Hiltzik: TMTG racks up huge losses

So much Trump-related news has appeared lately on the airwaves and in web pixels — what with Iran and Epstein and Minnesota and so on — that inevitably a nugget will fall between the cracks.

That seems to have been the fate of the most recent annual financial report of Trump Media and Technology Group, which covered calendar year 2025 and was issued Friday.

Trump Media, which is 52% owned by Donald Trump and trades on Nasdaq with a ticker symbol based on his initials (DJT), is the holding company for Trump’s social media platform, Truth Social.

The value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.

— A risk factor disclosed by Trump Media

The annual financial disclosure has garnered minimal press coverage. That’s a pity, because it makes fascinating reading, though not in a good way.

Here are the top and bottom lines from the 10-k annual report: Trump Media lost $712.1 million last year on revenue of about $3.7 million. That’s quite a bit worse than its performance in 2024, when it lost $409 million on revenue of about $3.6 million. The company attributed most of the flood of red ink to “loss from investments,” of which more in a moment.

Truth Social isn’t an especially strong keystone of this operation. The platform is chiefly an outlet for Trump’s social media ramblings and the occasional official White House statements. But no one has to sign in to Truth Social to see them — they’re almost invariably picked up by the news media or reposted by users on other platforms such as X.

That might explain Truth Social’s relatively scrawny user base. The platform is estimated to have about 2 million active users, according to the analytical firm Search Logistics. By comparison, X has about 450 million monthly active users and Facebook has more than 2.9 billion.

It’s no mystery, then, why TMTG disdains “traditional performance metrics like average revenue per user, ad impressions and pricing, or active user accounts, including monthly and daily active users,” according to its annual report.

Relying on those metrics, which are used to judge TMTG’s social media rivals, “might not align with the best interests of TMTG or its stockholders, as it could lead to short-term decision-making at the expense of long-term innovation and value creation.”

Instead, the company says it should be evaluated based on “its commitment to a robust business plan that includes introducing innovative features, new products, new technologies.” But it also acknowledges that, at its heart, TMTG is a proxy for “the reputation and popularity of President Donald J. Trump.” The company warns that “the value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.”

