The Smartest Index ETF to Buy With $1,000 Right Now

You can make a strong argument that buying the S&P 500 index is a good choice today, but maybe you should consider some value stocks, too.

The S&P 500 index (SNPINDEX: ^GSPC) is trading near all-time highs. Since the Vanguard S&P 500 Index ETF (VOO 0.60%) tracks the S&P 500, it is also trading near all-time highs. And it could still be a smart move to buy the index via an investment in the exchange-traded fund.

But there might be a smarter choice, if you take valuations into consideration. Which is where another Vanguard exchange-traded fund (ETF) comes into play. Here’s what you need to know.

Just get started

One of the biggest things any investor can do is get started. So if you have $1,000 to invest and you’ve never done so before, it could be a very good idea to just buy the market. By default, that would be the S&P 500 index for most investors. And then you should just keep buying the market every single month to benefit from dollar-cost averaging.

Image source: Getty Images.

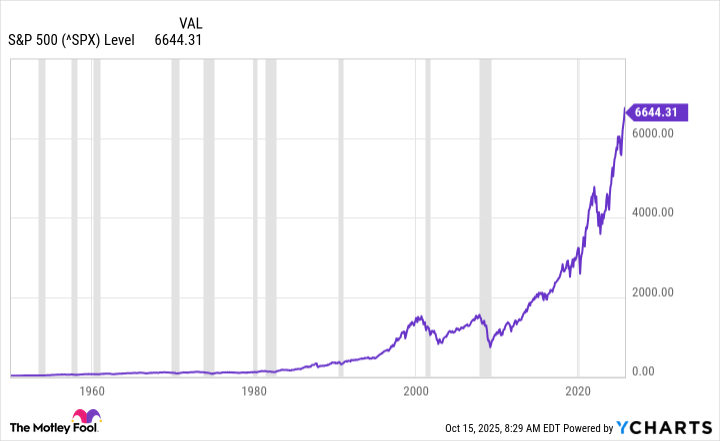

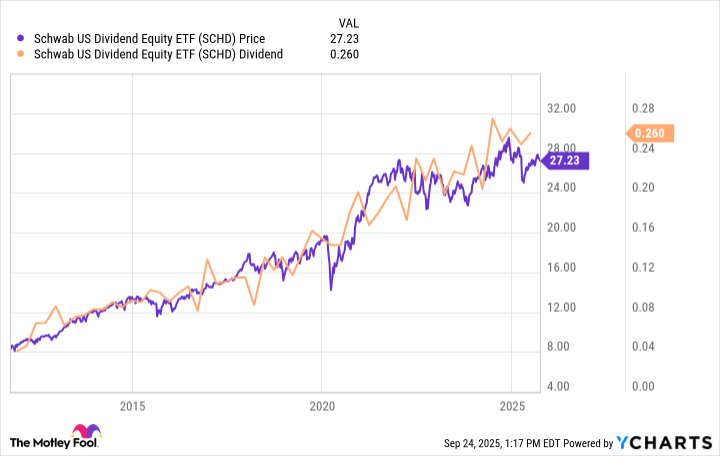

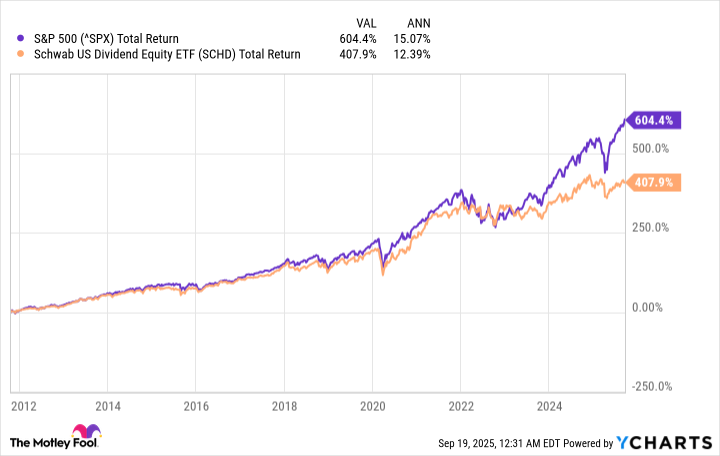

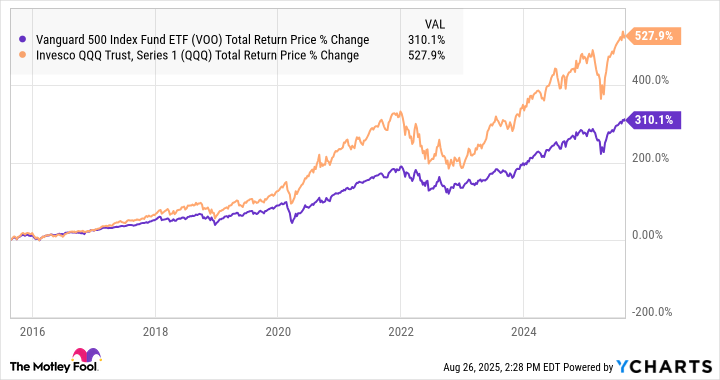

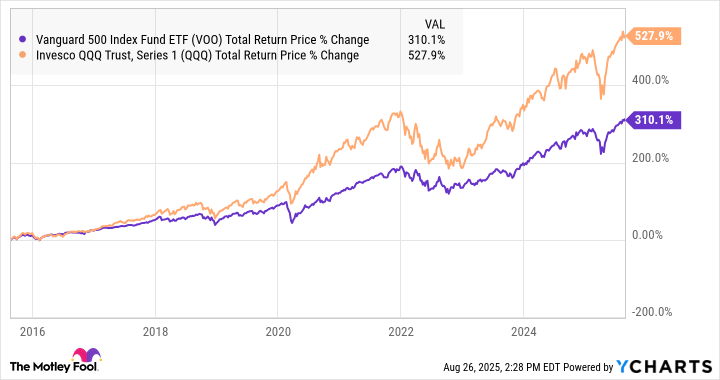

Since all of the products that track the same index basically do the same thing, the Vanguard S&P 500 ETF is going to be a top choice. With an expense ratio of just 0.03%, it is one of the cheapest ways to gain exposure to the S&P. Why pay more for the same basic service? As the chart below shows, the market has recovered from even the worst bear markets and then moved on to reach even higher highs.

If you have $1,000 or $10,000 (or even more) to invest, just getting started is going to be the smartest move. Then, keep going and never look back.

Sure, in the near term, you might suffer through some paper losses. But over the long term, history suggests you’ll still make out just fine. If buying when things are expensive is just too much for you, however, you might find that the Vanguard Value ETF (VTV 0.51%) is an even smarter choice.

Why go the value route?

