Is the Vanguard S&P 500 ETF the Simplest Way to Double Up on “Ten Titans” Growth Stocks?

The Ten Titans have rewarded S&P 500 investors, but they came with higher potential risk and volatility.

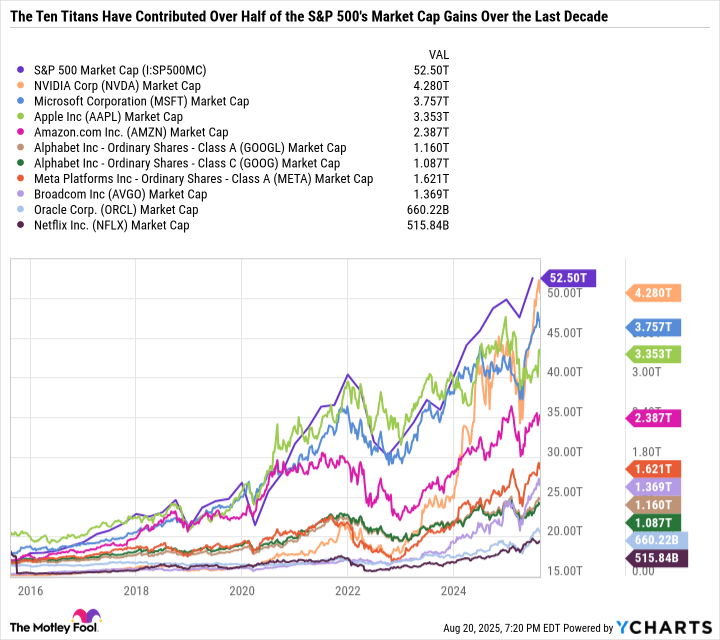

The largest growth-focused U.S. companies by market cap are Nvidia (NVDA 1.65%), Microsoft (MSFT 0.56%), Apple (AAPL 1.21%), Amazon (AMZN 3.12%), Alphabet (GOOG 2.98%) (GOOGL 3.10%), Meta Platforms (META 2.04%), Broadcom (AVGO 1.48%), Tesla (TSLA 6.18%), Oracle (ORCL 1.30%), and Netflix (NFLX -0.20%).

Known as the “Ten Titans,” this elite group of companies has been instrumental in driving broader market gains in recent years, now making up around 38% of the S&P 500 (^GSPC 1.52%).

Investment management firm Vanguard has the largest (by net assets) and lowest cost exchange-traded fund (ETF) for mirroring the performance of the index — the Vanguard S&P 500 ETF (VOO 1.46%). Here’s why the fund is one of the simplest ways to get significant exposure to the Ten Titans.

Image source: Getty Images.

Ten Titan dominance

Over the long term, the S&P 500 has historically delivered annualized results of 9% to 10%. It has been a simple way to compound wealth over time, especially as fees have come down for S&P 500 products. The Vanguard S&P 500 ETF sports an expense ratio of just 0.03% — or $3 for every $10,000 invested — making it an ultra-inexpensive way to get exposure to 500 of the top U.S. companies.

The Vanguard S&P 500 ETF could be a great choice for folks who aren’t looking to research companies or closely follow the market. But it’s a mistake to assume that the S&P 500 is well diversified just because it holds hundreds of names. Right now, the S&P 500 is arguably the least diversified it has been since the turn of the millennium.

Megacap growth companies have gotten even bigger while the rest of the market hasn’t done nearly as well. Today, the combined market cap of the Ten Titans is $20.2 trillion. Ten years ago, it was just $2.5 trillion. Nvidia alone went from a blip on the S&P 500’s radar at $12.4 billion to over $4 trillion in market cap. And not a single Titan was worth over $1 trillion a decade ago. Today, eight of them are.

S&P 500 Market Cap data by YCharts.

To put that monster gain into perspective, the S&P 500’s market cap was $18.2 trillion a decade ago. Meaning the Ten Titans have contributed a staggering 51.6% of the $34.3 trillion market cap the S&P 500 has added over the last decade. Without the Ten Titans, the S&P 500’s gains over the last decade would have looked mediocre at best. With the Ten Titans, the last decade has been exceptional for S&P 500 investors.

The Ten Titans have cemented their footprint on the S&P 500

Since the S&P 500 is so concentrated in the Ten Titans, it has transformed into a growth-focused index, making it an excellent way to double up on the Ten Titans. But the S&P 500 may not be as good a fit for certain investors.

Arguably, the best reason not to buy the S&P 500 is if you’re looking to avoid the Ten Titans, either because you already have comfortable positions in these names or you don’t want to take on the potential risk and volatility inherent in a top-heavy index.

That being said, the S&P 500 has been concentrated before, and its leadership can change, as it did over the last decade. The underperformance by former market leaders, like Intel, has been more than made up for by the rise of Nvidia and Broadcom.

So it’s not that the Ten Titans have to do well for the S&P 500 to thrive. But if the Titans begin underperforming, their sheer influence on the S&P 500 would require significantly outsized gains from the rest of the index.

Let the S&P 500 work for you

With the S&P 500 yielding just 1.2%, sporting a premium valuation and being heavily dependent on growth stocks, the index isn’t the best fit for folks looking to limit their exposure to megacap growth stocks or center their portfolio around dividend-paying value stocks.

The beauty of being an individual investor is that you can shape your portfolio in a way that suits your risk tolerance and investment objectives. For example, you use the Vanguard S&P 500 ETF as a way to get exposure to top growth stocks like the Ten Titans and then complement that position with holdings in dividend stocks or higher-yield ETFs.

In sum, the dominance of the Ten Titans means it’s time to start calling the Vanguard S&P 500 ETF what it has become, which is really more of a growth fund than a balanced way to invest in growth, value, and dividend stocks.

Investors with a high risk tolerance and long-term time horizon may cheer the concentrated nature of the index. In contrast, risk-averse investors may want to reorient their portfolios so they aren’t accidentally overexposing themselves to more growth than intended.

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Intel, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Tesla, and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft, short August 2025 $24 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.