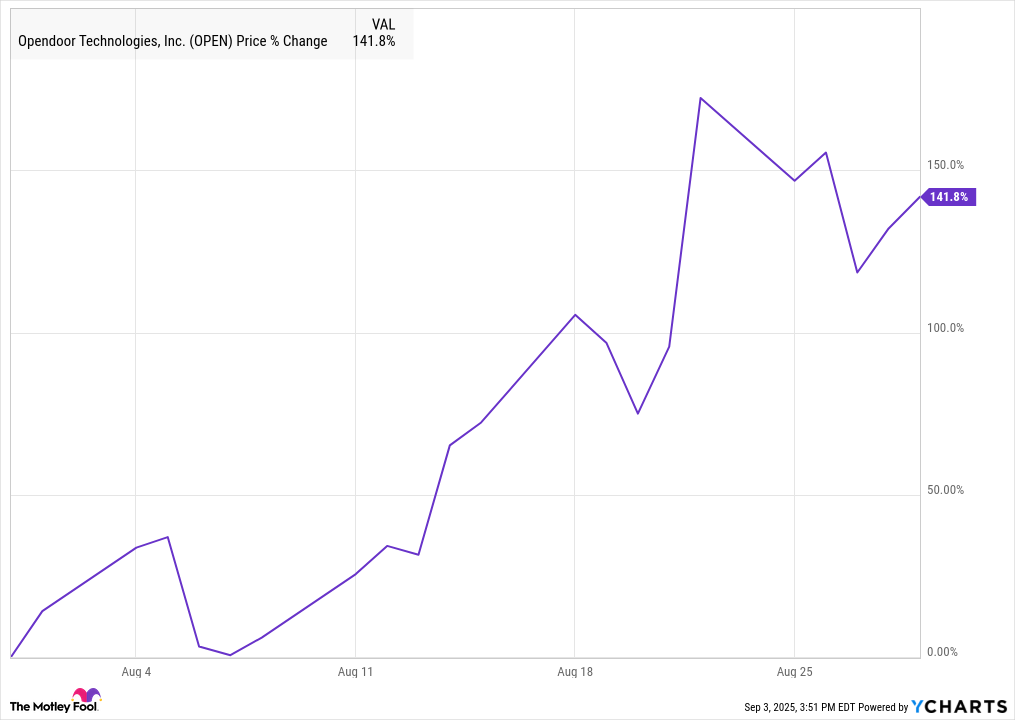

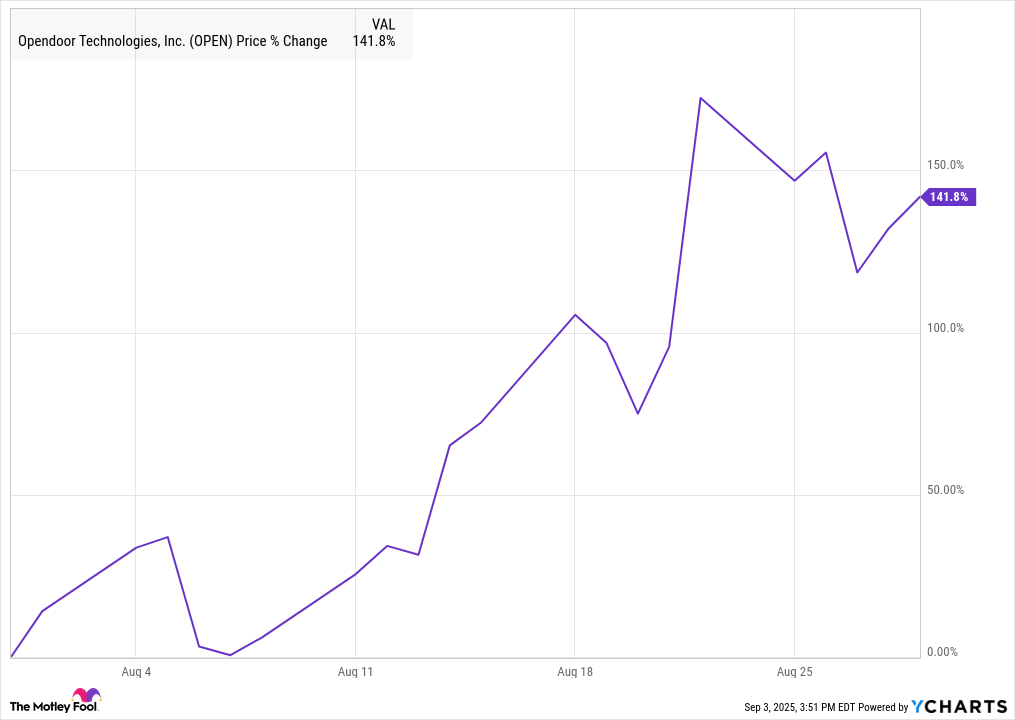

Opendoor has been a huge meme stock winner this year.

One of the hottest stocks this year has been Opendoor (OPEN 4.30%), which is up more than 500% year to date as of this writing. The stock recently shot up nearly 80% in one day after the company announced both a new CEO and that its co-founders were returning to take seats on its board of directors.

However, the stock’s meteoric rise this year is not because of the strength of its business or signs of a turnaround. In fact, the stock saw its share price actually cut in half earlier this year before hedge fund manager Eric Jackson of EMJ Capital started hyping the stock on social media platform X (formerly Twitter) in July, saying it had the potential to be a 100-bagger. Others then piled in, with influential newsletter writer and podcaster Anthony Pompliano also promoting the stock. Essentially, it’s become a meme stock.

With a high short interest and retail investors jumping in, the stock skyrocketed despite poor results.

A struggling business

Opendoor is essentially a company that flips houses. It uses a proprietary algorithm to act as an instant buyer of homes, making all-cash offers to sellers. While the company typically offers somewhat lower amounts than what a home is worth, the allure for sellers is that it’s a quick sale, and they can avoid the hassle of things like house showings and open houses.

The company makes money in two primary ways. The first revenue stream is through flipping the house, where it makes repairs and then sells it at a higher price. It charges a service fee, which it says is akin to a realtor’s commission. It’s also been working to expand its business into a more comprehensive platform, offering services such as mortgage services and title insurance.

The biggest issue with Opendoor’s business model is that the company takes on significant inventory risk. Once it buys a home, it owns the home. These things aren’t cheap. This process exposes Opendoor to losses if a house sits too long, since it has to pay real estate taxes and other costs like utilities. Meanwhile, home prices can also fall. The model can work in a rising price environment, but in a tough real estate environment, it can be challenging.

