Key Takeaways

- Olympic gold medals aren’t solid gold, but they’re still worth thousands based on metal content alone.

- Most U.S. Olympians no longer owe federal taxes on medal-related prize money, easing a long-standing financial burden.

- The real value of a medal often comes after the podium, through exposure, endorsements, and career opportunities.

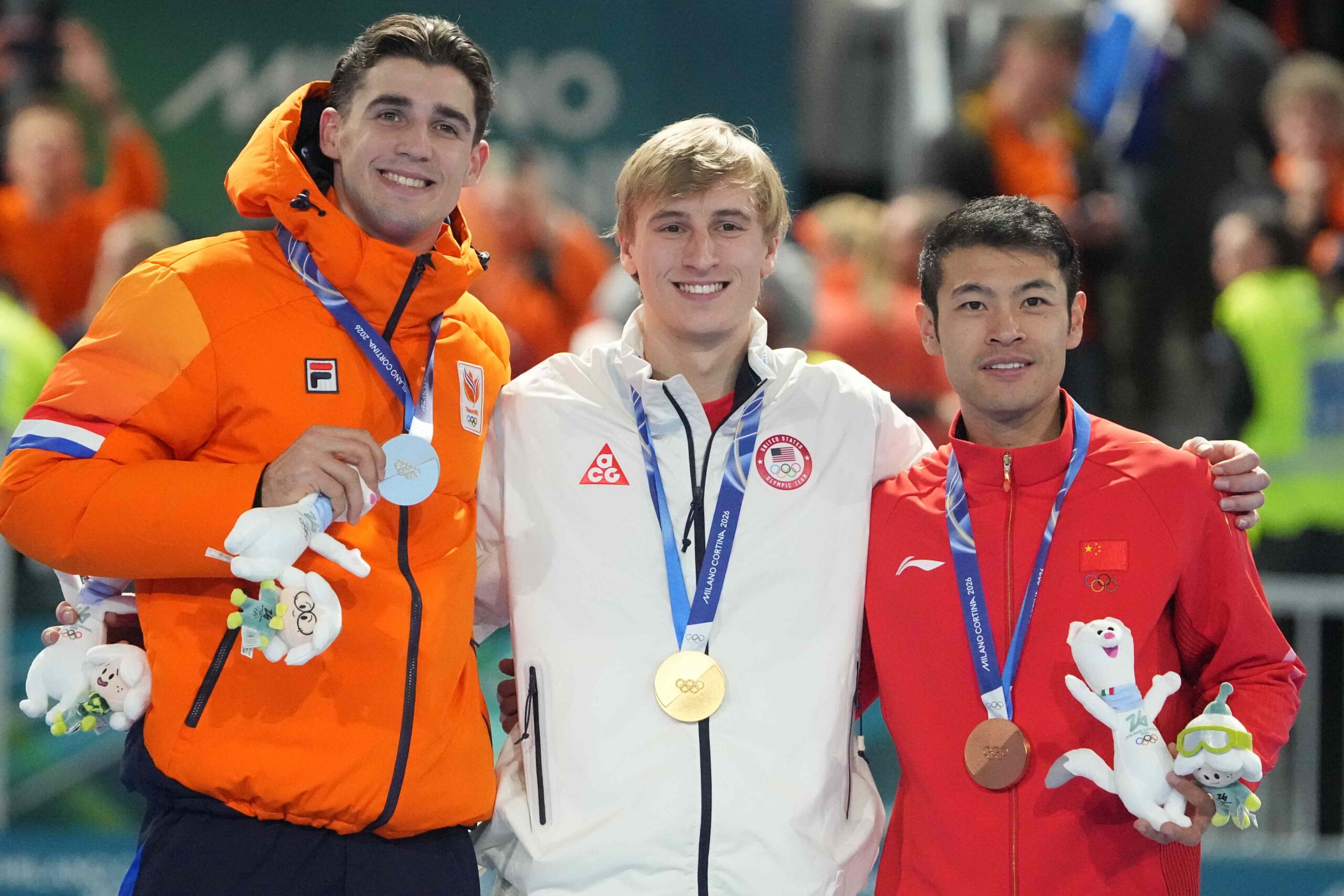

As the upcoming Winter Olympic Games Milano Cortina 2026 approaches, attention naturally shifts to records, rivalries, and the prestige of making it to the podium. But after the celebrations end, a practical question always resurfaces: What are those medals actually worth?

