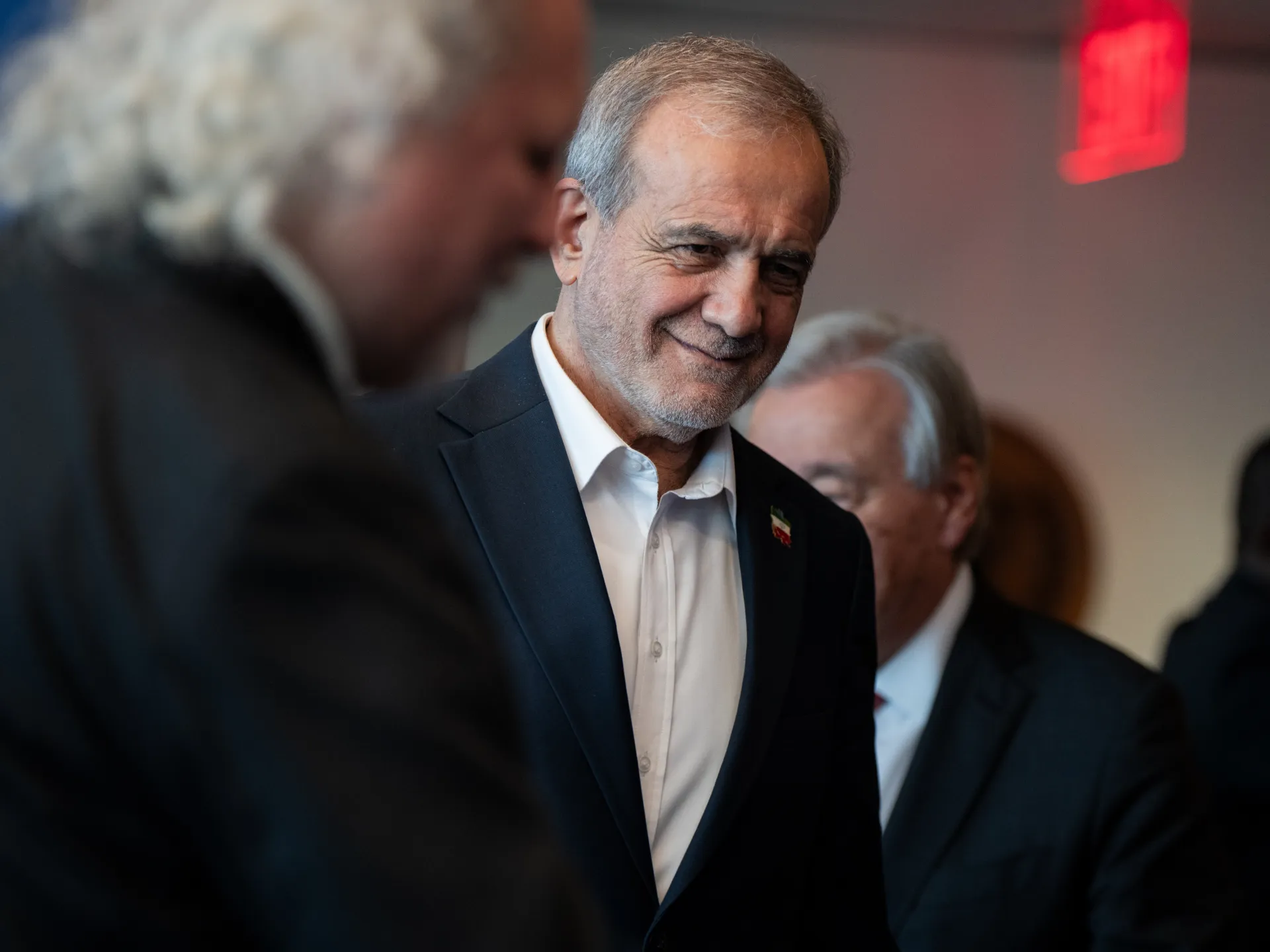

Iran president tells Saudi crown prince that US threats cause instability | News

Iranian President Masoud Pezeshkian emphasised that regional instability ‘benefits no one’ during the call.

Iranian President Masoud Pezeshkian has held a phone call with Saudi Crown Prince Mohammed bin Salman after a United States aircraft carrier arrived in the region amid growing fears of a new conflict with Israel or the US.

The US has indicated in recent weeks that it is considering an attack against Iran in response to Tehran’s crackdown on protesters, which left thousands of people dead, and US President Donald Trump has sent the USS Abraham Lincoln aircraft carrier to the region.

Recommended Stories

list of 3 itemsend of list

Pezeshkian hit out at US “threats” in the call with the Saudi leader on Tuesday, saying they were “aimed at disrupting the security of the region and will achieve nothing other than instability”.

“The president pointed to recent pressures and hostilities against Iran, including economic pressure and external interference, stating that such actions had failed to undermine the resilience and awareness of the Iranian people,” according to a statement from Pezeshkian’s office on Tuesday.

The statement said that Prince Mohammed “welcomed the dialogue and reaffirmed Saudi Arabia’s commitment to regional stability, security, and development”.

“He emphasised the importance of solidarity among Islamic countries and stated that Riyadh rejects any form of aggression or escalation against Iran,” it said, adding that he had expressed Riyadh’s readiness to establish “peace and security across the region”.

The call between the two leaders comes after Trump repeatedly threatened to attack Iran during a deadly crackdown on antigovernment protests this month. Last week, he dispatched an “armada” towards Iran but said he hoped he would not have to use it.

Amid growing fears of a new war, a commander from Iran’s Islamic Revolutionary Guard Corps (IRGC) on Tuesday issued a warning to Iran’s neighbours.

“Neighbouring countries are our friends, but if their soil, sky, or waters are used against Iran, they will be considered hostile,” Mohammad Akbarzadeh, political deputy of the IRGC naval forces, was quoted as saying by the Fars news agency.

Israel carried out a wave of attacks on Iran last June, targeting several senior military officials and nuclear scientists, as well as nuclear facilities. The US then joined the 12-day war to bombard three nuclear sites in Iran.

The war came on the eve of a round of planned negotiations between the US and Iran over Tehran’s nuclear programme.

Since the conflict, Trump has reiterated demands that Iran dismantle its nuclear programme and halt uranium enrichment, but talks have not resumed.

On Monday, a US official said that Washington was “open for business” for Iran.

“I think they know the terms,” the official told reporters when asked about talks with Iran. “They’re aware of the terms.”

Ali Vaez, director of the Iran Project at the International Crisis Group, told Al Jazeera that the odds of Iran surrendering to the US’s demands are “near zero”.

Iran’s leaders believe “compromise under pressure doesn’t alleviate it but rather invites more”, Vaez said.

But while the US builds up its presence in the region, Iran has warned that it would retaliate if an attack is launched.

Iran’s Foreign Ministry spokesperson warned on Tuesday that the consequences of a strike on Iran could affect the region as a whole.

Esmaeil Baghaei told reporters, “Regional countries fully know that any security breach in the region will not affect Iran only. The lack of security is contagious.”