Bain Capital started with help of offshore investors

Washington Bureau

WASHINGTON — When Mitt Romney launched Bain Capital in 1984, he struggled at first to raise enough money for the untested venture. Old-money families like the Rothschilds turned down the young Boston consultant.

So he and his partners tapped an eclectic roster of investors, raising more than a third of their first $37-million investment fund from wealthy foreigners.

Most of the foreign investors’ money came through corporations registered in Panama, then known for tax advantages and unusual banking secrecy.

Previously unreported details, documented in Massachusetts corporate filings and other public records, show that Bain Capital was enmeshed in the largely opaque world of international high finance from its very inception.

The documents don’t indicate any wrongdoing, and experts say that such financial vehicles are common for wealthy foreign investors. But the new details come as President Obama has criticized Romney for profiting from Bain Capital’s own offshore investment entities, which are unavailable to most Americans.

The Romney campaign declined to comment on the specifics of Bain’s early investors. Romney has argued that his offshore investments are entirely proper, and that he has paid all the U.S. taxes that he owes. The offshore funds do provide tax advantages for foreign investors, allowing Bain to attract billions of dollars.

“The world of finance is not as simple as some would have you believe,” Romney said in an interview this week with National Review Online.

The first outside investor in Bain was a leading London financier, Sir Jack Lyons, who made a $2.5-million investment through a Panama shell company set up by a Swiss money manager, further shielding his identity. Years later, Lyons was convicted in an unrelated stock fraud scandal.

About $9 million came from rich Latin Americans, including powerful Salvadoran families living in Miami during their country’s brutal civil war.

That first investment fund — used to invest in start-up companies and leveraged buyouts — paid out a stunning 173% in average annual returns over a decade, according to a prospectus prepared by an outside bank. It was the start of the private equity powerhouse that ultimately fueled Romney’s political career. He now cites his experience at Bain as a chief qualification for the White House.

Romney faced unusual complications when he launched Bain Capital, a spinoff of Bain & Co., the Boston consulting firm he joined when he graduated from Harvard Business School.

At the time, U.S. officials were publicly accusing some exiles in Miami of funding right-wing death squads in El Salvador. Some family members of the first Bain Capital investors were later linked to groups responsible for killings, though no evidence indicates those relatives invested in Bain or benefited from it.

Romney has said he checked the foreign investors’ backgrounds. His campaign and Bain Capital declined to provide specifics.

Alex Stanton, a spokesman for Bain Capital, said confidentiality rules barred him from commenting on the investors.

“The hyperbole of political campaigns cannot change the fact that Bain Capital has operated with high standards of integrity and excellence, including compliance with all applicable laws and regulations regarding the vetting of our investors in consultation with experienced counsel and other advisors,” he said. “Any suggestion to the contrary is baseless.”

Matt McDonald, a spokesman for the Romney campaign, also declined to discuss details of the original fund. “There were many investors who saw the opportunity of a firm that could help fix broken companies and help them grow.”

But when Romney and his partners started the firm, Bain & Co. founder Bill Bain — worried the new venture could fail — barred them from soliciting current clients or corporations that would have to publicly disclose the investment, according to an early Bain Capital employee.

Bain partners put in $12 million of their own money, then sought the rest from wealthy individuals.

Records show the first investment in Bain Capital — $1.25 million in June 1984 — was in the name of Jean Overseas Ltd., registered in Panama by Marcel Elfen, a Swiss money manager. Later, the investment was doubled.

The Panamanian shell company apparently was a vehicle for Lyons, the British businessman and philanthropist. Lyons died in 2008.

His son, David Lyons of Quebec, said in a phone interview that he had never heard of Jean Overseas, but he confirmed that his father was “absolutely” an early investor in Bain Capital and said that Elfen, who died last year, was his father’s money manager.

David Lyons said that wealthy Europeans like his father often invested through offshore shell corporations. “It allowed some confidentiality,” he said. “It allowed a lot of things.”

Jack Lyons worked as an outside consultant for Bain & Co., but that ended when he and three others were charged in the Guinness Affair, a stock scandal that rocked Britain. Convicted of fraud in 1990, he was spared prison time due to his failing health, but was stripped of his knighthood.

Romney and his partners also won over the money manager for one of California’s wealthiest families, the Crockers, whose family trust put in $4.8 million. Romney “was the most confident executive I’ve ever come across,” said William Swanson, who at the time managed the family’s investments.

Other early investors included Robert Maxwell, the British publishing baron, who invested $2 million. After his drowning death in 1991, investigators discovered Maxwell had stolen hundreds of millions of dollars from his company’s pension funds.

But early on, the fundraising was still falling short. Harry Strachan, a Bain Capital partner who was born in Costa Rica to American missionary parents, knew Central American businessmen through his involvement in a Harvard-backed business school in Nicaragua. Why not pitch to them?

Romney and Bill Bain were initially “terrified of bringing in Central Americans,” Strachan told the Boston Globe in August 1994. “They were afraid of drug money.”

Reassured by Strachan, Romney flew to Miami to meet the group in 1984.

“My friends were impressed by Mitt and the team and signed up for 20% of the fund,” Strachan wrote in his self-published memoir, “Finding a Path.” He did not respond to requests for comment.

