Ukraine’s patience with US peace push wears thin as Russia skirts pressure | Russia-Ukraine war News

Ukraine expressed frustration with its ongoing peace talks with Russia and the United States this week, saying US pressure was too one-sided against it.

“As of today, we cannot say that the outcome is sufficient,” Zelenskyy told Ukrainians in a Wednesday evening video address.

Before Wednesday’s talks in Geneva had begun, Zelenskyy told Axios news service that ceding the remaining one-fifth of the eastern Donetsk region that Russia doesn’t control, as Moscow has demanded, would not be accepted by Ukrainians.

“Emotionally, people will never forgive this. Never. They will not forgive … me, they will not forgive [the US],” Zelenskyy said, adding that Ukrainians “can’t understand why” they would be asked to give up additional land.

Russia currently controls about 19 percent of Ukraine, down from 26 percent in March 2022.

Last month, 54 percent of surveyed Ukrainians told the Kyiv International Institute of Sociology they categorically reject transferring the whole of the Donetsk region to Russian control, even in return for strong security guarantees, with only 39 percent accepting the proposal.

Two-thirds of respondents also said they did not believe the current US-sponsored peace negotiations would lead to lasting peace.

Instead of ceding land now, Zelenskyy favours freezing the current line of contact as a pretext for a ceasefire and territorial negotiations.

“I think that if we will put in the document … that we stay where we stay on the contact line, I think that people will support this [in a] referendum. That is my opinion,” he told Axios.

Blaming Ukraine

US President Donald Trump told Reuters last month that Ukraine, not Russia, was holding up a peace deal.

But Zelenskyy said it was “not fair” that Trump was putting public pressure on Ukraine to accept Russian terms, adding, “I hope it is just his tactics.”

US senators visiting Odesa last week agreed with him, saying they want their government to put more pressure on Russia.

“Nobody, literally nobody, believes that Russia is acting in good faith in the negotiations with our government and with the Ukrainians. And so pressure becomes the key,” said Senator Sheldon Whitehouse of Rhode Island.

Russia unleashed a barrage of 396 attack drones and 29 missiles on Ukraine’s energy infrastructure on the day of the Geneva talks, its second large-scale blow in six days. On February 12, another attack had left 100,000 families without electricity, and 3,500 apartment buildings without heat in Kyiv alone.

“Russia greets with a strike even the very day new formats begin in Geneva – trilateral and bilateral with the United States,” said Zelenskyy in a video address. “This very clearly shows what Russia wants and what it is truly intent on.”

Zelenskyy has repeatedly asked Western allies to stop Russian energy sales that circumvent sanctions, and to stop exporting components to third countries, which re-export them to Russia’s armaments industry.

Russia is believed to be using a shadow fleet estimated at between 400 and 1,000 oil tankers to carry and sell its crude oil. France has seized two of those tankers, and the US seized a second tanker on Monday.

The US Senate has held off voting on a sanctions bill that has 85 percent support because of opposition from Trump. The bill would impose secondary sanctions on buyers of Russian oil – notably India and China.

Can Russia take Donetsk anyway?

