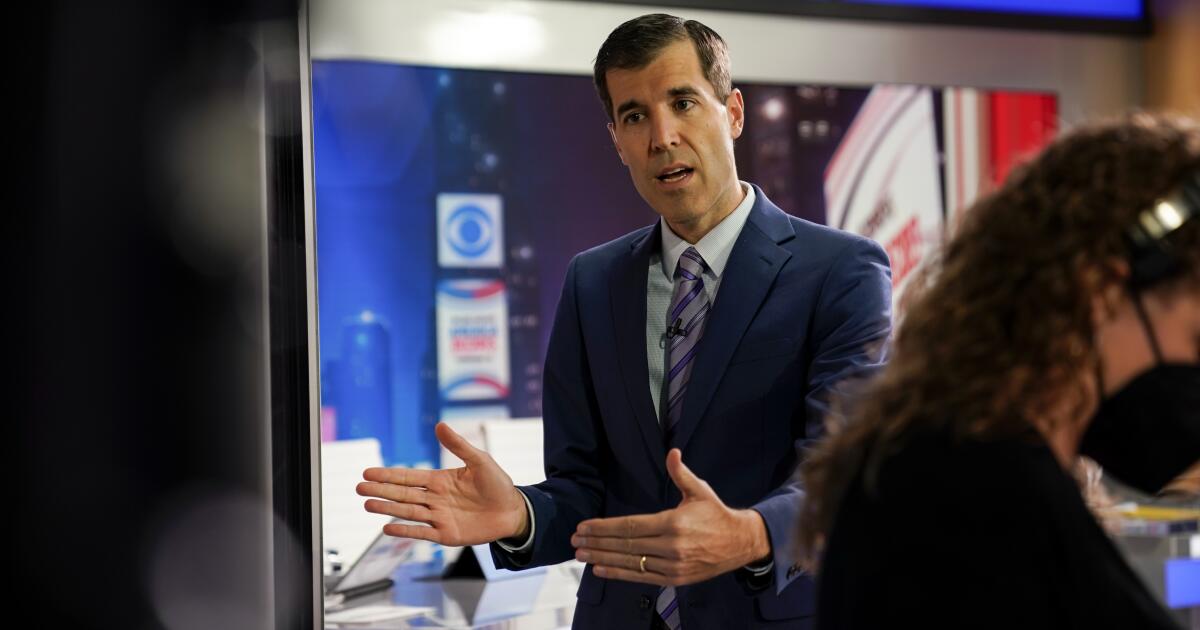

CBS News Justice correspondent Scott MacFarlane exits network

Scott MacFarlane, a high-profile hire for CBS News five years ago, announced Monday he is leaving the network.

MacFarlane told colleagues in an email that the departure is his decision.

“I will always value the opportunity I had to work alongside the talented and committed professionals here,” MacFarlane said. “I’m proud to have had the words ‘CBS correspondent’ next to my name and always will be.”

MacFarlane added that he looks forward to “some independence and finding new spaces to share my work in line with my personal goals.”

MacFarlane is the first significant name to depart CBS News since parent company Paramount won its bid to acquire Warner Bros. Discovery on Feb. 27. CBS News is likely to be combined with Warner Bros. Discovery‘s CNN if the deal gets regulatory approval.

Journalists at CBS News have also been concerned over the moves by Bari Weiss, the contrarian opinion writer and founder of the digital news site the Free Press who was brought in as editor in chief of the division. Weiss was recruited by Paramount Chief Executive David Ellison with a mandate to move CBS News to the political center.

Weiss is expected to make significant changes to “60 Minutes” and other CBS News programs in the coming months.

Executives at other TV news organizations say privately that they are seeing a heavy influx of resumes from CBS News journalists due to the upheaval at the company.

MacFarlane covered Congress and the Justice Department. CBS viewers saw him featured during extended network coverage of the State of the Union addresses and election nights.

MacFarlane was in Butler, Pa., during the assassination attempt of President Trump in July 2024. He reported the first accounts of the shooting scene and emergency responses moments after the shots were fired.

Before arriving at CBS News, MacFarlane served for eight years as an investigative reporter for WRC-TV, the NBC station in Washington, D.C.