A $1,000 investment in the Vanguard Value ETF will buy you around five shares of the exchange-traded fund. What you will end up owning is a portfolio of large U.S. companies that have valuations that are low relative to the broader market. With the S&P 500 near all-time highs, that’s not an insignificant issue.

Putting some numbers on this might help. The Vanguard Growth ETF (VUG 0.56%), the opposite extreme from the value ETF, has an average price-to-earnings ratio of around 40. That’s pretty expensive, but you would expect that, given its focus on growth.

The Vanguard S&P 500 Index ETF has an average P/E of about 29. Still pretty high, thanks to the fact that some very large technology stocks (which tend to be growth-focused) are driving its performance. The Vanguard Value ETF’s average P/E is a little under 21. It wouldn’t be fair to call 21 cheap, but it is most certainly cheaper than both the S&P 500 and Vanguard Growth ETF.

The same trend exists with the price-to-book-value ratio (P/B). The Vanguard Growth ETF comes in with a P/B ratio of 12.5, the Vanguard S&P 500 Index ETF sits at 5.2, and the Vanguard Value ETF is the lowest on the valuation metric at just 2.8. While it won’t necessarily save you from a bear market, focusing on value stocks when growth is in favor could soften the pain of a deep downturn.

Get started first, but consider a value component when you do

To reiterate the theme here, the most important investment decision you can make is to start investing in the first place. The second one is to keep it up even when times get tough on Wall Street. But if you have already made those choices, then maybe it makes sense to consider taking a more nuanced approach with what you choose to buy.

If all you have is $1,000 to start, perhaps consider splitting it between the S&P 500 Index ETF and the Value ETF, to lean you toward cheaper stocks. If you already have a portfolio, then the smartest move could be to put a grand into just the Value ETF to help diversify you away from the growth stocks that are leading the market into the nosebleed seats.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.