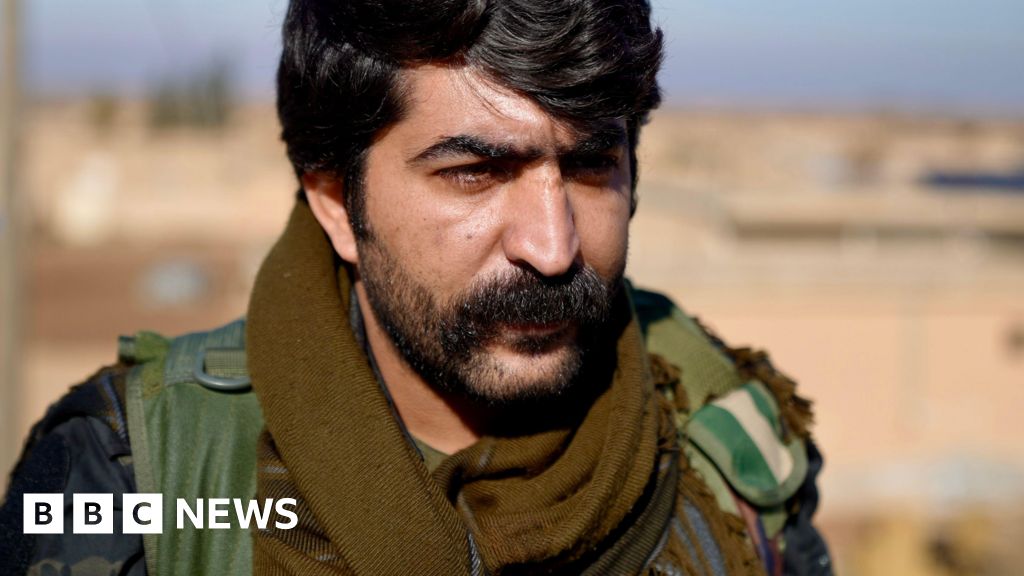

Russia has fought since 2014 to seize the two eastern regions of Ukraine, which triggered its invasion – Luhansk and Donetsk – where it claimed a Russian-speaking population was being persecuted by the government in Kyiv.

Late last year, Russia managed to seize all of Luhansk, but analysts believe it is doubtful that it could take the remainder of Donetsk without serious losses, because Ukraine has heavily fortified a series of cities in the western part of the region.

That task has now become even harder, according to observers, since Russia this month lost access to Starlink terminals, which helped it communicate, fly its drones and coordinate accurate counter-battery fire.

As Russian ground assaults have faltered, Ukraine has seized the initiative to make gains in Dnipropetrovsk, said Ukrainian military observer Konstantyn Mashovets.

Ukrainian forces gained 201sq km of territory from Russian occupation forces between February 11 and 15, according to observers, reportedly their fastest advance since a 2023 counteroffensive.

Russia has been trying to replace Starlink using stratospheric balloons, reported Ukrainian Defence Ministry adviser Serhiy “Flash” Beskrestnov.

Russia would likely take six months to replace Starlink, said a Ukrainian unmanned systems commander, offering Ukrainian forces a window to roll back Russian advances.

It also suffered 31,680 casualties in January, estimated Ukraine’s General Staff – a sustainable number given Russian recruitment levels of about 40,000 a month. But those numbers would rise in the event of a major assault on the remainder of Donetsk, experts say.

“Our goal is to have at least 50,000 confirmed enemy losses every month,” said Ukrainian Minister of Defence Mykhailo Fedorov on February 12, echoing a goal set by Zelenskyy last month.

Fedorov has set out to increase the production of remote-control FPV drones used on the front lines, which Ukraine says are now responsible for 60 percent of all Russian casualties.

As part of that effort, joint drone production facilities are planned in several European countries. The first started operating on February 13 in Germany, Zelenskyy told the Munich Security Conference, and nine more are planned.

In addition, Ukraine’s European allies pledged 38 billion euros ($44.7bn) in military aid this year during a Ramstein format meeting – the alliance of more than 50 countries which plans military aid for Ukraine – including 2.5 billion euros ($2.9bn) for Ukrainian drones – “one of the most successful ‘Ramsteins’,” Fedorov said.

The European Union has additionally voted to borrow 90 billion euros ($106bn) to give to Ukraine in financial aid this year and next.

The US stopped being a donor of military and financial aid to Ukraine after Trump was sworn in as president in January 2025.

Against Trump’s wishes, the US Senate voted to spend $400m in each of the next two years as part of the Ukraine Security Assistance Initiative, which pays US companies for weapons for Ukraine’s military. Europeans have pledged to spend at least 5 billion euros ($5.8bn) on US weapons this year.

Europe would also be the main contributor to a “reassurance force” policing the line of contact after a ceasefire, and on Ukraine’s insistence, US representatives also met with British, French, German, Italian and Swiss representatives before the talks in Geneva.