The group included some of El Salvador’s wealthiest people: coffee grower Miguel A. Dueñas; members of the De Sola family, also coffee exporters; and Ricardo Poma, whose family conglomerate now owns car dealerships and luxury hotels across Central America. Other investors included Frank Kardonski, who co-founded the Panama Stock Exchange, and Diego Ribadeneira, nowEcuador’sambassador to Peru.

Most of the money they put into Bain Capital was through corporations set up in Panama with names such as Velof Trust, Jolla and Universal Selling Co.

In the 1980s, Panama was “the country of choice for foreigners wanting to make investments on a confidential basis,” said Steven H. Hagen, a Miami lawyer who provides tax advice to offshore companies and international investors.

The use of an offshore corporation to invest in a U.S. business shields foreign investors from estate taxes, but not income taxes, Hagen said.

At the time, El Salvador was being torn apart in a civil war that ultimately left tens of thousands dead. The Bain investors — some of whom had their plantations seized and family members targeted — were waiting out the war in Miami.

“Many of them were trying to move their money elsewhere,” said Jeffery M. Paige, a University of Michigan professor who wrote a book about the Salvadoran ruling class. “It was a difficult transition, and of course their investment outlets were limited.”

Among the Bain investors were Francisco R.R. de Sola and his cousin Herbert Arturo de Sola, whose brother Orlando de Sola was suspected by State Department officials and the CIA of backing the right-wing death squads, according to now-declassified documents.

Orlando de Sola, who has denied supporting the death squads, is now serving a four-year prison term for unrelated fraud charges. In an interview at the prison in Metapan, El Salvador, he said he did not benefit from the family investment in Bain Capital.

Before Bain, the family’s holdings were based in El Salvador, he said. “I would say their relationship with Bain Capital was a step to diversify into foreign investments. But I insist to you, I was not part of it.”

The other Latin American investors declined or did not respond to requests to comment.

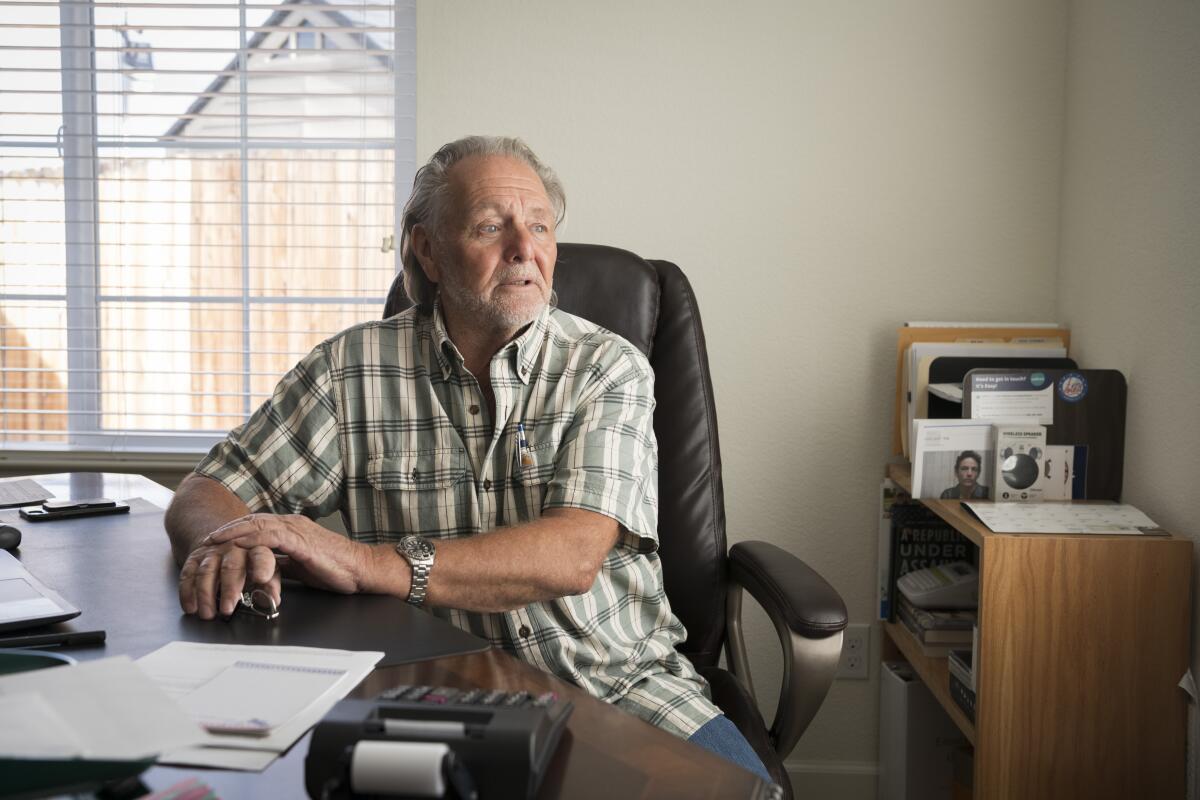

Other early investors were happy to talk about their lucrative early bet. Jack Hanley, former head ofMonsanto Co., put in $1 million.

“It seemed like a hell of a smart thing for me to do to ride their coattails,” said Hanley, now 83. “I got rich.”

Special correspondent Alex Renderos in Metapan, El Salvador, contributed to this report.