Illusion of Supremacy or Reality of Power: Why the U.S. Cannot Wage War on China

During the past several years, war scenarios and analyses issuing from Washington have hewed to a familiar but deceptively reassuring image of the future: one of an “absoluteness of reliance on technological superiority, precision initial strikes, and the illusion of a ‘quick victory’ as some sort of magic solution to crises like a Chinese attack on Taiwan.” This is arguably decisive and reassuring on the surface but is, on closer and realistic examination, a dangerous fantasy rather than a practical operational scenario. Not only is it wholly incompatible with the military, industrial, and political situation in which the United States currently finds itself, but it also conceals the danger of involving the world in a nuclear escalation and a prolonged conflict, which the United States cannot afford.

In reality, U.S. military strategists are faced with an insoluble dilemma: Insisting on the “quick victory” doctrine raises the chances of a preemptive nuclear response from Beijing to certainty. If they start preparing for a long, grinding war, the more important question becomes: Is the U.S., in terms of industry, military capability, and political will, even capable of it? The realistic answer is no—at least not on the scale that many American decision-makers imagine.

Most Pentagon war plans, accordingly, emphasize cyberattacks and long-range strikes against China’s command structures, communication hubs, logistical networks, and missile bases. Ideally, this would leave China paralyzed within days, with a collapsed will to fight. In the real world, this can backfire: hitting essential Chinese systems, the leadership in Beijing—operating under unprecedented isolation and pressure—might revert to “escalation vertically,” that is, the early use of nuclear weapons to sustain their deterrent.

China’s nuclear arsenal, though still smaller than that of the US, is growing rapidly. By 2040, estimates suggest, China could possess some 600 operational warheads, compared with the United States’s stockpile of about 3,700. This growing disparity could be driving Beijing toward a more perilous posture—one in which it resorts to using nuclear weapons before that option disappears. Most Chinese missile systems are dual-use, meaning they can be equipped with either conventional or nuclear warheads. A U.S. strike against DF-21 or DF-26 launchers might thus be viewed as an attack on the survivability of China’s nuclear deterrent and could invite a nuclear response.

This is far from theoretical. Recent Pentagon war games have set off alarms. In many of the simulations, U.S. anti-ship missile stocks are depleted in just days; long-range munitions, in two weeks. Even scenarios in which Taiwan, supported by the U.S. and Japan, resists Chinese aggression depict victories at a devastating cost: dozens of ships sunk, hundreds of aircraft destroyed, and thousands of U.S. casualties—numbers that the American public and policymakers could scarcely accept.

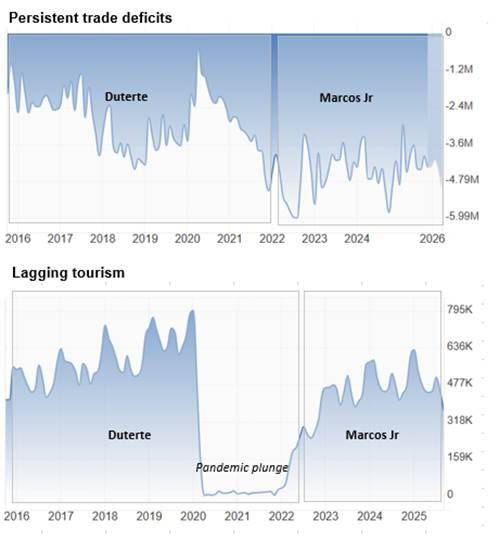

For a global power, effective strategy must correspond with the country’s real industrial, financial, and societal capacity. In recent decades, the U.S. has drastically reduced its military production capabilities while increasing dependence on foreign supply chains. The war in Ukraine has given a glimpse of how even modest arms support for allies can deplete critical stockpiles quickly. Imagine the strain should the U.S. fight a full-scale war with the world’s second-largest economy thousands of miles from its shores.

The problem goes far beyond military planning and munitions shortages. Domestically, the U.S. does not have political and social consensus with regard to defending Taiwan. In contrast with the Cold War era, when the Soviet threat unified the American public, today Americans feel much less that their vital interests in East Asia are at stake. In such a context, how could the public accept tens of thousands of casualties and astronomical costs to defend a small island?

It is during any protracted conflict that national will plays as important a role as weapons and technology. Without political unity, industrial capacity, and societal tolerance, technological superiority means nothing. Washington will continue to remain enmeshed in the same fantasy that has brought empires low: that technology and military power can somehow substitute for strategic judgment.

A way out of this deadlock is quite evident, but the political will is lacking. Firstly, the U.S. should recognize that technological superiority does not necessarily translate into strategic dominance. Secondly, if it is serious about defending Taiwan, it needs to start rebuilding industrial capacity now, expand munitions production lines, and level with its people about what war would really look and feel like. Thirdly, diplomacy and sustainable deterrence must be reinstated—not through threats or arms races, but through dialogue, crisis management, and reduction of the risk of miscalculation between Washington and Beijing.

If the U.S. keeps on fantasizing about a quick and cost-free victory, then it will not only face defeat on the battlefield but also push the world to the brink of a nuclear catastrophe. The ability to engage in war depends not only on the number of missiles and ships but also on political wisdom, economic capability, and a clear-eyed view of reality—three things the U.S. plainly lacks in its confrontation with China. It is time for Washington to wake up from its comforting illusions of power and face reality in terms of true strength—before it is too late.