China pitches itself as a reliable partner as Trump alienates US allies | International Trade News

China is showcasing itself as a solid business and trading partner to traditional allies of the United States and others who have been alienated by President Donald Trump’s politics, and some of them appear ready for a reset.

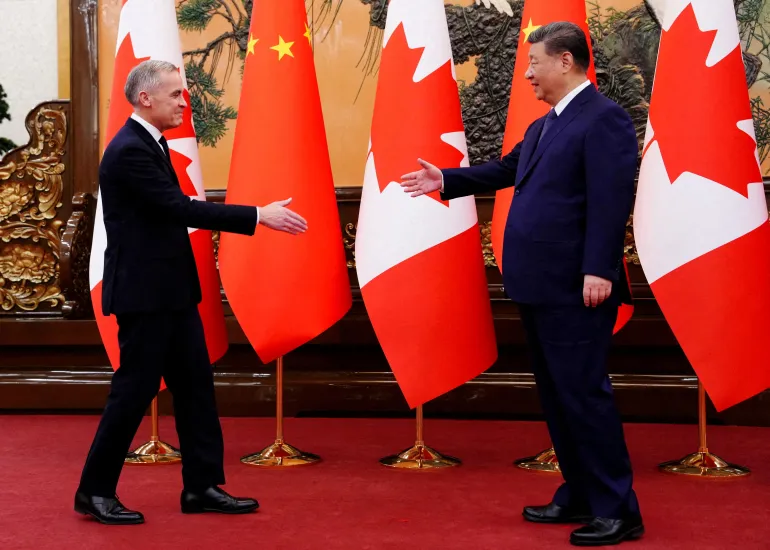

Since the start of 2026, Chinese President Xi Jinping has received South Korean President Lee Jae Myung, Canadian Prime Minister Mark Carney, Finnish Prime Minister Petteri Orpo and Irish leader Micheal Martin.

Recommended Stories

list of 4 itemsend of list

This week, United Kingdom Prime Minister Keir Starmer is on a three-day visit to Beijing, while German Chancellor Friedrich Merz is expected to visit China for the first time in late February.

Among these visitors, five are treaty allies of the US, but all have been hit over the past year by the Trump administration’s “reciprocal” trade tariffs, as well as additional duties on key exports like steel, aluminium, autos and auto parts.

Canada, Finland, Germany and the UK found themselves in a NATO standoff with Trump this month over his desire to annex Greenland and threats that he would impose additional tariffs on eight European countries he said were standing in his way, including the UK and Finland. Trump has since backed down from this threat.

China’s renewed sales pitch

While China has long sought to present itself as a viable alternative to the post-war US-led international order, its sales pitch took on renewed energy at the World Economic Forum‘s (WEF) annual summit in Davos, Switzerland, earlier this month.

As Trump told world leaders that the US had become “the hottest country, anywhere in the world” thanks to surging investment and tariff revenues, and Europe would “do much better” to follow the US lead, Chinese Vice Premier Li Hefeng’s speech emphasised China’s ongoing support for multilateralism and free trade.

“While economic globalisation is not perfect and may cause some problems, we cannot completely reject it and retreat to self-imposed isolation,” Li said.

“The right approach should be, and can only be, to find solutions together through dialogue.”

Li also criticised the “unilateral acts and trade deals of certain countries” – a reference to Trump’s trade war – that “clearly violate the fundamental principles and principles of the [World Trade Organization] and severely impact the global economic and trade order”.

Li also told the WEF that “every country is entitled to defend its legitimate rights and interests”, a point that could be understood to apply as much to China’s claims over places like Taiwan as to Denmark’s dominion over Greenland.

“In many ways, China has chosen to cast itself in the role of a stable and responsible global actor in the midst of the disruption that we are seeing from the US. Reiterating its support for the United Nations system and global rules has often been quite enough to bolster China’s standing, especially among countries of the Global South,” Bjorn Cappelin, an analyst at the Swedish National China Centre, told Al Jazeera.

The West is listening

John Gong, a professor of economics at the University of International Business and Economics in Beijing, told Al Jazeera that the recent series of trips by European leaders to China shows that the Global North is listening, too. Other notable signs include the UK’s approval of a Chinese “mega embassy” in London, Gong said, and progress in a years-long trade dispute over Chinese exports of electric vehicles (EVs) to Europe.

Starmer is also expected to pursue more trade and investment deals with Beijing this week, according to UK media.

“A series of events happening in Europe seems to suggest an adjustment of Europe’s China policy – for the better, of course – against the backdrop of what is emanating from Washington against Europe,” Gong told Al Jazeera.

The shifting diplomatic calculations are also clear in Canada, which has shown a renewed willingness to deepen economic ties with China after several spats with Trump over the past year.

Carney’s is the first visit to Beijing by a Canadian prime minister since Justin Trudeau went in 2017, and he came away with a deal that saw Beijing agree to ease tariffs on Canadian agricultural exports and Ottawa to ease tariffs on Chinese EVs.

Trump lashed out at news of the deal, threatening 100 percent trade tariffs on Canada if the deal goes ahead.

In a statement last weekend on his Truth Social platform, Trump wrote that Carney was “sorely mistaken” if he thought Canada could become a “‘Drop Off Port’ for China to send goods and products into the United States”.

The meeting between Carney and Xi this month also thawed years of frosty relations after Canada arrested Huawei executive Meng Wanzhou in late 2018 at the behest of the US. Beijing subsequently arrested two Canadians in a move that was widely seen as retaliation. They were released in 2021 after Meng reached a deferred agreement with prosecutors in New York.

In Davos, Carney told world leaders that there had been a “rupture in the world order” in a clear reference to Trump, followed by remarks this week to the Canadian House of Commons that “almost nothing was normal now” in the US, according to the CBC.

Carney also said this week in a call with Trump that Ottawa should continue to diversify its trade deals with countries beyond the US, although it had no plans in place yet for a free-trade agreement with China.

Filling the void

Hanscom Smith, a former US diplomat and senior fellow at Yale’s Jackson School of International Affairs, told Al Jazeera that Beijing’s appeal could be tempered by other factors, however.

“When the United States becomes more transactional, that creates a vacuum, and it’s not clear the extent to which China or Russia, or any other power, is going to be able to fill the void. It’s not necessarily a zero-sum game,” he told Al Jazeera. “Many countries want to have a good relationship with both the United States and China, and don’t want to choose.”

One glaring concern with China, despite its offer of more reliable business dealings, is its massive global trade surplus, which surged to $1.2 trillion last year.

Much of this was gained in the fallout from Trump’s trade war as China’s manufacturers – facing a slew of tariffs from the US and declining demand at home – expanded their supply chains into places like Southeast Asia and found new markets beyond the US.

China’s record trade surplus has alarmed some European leaders, such as French President Emmanuel Macron, who, in Davos, called for more foreign direct investment from China but not its “massive excess capacities and distortive practices” in the form of export dumping.

Li tried to address such concerns head-on in his Davos speech. “We never seek trade surplus; on top of being the world’s factory, we hope to be the world’s market too. However, in many cases, when China wants to buy, others don’t want to sell. Trade issues often become security hurdles,” he said.