United States President Donald Trump has announced his administration is raising tariffs on steel imports from 25 percent to 50 percent.

Speaking to steelworkers and supporters at a rally outside Pittsburgh, Pennsylvania, Trump framed his latest tariff increase as a boon to the domestic manufacturing industry.

“We’re going to bring it from 25 percent to 50 percent, the tariffs on steel into the United States of America, which will even further secure the steel industry in the United States,” Trump told the crowd. “Nobody’s going to get around that.”

How that tariff increase would affect the free-trade deal with Canada and Mexico – or a separate trade deal struck earlier this month with the United Kingdom – remains unclear.

Also left ambiguous was the nature of a deal struck between Nippon Steel, the largest steel producer in Japan, and the domestic company US Steel. Still, Trump played up the partnership between the two companies as a “blockbuster agreement”.

“ There’s never been a $14bn investment in the history of the steel industry in the United States of America,” Trump said of the deal.

A tariff hike on steel

Friday’s rally was a return to the site of many election-season campaign events for Trump and his team.

In 2024, Trump hinged his pitch for re-election on an appeal to working-class voters, including those in the Rust Belt region, a manufacturing hub that has declined in the face of the shifting industry trends and greater overseas competition.

Key swing states like Pennsylvania and Michigan are located in the region, and they leaned Republican on election day, helping to propel Trump to a second term as president.

Trump, in turn, has framed his “America First” agenda as a policy platform designed to bolster the domestic manufacturing industry. Tariffs and other protectionist policies have played a prominent part in that agenda.

In March, for instance, Trump announced an initial slate of 25-percent tariffs on steel and aluminium, causing major trading partners like Canada to respond with retaliatory measures.

The following month, he also imposed a blanket 10-percent tariff on nearly all trade partners as well as higher country-specific import taxes. Those were quickly paused amid economic shockwaves and widespread criticism, while the 10-percent tariff remained in place.

Trump has argued that the tariffs are a vital negotiating tool to encourage greater investment in the US economy.

But economists have warned that attempting a “hard reset” of the global economy – through dramatic tax hikes like tariffs – will likely blow back on US consumers, raising prices.

Rachel Ziemba, a senior fellow at the Center for a New American Security, said the latest tariff hike on steel also signals that negotiating trade deals with Trump may result in “limited benefits”, given the sudden shifts in his policies.

Further, Friday’s announcement signals that Trump is likely to continue doubling down on tariffs, she said.

“The challenge is that hiking the steel tariffs may be good for steel workers, but it is bad for manufacturing and the energy sector, among others. So overall, it is not great for the US economy and adds uncertainty to the macro outlook,” Ziemba explained.

Trump’s tariff policies have also faced legal challenges in the US, where businesses, interest groups and states have all filed lawsuits to stop the tax hikes on imports.

On Thursday, for instance, a federal court briefly ruled that Trump had illegally exercised emergency powers to impose his sweeping slate of international tariffs, only for an appeals court to temporarily pause that ruling a few hours later.

A deal with Nippon Steel

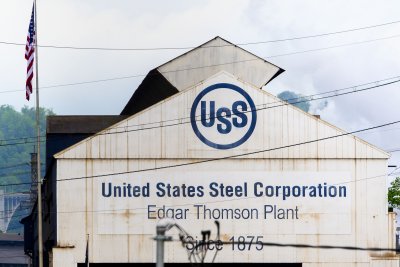

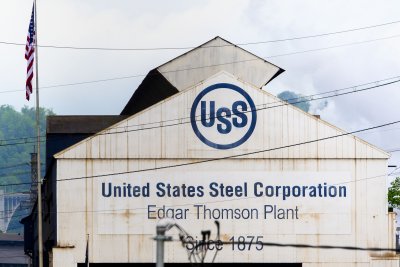

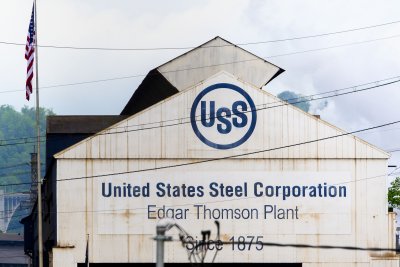

Before the tariff hike was announced, Friday’s rally in Pittsburgh was expected to focus on Nippon Steel’s proposed acquisition of US Steel, the second largest steel producer in the country.

“We’re here today to celebrate a blockbuster agreement that will ensure this storied American company stays an American company,” Trump said at the outset of his speech.

But the merger between Nippon Steel and US Steel had been controversial, and it was largely opposed by labour unions.

Upon returning to the White House in January, Trump initially said he would block the acquisition, mirroring a similar position taken by his predecessor, former US President Joe Biden.

However, he has since pivoted his stance and backed the deal. Last week, he announced an agreement that he said would grant Nippon only “partial ownership” over US Steel.

Speaking on Friday, Trump said the new deal would include Nippon making a “$14bn commitment to the future” of US Steel, although he did not provide details about how the ownership agreement would play out.

“Oh, you’re gonna be happy,” Trump told the crowd of steelworkers. “There’s a lot of money coming your way.”

The Republican leader also waxed poetic about the history of steel in the US, describing it as the backbone of the country’s economy.

“The city of Pittsburgh used to produce more steel than most entire countries could produce, and it wasn’t even close,” he said, adding: “If you don’t have steel, you don’t have a country.”

For its part, US Steel has not publicly communicated any details of a revamped deal to investors. Nippon, meanwhile, issued a statement approving the proposed “partnership”, but it also has not disclosed terms of the arrangement.

The acquisition has split union workers, although the national United Steelworkers Union has been one of its leading opponents.

In a statement prior to the rally, the union questioned whether the new arrangement makes “any meaningful change” from the initial proposal.

“Nippon has maintained consistently that it would only invest in US Steel’s facilities if it owned the company outright,” the union said in a statement, which noted firmer details had not yet been released.

“We’ve seen nothing in the reporting over the past few days suggesting that Nippon has walked back from this position.”

The rally on Friday comes as Trump has sought to reassure his base of voters following a tumultuous start to his second term.

Critics point out that steel prices have risen in the US by roughly 16 percent since Trump took office, and his Republican Party faces potentially punishing congressional elections in 2026.