

It’s unclear how many employees will be laid off or what departments will see cuts, but Kyncl emphasized the company will be focused on increasing investments in its artists and repertoire department and mergers and acquisitions.

Hours before the news of layoffs, the company announced a $1.2-billion joint venture with Bain Capital to invest in music catalogs. The collaboration will add to the company’s catalog-purchasing power across both recorded music and music publishing, Kyncl said.

“In an ever-changing industry, we must continue to supercharge our capabilities in long-term artist, songwriter, and catalog development,” he wrote. “That’s why this company was created in the first place, it’s what we’ve always been best at, and it’s how we’ll differentiate ourselves in the future.”

In 2024, Warner Music laid off 600 employees, or approximately 10% of its workforce, and in 2023, 270 jobs were cut.

Warner Music Group shares closed at $27.83, up 2.17%, on Tuesday.