Nov. 19 (UPI) — Tech giant Nvidia on Wednesday posted record revenue and strong profit for the third quarter, beating Wall Street expectations, amid exploding growth in artificial intelligence.

Nvidia, which has the world’s largest market capitalization at $4.5 trillion, reported record sales. It said sales grew 62% in one year to $57 billion through Oct. 26. Wall Street had projected a $54.9 billion figure.

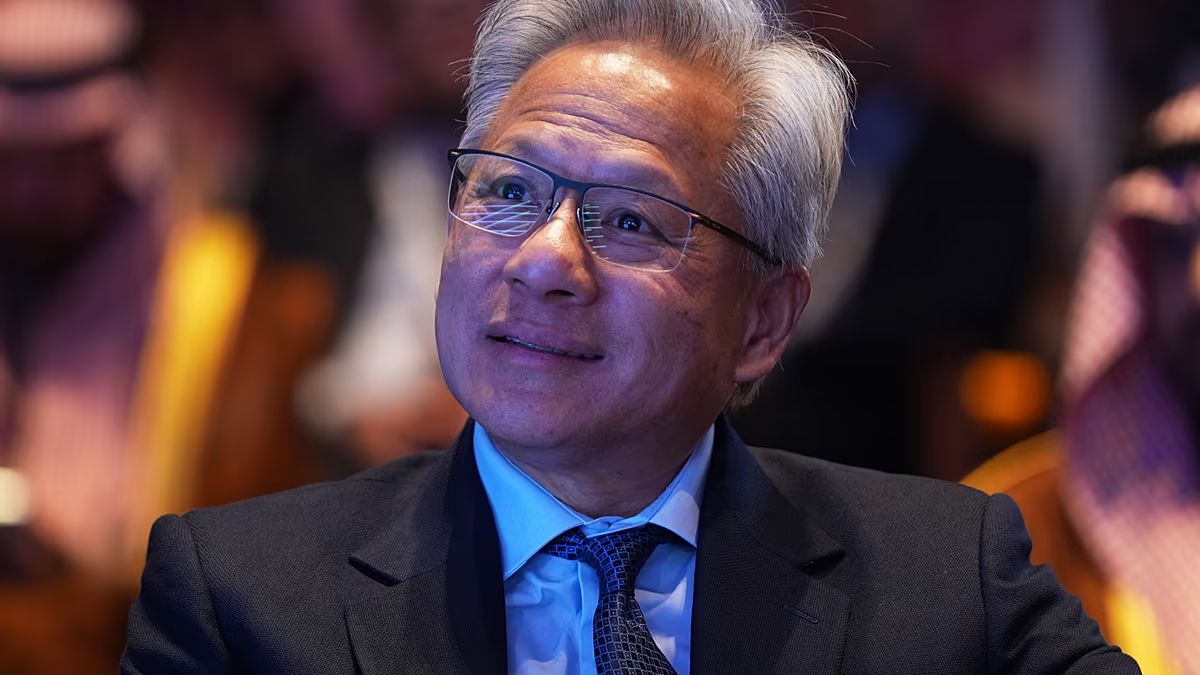

On Oct. 29, Nvidia became the first company worldwide with a $5 trillion cap one day before CEO Jensen Huang met with President Donald Trump in the White House.

“There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different,” Huang said during a conference call with investors.

Fourth-quarter sales are estimated to be around $65 billion, contrasting with $61.66 billion by analysts.

Profit was up 65% from last year in the quarter to $31.9 billion or 78 cents per share, slightly ahead of expectations. The net income represents 58% of revenue.

NVIDIA will pay its next quarterly cash dividend of 1 cent per share on Dec. 26.

Nvidia builds chips and software platforms for the AI industry. The company, founded in 1993 in the Silicon Valley in California, pioneered the graphics processing unit, initially for 3D video games.

The chips are made in the United States by GlobalFoundries, Taiwan Semiconductor Manufacturing Company and Samsung in South Korea. Taiwan’s new factory in Arizona focuses on chips for Nvidia.

The design work is done in the United States, GeekBitz reported.

Most AI companies’ technology runs on Nvidia’s chip, CNN reported.

Its best-selling chip is the Blackwell Ultra, a second generation. The company is banned from selling the new ones to China.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Huang said in a statement about its best-selling chip.

“Compute demand keeps accelerating and compounding across training and inference — each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once.”

In October, Huang said there were $500 billion in AI chip orders for 2025 and 2026 combined.

“The number will grow,” Nvidia finance chief Colette Kress said during the earnings call with analysts.

Nvidia said there were $51.2 billion in revenue in data center sales, a 66% rise year-over-year.That includes $43 billion in revenue was for “compute,” or the GPUs. The company said most growth was from GB300 chips.

Nvidia’s stock price rose 5.08% in after-hours trading on Wednesday night on NASDAQ. The stock was at $196.00, below the record $207.04 on Oct. 29.

The stock, with the ticker symbol NVDA, initially traded at $12 per share, through its Initial Public Offering on Jan. 22, 1999.

The strong Nvidia report boosted after-hours trading of tech firms Meta, Microsoft, Amazon and Google.

“This answers a lot of questions about the state of the AI revolution, and the verdict is simple: it is nowhere near its peak, neither from the market-demand nor the production-supply-chain sides for the foreseeable future,” Thomas Monteiro, senior analyst at Investing.com, said in emailed commentary following the report.

In September, Nvidia announced a $100 billion investment in OpenAI in exchange for chip purchases.

On Monday, Anthropic committed to buying $30 billion in computing capacity from Microsoft Azure in exchange for an investment in the AI lab from both tech giants.

Nvidia announced a collaboration with Intel to jointly develop multiple generations of custom data center and PC products with NVIDIA NVLink.

Nvidia has reviewed plans to accelerate seven new supercomputers, including with Oracle to build the U.S. Department of Energy’s largest AI supercomputer, Solstice, plus another system, Equinox.

Nvidia said it had $4.3 billion in gaming revenue, which is a 30% boost from one year ago.

Despite the boom, CEO of one of the world’s largest independent financial advisory organizations warnsthere is a “real risk” because of complacency.

“Exceptional results don’t remove the need for discipline,” Nigel Green of deVere Group in Britain said in an email to UPI. “The AI ecosystem is growing fast, but fast growth doesn’t protect anyone from the consequences of over-extension.”

He said the path from deployment to real commercial returns “remains untested” in many industries.

“Investors must examine whether business models can convert this scale of capital investment into sustained earnings,” he said. “Complacency could be a real risk.”