Profits have been tough to come by for the company, although last quarter it was able to squeeze out its first quarter of EBITDA profitability in three years. Its revenue climbed 4% to $1.6 billion, as it sold 4,299 homes, up 5%.

This is a low-gross-margin business, and gross margins slipped by 30 basis points to 8.2%. It recorded a net loss of $29 million in the quarter, but positive adjusted EBITDA of $23 million.

However, the company offered up a cautious outlook going forward due to what it called a deteriorating housing market. It said consistently high mortgage rates are leading to less buyer demand, resulting in both fewer acquisitions and lower resale volumes. The company only purchased 1,757 homes in the second quarter, which was down 63% versus a year ago.

As a result, it guided for third-quarter revenue of between $800 million to $875 million, and an adjusted EBITDA loss of between $28 million and $21 million. That compares to revenue of $1.4 billion in Q3 last year and an adjusted EBITDA loss of $28 million.

The company has started to lean more into working with real estate agents for business. It’s also introduced a cash plus hybrid product where a seller gets cash upfront, but can receive additional proceeds after the sale.

Image source: Getty Images.

Why the stock is unlikely to be a long-term winner

While Opendoor has had a great run, it’s unlikely to be a long-term winner. It has a capital-intensive business model with slim gross margins. The ability to really scale this business over the long run is difficult, and the company carries significant inventory risk.

After its latest surge, its market cap jumped to $7.7 billion. The company only generated $433 million in gross profits last year and $227 million through the first six months of this year, while projecting a slowdown in the second half.

The company would be smart to use its elevated stock price to issue stock and start stockpiling cash. However, even with that, it is hard to justify its current valuation for a business model that, as currently constructed, just isn’t that attractive.