Imagineers and Shigeru Ban redesigned these Altadena community centers

Altadena has never organized itself around a traditional civic center, like a city hall plaza or downtown square. Instead, this decidedly informal community has relied on an informal constellation of shared spaces — parks and playgrounds tucked into the foothills, popular mid-century libraries, an amphitheater carved into a slope, a handful of living room-like bars and cafés.

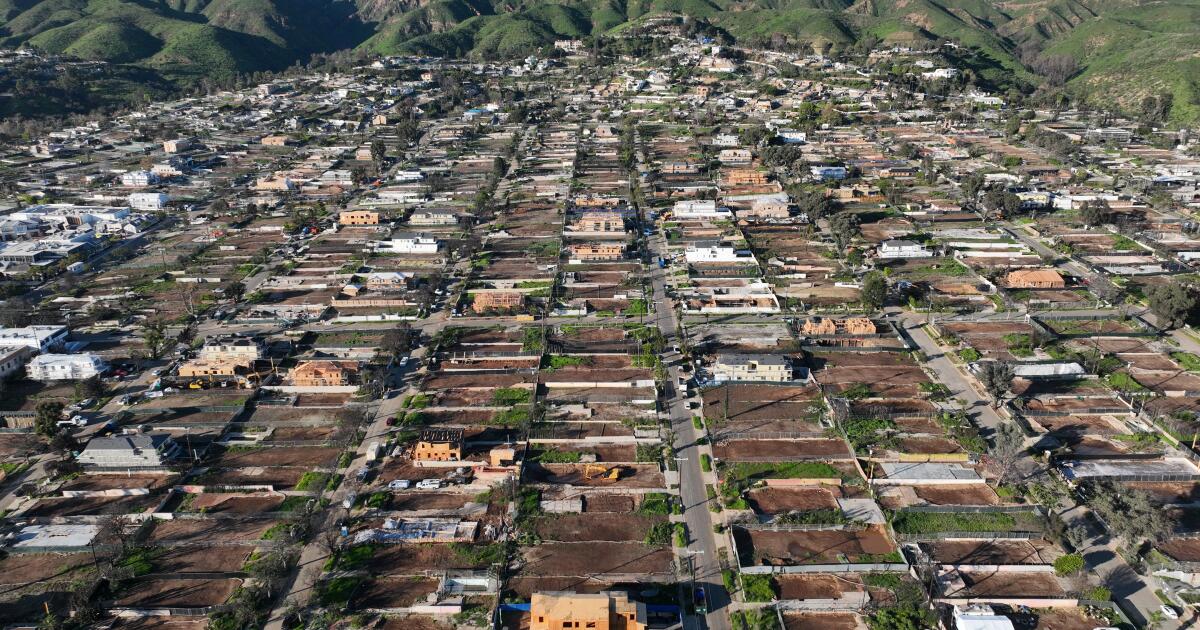

After last year’s Eaton Fire tore through town, incinerating community infrastructure and scattering residents across the region, the importance of such places has grown dramatically — not only as centers of gathering, but as sites of refuge, planning and healing. Thanks to a determined commitment from residents and officials, these communal sites are starting to return — in many cases better than before — revealing innovative thinking about the ways we can create and use community spaces.

Earlier this month, L.A.-based aid organization Community Organized Relief Effort, or CORE, founded by Sean Penn and Ann Lee, broke ground on one of the hamlet’s newest local gathering spots: the Altadena Center for Community. Designed by acclaimed Japanese architect Shigeru Ban (who will be receiving the 2026 American Institute of Architects Gold Medal Award later this year), the 1,600-square-foot building, located on a county-owned lot on Lincoln Avenue, adapts a prototype that Ban — who has been designing lightweight structures for disaster victims for more than thirty years — first employed in Onagawa, Japan, following the 2011 Tōhuku earthquake and tsunami.

The vaulted, wood-beamed space, supported on its flanks by shipping containers, is designed to be put up quickly, affordably and with minimal waste, said Ban, who estimates construction will cost about $300,000 and be completed in two to three months once permits are approved.

“Every move we make has to be very cost effective,” noted Ben Albertson, the local project manager for Ban’s firm.

The center can host workspaces, meeting rooms, mental health facilities and community events, but programming is still pending, based on an assessment of community needs, noted CORE co-founder Lee.

An architectural rendering of Shigeru Ban’s design for the 1,600-square-foot Altadena Center for Community, located at 2231 Lincoln Avenue. Construction began in January and is set for completion this summer.

(Shigeru Ban Architects / CORE)

“What are the gaps? What do they want to name it?” said Lee. The center’s open, flexible design, she added, will allow programs to evolve over time — inside and out — with the goal of accommodating markets, religious services, yoga classes and other types of support.

Local officials, particularly L.A. County Parks and Recreation, immediately started to address the dearth of places to congregate after the fires. While parts of Eaton Canyon still burned, parks staff organized sheriff-escorted site visits to assess damage and determine which spaces could safely reopen first, said Chester Kano, deputy director of the planning and development agency at L.A. County Parks.

In May, Loma Alta Park was the first major spot to reemerge with significant upgrades, funded in part by an outpouring of donations from local residents and businesses as well as philanthropic sources like FireAid, the L.A. Clippers Foundation and the L.A. Dodgers Foundation.

“There’s been so much trauma. I think just building back the way things were would be insufficient,” says Kano.

