The seaside rich list is out from millionaire’s row to the bucket and spade champions of the north – check out how some of the UK’s favourite getaway destinations rank

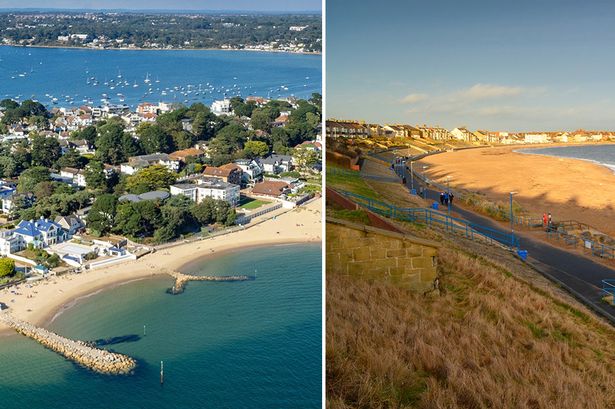

Britain’s most expensive seaside towns and the bargain “hidden gems” have been revealed. While the beaches of Sandbanks in Dorset still sit at the top of the seaside rich list, there are bargains to be had in the north of England according to the latest research.

But home buyers wanting to move to Sandbanks will not get much change from £1 million with the average house price £965,708 last year, according to Lloyds. While some of the cheapest can be found at Blackpool at £146,764 and Newbiggin-by-Sea in Northumberland at £132,863.

Sandbanks in Dorset, a popular location for celebrities such as former football manager, Harry Redknapp, with its array of upscale restaurants and glitzy nightlife. The bank said the average house price in Sandbanks has fallen by 3%, or £33,595, compared with 2023, but still sits at the top of its coastal property league.

One of the most expensive properties on the peninsula is a waterfront mansion on the site of a bungalow that John Lennon bought for his aunt 60 years ago, which has gone up for sale for almost £15m.

It was renamed ‘Imagine’, in honour of the land’s connection to Lennon, who once described sandbanks as the most beautiful place he had been. Salcombe in Devon is second on the Lloyds list, with an average house price of £826,159 in 2024.

Foodie hotspot Padstow in Cornwall, where celebrity chef Rick Stein operates is third , with buyers paying £715,974 on average to live there and enjoy the charm of its harbour and seafood scene on a daily basis.

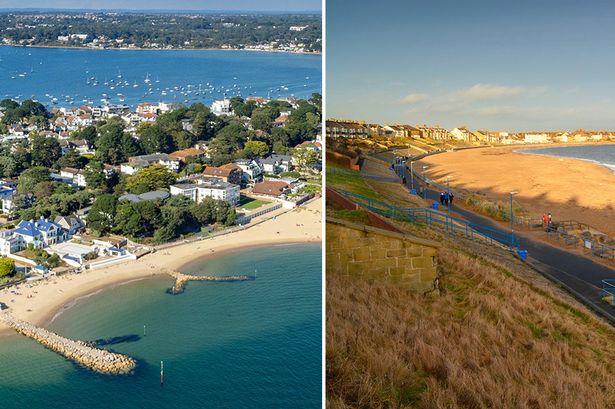

But Newbiggin-on-sea in Northumberland is described as a “hidden gem” with it’s rugged beauty but rock bottom prices. It is described as a bay “teeming with marine wildlife, a peaceful beach known for its glowing sunrises and fiery sunsets, and Sean Henry’s intriguing Couple sculpture that sits out at sea. They’re all waiting for you in Newbiggin-by-the-Sea.”

Amanda Bryden, head of mortgages at Lloyds, said: “Coastal living continues to hold a special appeal – whether it’s the lure of sea views, sandy beaches, or a slower pace of life. “Our latest research shows the most exclusive seaside spots – like Sandbanks – still command premium prices.

“In some of the UK’s most desirable coastal towns, average prices have dipped slightly over the past year.

“But, over the longer term, values remain significantly higher – especially in the South West, where demand from lifestyle movers continues to shape the market. At the other end of the scale, there are still pockets of real affordability – particularly in Scotland, where buyers can find coastal homes for a fraction of the price.

“For those willing to look beyond the traditional hotspots, there are some hidden gems offering great value and a strong sense of community. It’s also important to recognise that not all coastal areas share the same fortunes.

“Some seaside towns face significant challenges, from seasonal economies to a lack of affordable housing for local people.”

Here are Britain’s most expensive seaside locations, with the average house price in 2024, according to Lloyds:

1. Sandbanks, South West, £965,708. 2. Salcombe, South West, £826,159. 3. Padstow, South West, £715,974. 4. Aldeburgh, East of England, £619,693. 5. Lymington, South East, £608,253. 6. St Mawes, South West, £552,198. 7. Lyme Regis, South West, £531,815. 8. Budleigh Salterton, South West, £496,998. 9. Dartmouth, South West, £495,643. 10. Kingsbridge, South West, £484,986

Here are Britain’s least expensive coastal locations, according to Lloyds, with the average house price in 2024:

1. Campbeltown, Argyll and Bute, Scotland, £103,078. 2. Rothesay, Argyll and Bute, Scotland, £111,764. 3. Millport, North Ayrshire, Scotland, £114,008. 4. Port Bannatyne, Argyll and Bute, Scotland, £115,421. 5. Girvan, South Ayrshire, Scotland, £116,211. 6. Greenock, Inverclyde, Scotland, £117,751. 7. Ardrossan, North Ayrshire Scotland, £124,532. 8. Wick, Highlands, Scotland, £126,708. 9. Stranraer, Dumfries and Galloway, Scotland, £128,888. 10. Saltcoats, North Ayrshire, Scotland, £129,194

Here are England and Wales’s least expensive coastal locations, according to Lloyds, with average house prices in 2024:

1. Newbiggin-by-the-Sea, North East, £132,863. 2. Fleetwood, North West, £146,338. 3. Blackpool, North West, £146,764. 4. Withernsea, Yorkshire and the Humber, £148,402. 5. Maryport, North West, £153,243. 6. Seaham, North East, £157,100. 7. Blyth, North East, £158,265. 8. Hartlepool, North East, £158,271. 9. Cleethorpes, Yorkshire and the Humber, £166,909. 10. Whitehaven, North West, £170,673

Here are the most, followed by the least, expensive coastal locations in each region or nation, according to Lloyds, with average house prices in 2024:

East Midlands – most Chapel St Leonards, £214,802 least Skegness, £202,559. In the East of England Aldeburgh, £619,693 – Lowestoft, £238,372. North East it is Whitley Bay, £310,918 then Newbiggin-by-the-Sea, £132,863. In the North West Grange-over-Sands, £308,419 then Fleetwood, £146,338. In Scotland, St Andrews, Fife, £458,381 then Campbeltown, Argyll and Bute, £103,078. South East it is most Lymington, £608,253 and least East Cowes, £239,605 and in the South West Sandbanks, £965,708 withe the least in Plymouth, £248,668. In Wales top spot goes to The Mumbles, £417,043 with Prestatyn, £192,331 at the bottom and in Yorkshire and the Humber Whitby/Robin Hood’s Bay, £299,161 and Withernsea, £148,402