Nearly half of Korean exporters cite China’s low-price competition as top challenge

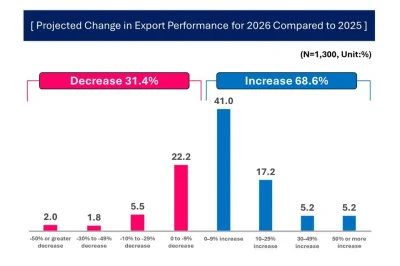

Results of the Korea Federation of SMEs’ “2026 SME Export Outlook Survey.” Graphic by Asia Today and translated by UPI

Dec. 21 (Asia Today) — Nearly half of South Korea’s small and medium-sized exporters expect their overseas shipments to decline next year, with many citing intensifying low-price competition from China as their biggest challenge, a survey released Sunday found.

The Korea Federation of SMEs said its “2026 SME Export Outlook Survey” polled 1,300 exporting SMEs from Dec. 1-12.

In the survey, 68.6% of respondents said they expect exports to increase in 2026 compared with this year, while 31.4% forecast a decrease, the federation said.

Among firms expecting export growth, cosmetics exporters (86.4%) and medical and biotech exporters (86.1%) were the most optimistic, the federation said. The most common reason for expecting export growth, in multiple responses, was improved product competitiveness through new product launches and quality improvements (47.1%), followed by diversification of export markets (29.8%) and improved price competitiveness due to exchange rate appreciation (21.6%).

Among SMEs forecasting weaker exports, 49.3% cited intensifying low-price competition from China as their main export challenge, followed by greater exchange rate volatility (44.6%), sharp increases in raw material prices (37.0%) and uncertainty over U.S. and European Union tariff policies (35.0%), the federation said.

Planned responses to weaker export performance included diversifying export markets (28.2%), improving quality or launching new products (23.0%) and reducing production costs such as labor and raw materials (21.8%), according to the survey.

Despite tariff concerns, the United States ranked first among markets SMEs most want to enter or expand into, at 21.0% when combining first-, second- and third-priority choices, the federation said. Europe followed at 15.2%, with Japan and China tied at 10.6%.

For government priorities to strengthen export competitiveness, respondents most frequently called for expanding support for an export voucher program (53.5%), followed by building a system to counter China’s low-cost offensive (35.8%) and strengthening diplomacy to respond to U.S. and EU tariffs (35.1%), the federation said. Other priorities included expanding support for participation in overseas exhibitions, including in emerging markets (31.5%) and supporting overseas certification and regulatory compliance (27.2%).

Chu Moon-gap, head of the federation’s economic policy division, said it was significant that SMEs are projecting export growth by improving competitiveness despite external headwinds such as tighter export regulations by various countries. He added that companies’ ability to reduce total costs, including production and logistics costs, tariffs and lead times, will be key to export competitiveness and said the government should prepare cost-reduction support measures to help SMEs respond to China’s low-cost competition.

– Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.