County crews first addressed widespread damage, then installed new play facilities — including Landscape Structures’ towering “Volo Aire” jungle gym, featuring three tunnel slides — as well as two refurbished baseball fields, a new computer lab and a renovated pool and gymnasium. Several local artists, including Victor Ving, Eric Junker and Katie Chrishanthi Sunderalingam, have painted colorful murals.

Four-year-old twins Noah and Luke Stafford, who had to evacuate during the Eaton Fire, play on new equipment at Loma Alta Park in Altadena.

(Allen J. Schaben / Los Angeles Times)

The park addresses the need for communal gathering via a new cluster of colorful outdoor furniture known as the Alta Chat Space.

“People didn’t have anywhere to go,” says Kano. “They were meeting on their driveways, literally on top of ash and debris, bringing folding chairs.”

Perhaps the most significant transformation will be to Charles White Park, located a short drive from CORE’s future facility and named for the famed Altadena artist. Long a community focal point, the five-acre park is set to undergo a redesign thanks to a $5-million donation from the Walt Disney Company, and a $5.5-million outlay from California State Parks.

County Parks and Salt Landscape Architects are set to take the lead on the work. New facilities will include a play area and splash pad designed by Disney Imagineers, a community center (with meeting spaces and interpretive exhibits about White), pathways, bathrooms, a small amphitheater, a bronze of White and public art by White’s son, Ian White.

Ian White said his designs are still being finalized, but could include poetry, sculpture, landscape art, and information and quotes relating to notable Altadena residents, including artists, scientists and indigenous tribes.

“It will be a dramatic shift,” noted White. “I must admit every time we have a meeting about it, I’m excited about the potential.”

White is complimentary of Disney’s willingness to take input from the community, despite a flurry of concerns that arose last fall around the release of an early design sketch of the play area, depicting somewhat cartoonish, pinecone-shaped play structures that some locals felt didn’t reflect local identity.

“Disney’s been doing the work, trying to understand the legacy and history of Altadena,” said White, who recently hosted 17 Imagineers at his house. “I think there’s going to be an evolution of their design,” added Kano.

Challenges remain

Despite early victories, there are more than a few remaining “heavy lifts,” as Kano put it. The county has brought in about $60 million to restore parks damaged in the Eaton and Hughes Fires, but about $190 million is still needed.

Arguably no lift is bigger than Farnsworth Park, the beloved recreation space along Altadena’s northeast side. That facility, now largely overgrown and covered with opaque fencing, still needs electricity after the destruction of its power lines and an on-site utility building. Its centerpiece, the lodge-like Davies Building, was all but obliterated by the fire, and its amphitheater, while still intact, suffered notable damage.

A view of the closed and heavily damaged Farnsworth Park in Altadena, which needs about $69 million in repairs.

(Allen J. Schaben / Los Angeles Times)

Thus far, the park — which needs about $69 million in repairs, said Kano — has only received $5 million from the Santa Monica Mountains Conservancy to build a healing and reflection garden along its west flank; and $3 million from the Rivers and Mountains Conservancy to rebuild a restroom and restore some landscaping and other related work.

Liz MacLean, a principal at Architectural Resources Group, a preservation-focused firm that has been advising L.A. County Parks about repairs to Farnsworth’s amphitheater, lived less than half a mile from the park. She and her family are still undecided on whether they will return to the area, making her memories of the park particularly poignant.

“It was a real destination for the community, tucked up in the hills,” noted MacLean. “They’d have a musical in the summer, and people would picnic outside of the amphitheater on the lawn. And every type of sport you wanted to do, there seemed to be a field for it. My daughters have had a bunch of events for their schools up there. Graduations, performances, meetups. The community would vote there. Boys and Girl Scout troops would have events in the banquet hall.”

Altadena’s two libraries, both spared from destruction, have borne outsized responsibility for picking up the slack from these losses, and have hosted community events and workshops for those hoping to rebuild. But starting Feb. 1, the skylit, greenery-filled Main Library will undergo a long-planned renovation and expansion that will put it out of commission for about the next 18 months, officials said. Updates will include access improvements, new mechanical and electric systems, a seismic retrofit, and space reconfigurations.

“There have been people who have said, ‘Please don’t close. What are we going to do?’” said Nikki Winslow, director of the Altadena Library District. “But this has been a long time coming. Our Main Library really needs a renovation.”

As a result, the smaller, recently renovated Bob Lucas Memorial Library and Literacy Center will host far more activity. The district has also installed a temporary satellite library inside a multipurpose room at Loma Alta Park. Stewart noted that the district is looking for more spaces — including the Altadena Community Center — to host events.

Ian White, standing by the sign for Charles White Park, is the son of the park’s namesake and is working on creating public art for the project.

(Allen J. Schaben / Los Angeles Times)

“We’ve become so dependent on all things virtual, but nothing can really replace the human connection, especially coming out of a disaster,” said Carolina Romo, director of the Construction and Asset Management Division of the Los Angeles County Development Authority, which is coordinating with CORE on its new center. “You can’t really address the psychological toll in a virtual environment.”

CORE’s Lee says that such spaces are particularly important in areas where digital expertise is less common. “There’s just so much bad information out there. You don’t know who to trust. So going to a physical space and seeing people that you know you can talk to can make all the difference.”

Rebuilding will take years, and many decisions remain unresolved. But the community, said Architectural Resources Group’s MacLean, needs something solid sooner: “There are things that were lost that were special to everyone. At the end of the day people just want their community back. They want to gather again.”