The U.S. Treasury wants more states to adopt Trump’s tax cuts. Few have done so

JEFFERSON CITY, Mo. — To tax tips or not? That is a question that will confront lawmakers in states across the U.S. as they convene for work next year.

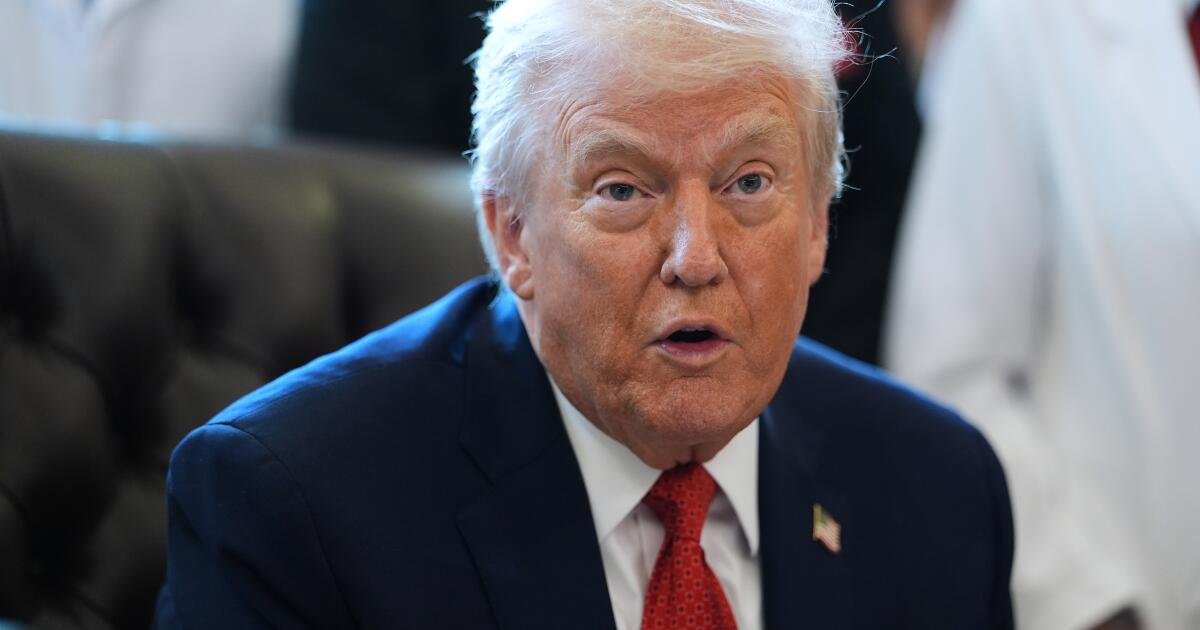

The Trump administration is urging states to follow its lead by enacting a slew of new tax breaks for individuals and businesses, including deductions for tips and overtime wages, automobile loans and business equipment.

In some states, the new federal tax breaks will automatically apply to state income taxes unless legislatures opt out. But in many other states, where tax laws are written differently, the new tax breaks won’t appear on state tax forms unless legislatures opt in.

In states that don’t conform to the federal tax changes, workers who receive tips or overtime, for example, will pay no federal tax on those earnings but could still owe state taxes on them.

States that adopt all of Trump’s tax cuts could provide hundreds of millions of dollars in annual savings to certain residents and businesses. But that could financially strain states, which are being hit with higher costs because of new Medicaid and SNAP food aid requirements that also are included in the GOP’s big bill that Trump signed this summer.

Most states begin their annual legislative sessions in January. To retroactively change tax breaks for 2025, lawmakers would need to act quickly so tax forms could be updated before people begin filing. States also could apply the changes to their 2026 taxes, a decision requiring less haste.

So far, only a few states have taken votes on whether to adopt the tax breaks.

“States in general are approaching this skeptically,” said Carl Davis, research director at the nonprofit Institute on Taxation and Economic Policy.

Treasury presses states to act

The bill Trump signed July 4 contains about $4.5 trillion of federal tax cuts over 10 years.

It creates temporary tax deductions for tips, overtime and loan interest on new vehicles assembled in the U.S. It boosts a tax deduction for older adults. And it temporarily raises the cap on state and local tax deductions from $10,000 to $40,000, among other things. The law also provides numerous tax breaks to businesses, including the ability to immediately write off 100% of the cost of equipment and research.

Forty-one states levy individual income taxes on wages and salaries. Forty-four states charge corporate income taxes.

Treasury Secretary Scott Bessent this month called on those states “to immediately conform” to the federal tax cuts and accused some Democratic-led states that haven’t done so of engaging in “political obstructionism.” Though Bessent didn’t mention it, many Republican-led states also have not decided whether to implement the tax deductions.

“By denying their residents access to these important tax cuts, these governors and legislators are forcing hardworking Americans to shoulder higher state tax burdens, robbing them of the relief they deserve and exacerbating the financial squeeze on low- and middle-income households,” Bessent said.

Some tax analysts contend that there’s more for states to consider. The tax break on tips, for example, could apply to nearly 70 occupational fields under a proposed rule from the Internal Revenue Service. But that would still exclude numerous low-wage workers, said Jared Walczak, vice president of state projects at the nonprofit Tax Foundation.

“Lawmakers need to consider whether these are worth the cost,” Walczak said.

Tips and overtime tax breaks

Because of the way state tax laws are written, the federal tax breaks for tips and overtime wages would have carried over to just seven states: Colorado, Idaho, Iowa, Montana, North Dakota, Oregon and South Carolina. But Colorado opted out of the state tax break for overtime shortly before the federal law was enacted.

Michigan this fall became the first — and so far only — state to opt into the tax breaks for tips and overtime wages, effective in 2026. The overtime tax exemption is projected to cost the state nearly $113 million and the tips tax break about $45 million during its current budget year, according to the state treasury department.

Michigan lawmakers offset that by decoupling from five federal corporate tax changes the state’s treasury estimated would have reduced state tax revenues by $540 million this budget year.

Republican state Rep. Ann Bollin, chair of the Michigan House Appropriations Committee, said the state could not afford to embrace all the tax cuts while still investing in better roads, public safety and education.

“The best path forward is to have more money in people’s pockets and have less regulation — and this kind of moved in that direction,” she said.

Arizona could be among the next states to act. Democratic Gov. Katie Hobbs has called upon lawmakers to adopt the tax breaks for tips, overtime, seniors and vehicle loans, and follow the federal government by also increasing the state’s standard deduction for individual income taxpayers. Republican state House leaders said they stand ready to pass the tax cuts when their session begins Jan. 12.

Corporate tax breaks

In addition to Michigan, lawmakers in Delaware, Illinois, Pennsylvania and Rhode Island have passed measures to block some or all of the corporate tax cuts from taking effect in their states.

A new Illinois law decoupling from a portion of the corporate tax changes could save the state nearly $250 million, said Democratic state Sen. Elgie Sims, chair of the Senate Appropriations Committee. He said that could help ensure continued funding for schools, healthcare and other vital services.

Illinois Gov. JB Pritzker, an outspoken Democratic opponent of Trump, also cited budget concerns for rejecting the corporate tax cut provision. He said states already stand to lose money because of other provisions in Trump’s big bill, such as a requirement to cover more of the costs of running the Supplemental Nutrition Assistance Program, known as SNAP.

“The decoupling is an effort to try to hold back the onslaught from the federal government to make sure that we can support programs like the one we’re announcing today,” Pritzker told reporters at a December event publicizing a grant to address homelessness in central Illinois.

Lieb writes for the Associated Press. AP writer John O’Connor in Springfield, Ill., contributed to this report.