Korea foreign currency deposits jump on won volatility

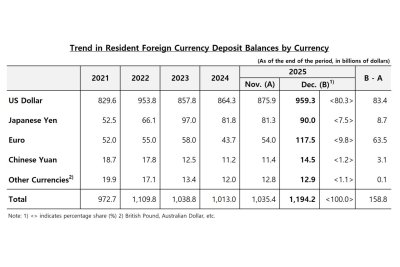

Resident foreign currency deposit balances by currency in December 2025. Data from Bank of Korea. Graphic by Asia Today; translated by UPI.

Jan. 26 (Asia Today) — South Korea’s resident foreign currency deposits rose sharply in December as renewed volatility in the won-dollar exchange rate prompted households and companies to park more money in dollars and other foreign currencies, central bank data showed.

Resident foreign currency deposits at local foreign exchange banks stood at $119.43 billion at the end of December, up $15.88 billion from the previous month, the Bank of Korea said.

Market participants increased foreign currency holdings as the exchange rate swung on expectations of further won weakness and repeated government and financial regulator efforts to curb sharp moves, the report said.

The won opened December near 1,470 per dollar and climbed into the 1,480 range by the end of the month before dropping below 1,450 following stronger verbal intervention by authorities. Since the start of the new year, the exchange rate has repeatedly moved higher and then retreated amid official efforts to stabilize the market.

The Bank of Korea said after its Jan. 15 policy meeting that most of the won’s recent weakness reflected external factors, with domestic factors accounting for roughly a quarter, while adding that authorities can mainly focus on smoothing short-term spikes.

Analysts said the dollar could lose some strength from prior levels, reducing the chance of a repeat of last year’s sharp surge in the exchange rate, as uncertainty rises over the U.S. interest-rate path amid growing political pressure on the Federal Reserve.

Park Sang-hyun, an analyst at iM Securities, said the dollar’s influence appears to be “temporarily weakening,” adding that inflation and employment data and political pressure could increase expectations for U.S. rate cuts.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.

Original Korean report: https://www.asiatoday.co.kr/kn/view.php?key=20260126010012006