Trump says he’s ‘inclined’ to keep ExxonMobil out of Venezuela after CEO’s remarks

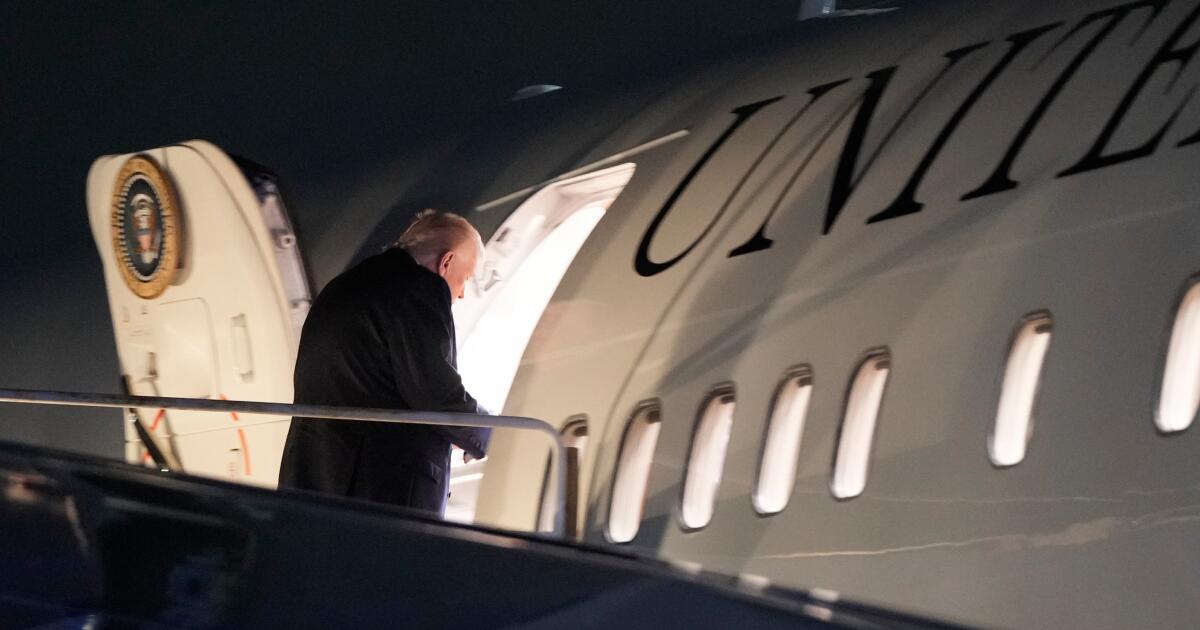

ABOARD AIR FORCE ONE — President Trump said Sunday that he is “inclined” to keep ExxonMobil out of Venezuela after its top executive voiced skepticism about oil investment efforts in the country after the U.S. toppling of President Nicolás Maduro.

“I didn’t like Exxon’s response,” Trump said to reporters on Air Force One as he departed West Palm Beach, Fla. “They’re playing too cute.”

During a meeting Friday with oil executives, Trump tried to assuage the concerns of the companies and said they would be dealing directly with the U.S., rather than the Venezuelan government.

Some weren’t convinced.

“If we look at the commercial constructs and frameworks in place today in Venezuela, today it’s uninvestable,” said Darren Woods, chief executive of ExxonMobil, the largest U.S. oil company.

An ExxonMobil spokesperson did not immediately respond Sunday to a request for comment.

Trump signed an executive order Friday that seeks to ensure that Venezuelan oil revenue remains protected from being used in judicial proceedings.

The order, made public Saturday, says that if the funds were to be seized for such use, it could “undermine critical U.S. efforts to ensure economic and political stability in Venezuela.” Venezuela has a history of state asset seizures, ongoing U.S. sanctions and decades of political uncertainty.

Getting U.S. oil companies to invest in Venezuela and help rebuild the country’s infrastructure is a top priority of the Trump administration after Maduro’s capture.

The White House is framing the effort to “run” Venezuela in economic terms, and Trump has seized tankers carrying Venezuelan oil, has said the U.S. is taking over the sales of 30 million to 50 million barrels of previously sanctioned Venezuelan crude, and plans to control sales worldwide indefinitely.

Kim and Nikhinson write for the Associated Press. Kim reported from West Palm Beach, Fla., and Nikhinson reported from aboard Air Force One.