Destiny Wealth Sells $8.1 Million in IBB Shares — Here’s Why Biotech Stocks Are Lagging

Destiny Wealth Partners reported in an SEC filing on Monday that it sold 59,354 shares of the iShares Biotechnology ETF (IBB) in the third quarter—an estimated $8.1 million transaction based on average pricing for the quarter.

What happened

According to a filing with the Securities and Exchange Commission on Monday, Destiny Wealth Partners reduced its holding in the iShares Biotechnology ETF (IBB) by 59,354 shares during the quarter. The estimated value of the shares sold was $8.1 million. The fund now holds 16,430 IBB shares valued at $2.4 million as of September 30.

What else to know

This sale left IBB representing 0.3% of Destiny Wealth Partners’ 13F reportable assets.

Top holdings after the filing:

- JAAA: $46.41 million (5.7% of AUM)

- VUG: $40.11 million (4.9% of AUM)

- DFLV: $32.03 million (3.9% of AUM)

- JCPB: $28.13 million (3.45% of AUM)

- AMZN: $27.70 million (3.4% of AUM)

As of Tuesday afternoon, IBB shares were priced at $149.73. The fund is up about 5% over the year.

Company overview

| Metric | Value |

|---|---|

| AUM | $6.2B |

| Dividend yield | 0.18% |

| Price as of Tuesday afternoon | $149.73 |

| 1-year total return (as of Sept. 30) | –0.65% |

Company snapshot

- IBB seeks to track the investment results of a biotechnology-focused equity index, investing at least 80% of assets in component securities and economically similar investments.

- It operates as a non-diversified ETF, with periodic rebalancing to maintain index alignment.

The iShares Biotechnology ETF (IBB) offers investors access to the U.S. biotechnology sector through a passively managed fund. With over $6 billion in market capitalization, the ETF provides exposure to biotechnology companies.

Foolish take

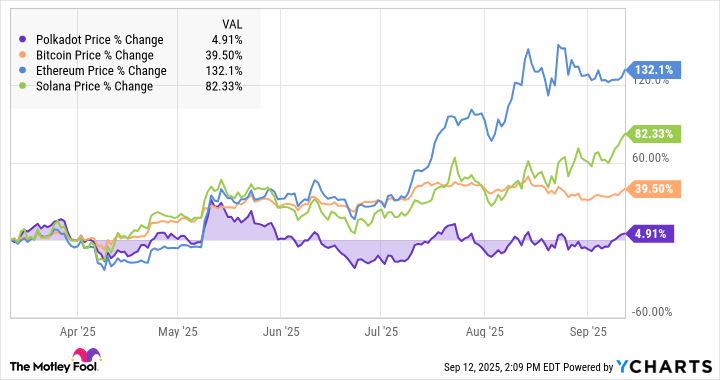

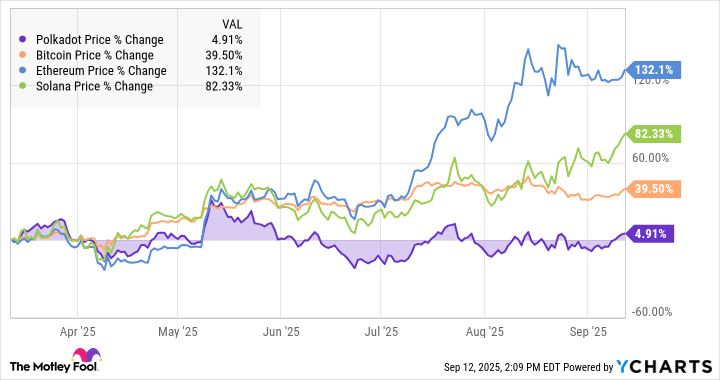

Destiny Wealth Partners’ decision to unload roughly $8.1 million in iShares Biotechnology ETF (IBB) shares adds to a broader theme in markets this year: Institutional investors have been cooling on biotech. The sector has struggled to regain its pandemic-era momentum as investors favor AI, energy, and industrial plays. IBB is up about 5% over the past year, trailing the S&P 500’s 18% gain.

IBB’s two largest holdings—Vertex Pharmaceuticals and Amgen—have each slumped, down about 8% and 7%, respectively, over the past year. That drag has offset strength from smaller, high-growth biotech names focused on oncology and gene therapy. Meanwhile, the fund’s expense ratio of 0.44% sits slightly above broad-market ETF averages, reflecting the niche exposure investors are paying for.

For long-term investors, IBB still offers diversified exposure to the innovation pipeline driving future drug breakthroughs—but near-term returns will depend on FDA approvals, pricing clarity, and investor appetite for higher-risk growth sectors.

Glossary

ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges, holding a basket of assets like stocks or bonds.

Biotechnology ETF: An ETF focused on companies in the biotechnology industry, such as drug development and medical research.

AUM (Assets Under Management): The total market value of assets that an investment manager or fund controls on behalf of clients.

13F reportable AUM: The portion of a fund’s assets that must be disclosed in quarterly SEC Form 13F filings, typically U.S. equity holdings.

Non-diversified ETF: A fund that invests in fewer securities or sectors, increasing exposure to specific industries or companies.

Index-based selection: An investment strategy where holdings are chosen to match a specific market index, rather than by active management.

Component securities: The individual stocks or assets that make up an index or ETF portfolio.

Dividend yield: The annual dividend income expressed as a percentage of the investment’s current price.

Total return: The investment’s price change plus all dividends and distributions, assuming those payouts are reinvested.

Rebalancing: Adjusting a fund’s holdings periodically to maintain alignment with its target index or asset allocation.