The answer depends on how you define “worth.” There’s the literal value of the metal, the tax implications that follow, and then the much bigger value that comes from status, visibility, and opportunity.

Are Olympic Gold Medals Actually Solid Gold?

Despite the name, Olympic gold medals are not solid gold. Even though the tradition of a solid gold medal was established in 1904, forging the medals 100% out of gold didn’t last long, as it became too costly after World War I. As a result, the top medal hasn’t been made of solid gold since the 1912 Olympic games.

Today, gold medals are primarily made of silver, with a relatively thin coating of pure gold on the surface. The exact specifications vary slightly, but the general formula has remained consistent. A modern Olympic gold medal typically contains 523 grams of sterling silver, with approximately six grams of gold plated on top. This allows it to look like gold and feel substantial, while also carrying enormous symbolic weight.

Silver medals are indeed solid, made of 525 grams of sterling silver. Bronze medals meanwhile contain no precious metals at all, typically containing 90 percent copper and other alloys, such as tin and zinc.

As a result, the true value of each medal comes more from the prestige of being a medalist and the opportunities it may offer than from the raw materials that comprise each medal.

What Gold, Silver, and Bronze Medals Are Worth at Today’s Metal Prices

Metal prices fluctuate constantly, so any estimate is a snapshot in time. Using current pricing, gold is trading around $4,900 per troy ounce, and silver around $85 per troy ounce. Six grams of gold works out to be worth about $945 at current prices, while the silver portion of a gold medal, about 523 grams, is worth about $1,430. Added together, the raw metal value of a gold medal currently lands around $2,375.

Silver medals, made of 525 grams of sterling silver, would be worth around $1,435, while bronze medals are worth far less from a materials standpoint. With copper currently priced at about $0.38 per ounce and a bronze medal comprising 495 grams of copper, the third-place medal would be worth less than $7 at today’s prices.

Do Olympic Athletes Have To Pay Taxes on Their Medals?

Fortunately for U.S. athletes, the tax picture has changed over time. In the past, medals and associated prize money were treated as taxable income, meaning athletes could owe federal taxes on both the cash bonuses and the fair market value of the medal itself.

That shifted in 2016, when Congress passed the United States Appreciation for Olympians and Paralympians Act of 2016. The legislation allows most U.S. Olympic and Paralympic athletes to exclude medal-related prize money from federal income taxes if their overall income falls below a certain threshold. The intent was to prevent athletes, many of whom train for years with limited financial support, from being hit with tax bills simply for winning.

Important

The exemption applies only to certain medal-related income and doesn’t extend to endorsement deals, appearance fees, or other earnings that often follow Olympic success.

Why Medals Are Worth Far More Than the Metal

If medals were only worth their metal content, they’d be impressive keepsakes, but not life-changing ones. The real value comes from what the medal represents and what it unlocks.

An Olympic medal can raise an athlete’s profile overnight, leading to endorsements, sponsorships, and paid appearances that weren’t on the table before. The impact often lasts well beyond competition, opening doors to coaching, leadership roles, and media opportunities long after the Games are over.

Those opportunities don’t look the same for every medalist—or arrive all at once. For some athletes, especially gold medalists, the exposure of winning on the sport’s biggest stage can translate quickly into major endorsement deals. For others, the payoff is more gradual, showing up as smaller sponsorships, speaking fees, or a clearer path into post-competition careers built on recognition and trust.

Winning multiple medals can also amplify the effect, creating a sustained spotlight that brands and audiences tend to value more than a single podium finish.

While the metal in an Olympic medal may only be worth a modest sum, the visibility it brings can reshape an athlete’s earning potential in ways that far outlast the Games themselves—making its true value less about what it’s made of, and more about what it makes possible.

Good News for Olympians Starting in 2026

For the first time in history, every U.S. Olympic athlete is getting something they’ve never had before: guaranteed financial support just for making a team. Thanks to a $100 million gift from financier Ross Stevens, every U.S. Olympian and Paralympian competing in the Milan-Cortina Games will be eligible for $200,000 in future benefits, whether they medal or not, providing a long-term boost for careers that often pay little during competition.