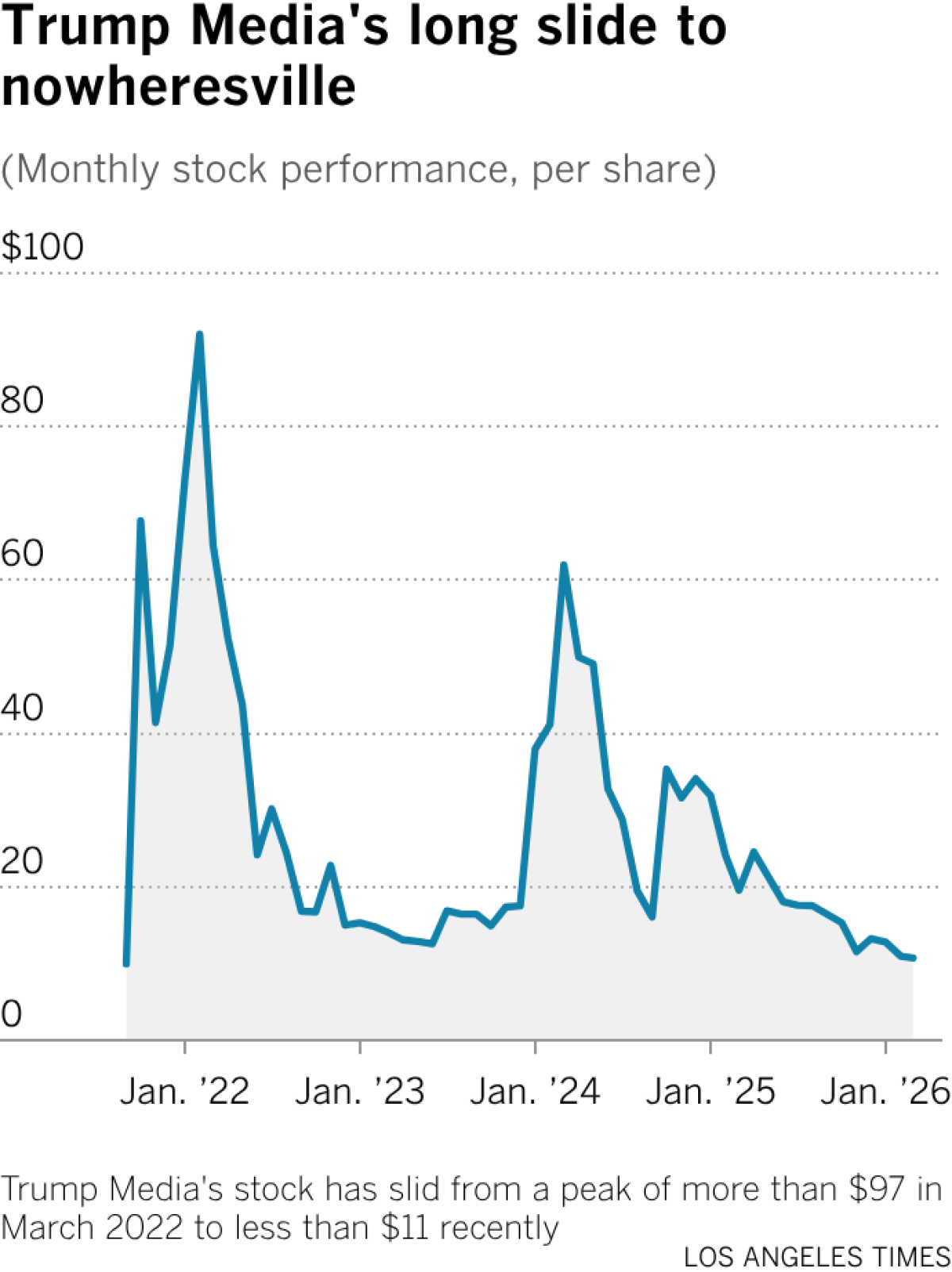

How has that played out in real time? Trump Media notched its highest closing price as a public company, $66.22, on March 27, 2024, the day after its initial public offering. In midday trading Monday, the shares were quoted at $11.08, for a loss of 83% since the IPO.

One can’t quibble with stock market price quotes; nor can one finagle annual profit and loss statements, at least not without receiving questions, and perhaps lawsuit complaints, from attentive investors and the Securities and Exchange Commission.

In recent months, TMTG has engaged in a number of baroque financial transactions.

In May, the company announced that it was planning to raise $3.5 billion from institutions to invest in bitcoin, with the money to come from issues of common and preferred shares. The goal was to climb onto the cryptocurrency train, which Trump himself was fueling by, among other things, issuing an executive order promoting the expansion of crypto in the U.S. and denigrating enforcement efforts by the Biden administration as reflecting a “war on cryptocurrency.”

Under Trump, federal regulators have dropped numerous investigations related to cryptocurrencies. Trump has also talked about creating a government crypto strategic reserve, which would entail large government purchases of bitcoin and other cryptocurrencies; a March 3 announcement on that subject briefly sent bitcoin prices soaring by nearly 20%, though they promptly fell back.

Then there’s TMTG’s relationship with Crypto.com, a Singapore-based crypto “service provider” best known to Angelenos unfamiliar with the crypto world as the firm with naming rights to the Los Angeles arena that hosts the NBA Lakers and Clippers, WNBA Sparks and NHL Kings.

In August, Crypto.com and TMTG announced a deal in which TMTG would pursue a crypto treasury strategy consisting mostly of Cronos tokens, a cryptocurrency sponsored by Crypto.com. The initial infusion would consist of 6.4 billion Cronos valued at $1 billion, or about 15.8 cents per Cronos.

As of Dec. 31, TMTG said in its 10-K, it owned 756.1 million Cronos, acquired at a cost of about $114 million, or 15 cents each. By year’s end, they were worth only about nine cents each, for a paper loss of about $46 million. In trading this week, Cronos was quoted at about 7.6 cents, producing a paper loss for TMTG of about $56.5 million, or roughly half the investment.

The financial maneuvering involved in this trade is a little dizzying. The initial transaction was a 50% stock, 50% cash trade in which Crypto.com bought $50 million in TMTG stock and TMTG bought $105 million in Cronos. Who gained in this deal? It’s almost impossible to say.

Crypto.com did gain, if not purely in cash, then arguably through the Trump administration’s good graces.

On March 27, the SEC formally closed an investigation of the company that it had launched during the Biden administration, when the agency was headed by a known crypto skeptic, Gary Gensler. Trump appointed a crypto-friendly regulator, Paul Atkins, as Gensler’s successor.

It’s reasonable to note that as a business model, crypto treasuries have been in vogue over the last year or so, allowing investors to play the crypto market without all the complexities of actually buying and holding the digital assets by buying shares in treasury companies.

I asked Crypto.com whether the steady decline in Cronos’ price suggested that the hookup with TMTG wasn’t bearing fruit. “The fluctuation in value during this time period is consistent with the entire crypto market, which is typical in a bear market,” company spokeswoman Victoria Davis told me by email.

Davis also asserted that the SEC’s investigation of the company had been closed by Gensler, “not the current administration” (i.e., Trump). That’s misleading, at best. Gensler put the investigation on hold after the 2024 election, when it became clear that Trump was going to be in charge.

Crypto.com’s March 27 announcement of the formal end of the case attributed the action to “the current SEC leadership” and blamed the case on “the previous administration.” I asked Davis to explain the discrepancy but got no reply.

TMTG, like Crypto.com, attributed the decline in Cronos’ value to the secular bear market raging in the entire cryptocurrency space, a reflection of “temporary price swings across the crypto market,” said TMTG spokeswoman Shannon Devine. She said the price decline “will not diminish our enthusiasm for the enormous potential of the [CRONOS] ecosystem.”

Trump’s coziness with crypto companies hasn’t gone unnoticed by Democrats on the House Judiciary Committee, who issued a scathing report on the topic in November. (The White House scoffed at the report, saying in response to the report that Trump “only acts in the best interests of the American public.”)

In mid-December, TMTG launched yet another remaking — this time, plunging into the business of fusion power. The instrument is TAE Technologies, a Foothill Ranch-based company working to develop the technology of nuclear fusion as a clean energy source. According to a Dec. 18 announcement, TMTG and TAE will merge, creating what they say is a $6-billion company.

According to the announcement, TMTG will contribute $200 million to the merged company when the deal closes in mid-2026, and an additional $100 million subsequently. Following the merger, TMTG said last month, it will consider spinning off Truth Social into a new publicly traded company.

These arrangements are murky. TAE is privately held and the value of Truth Social is conjectural at best, so TMTG shareholders could be hard-pressed to assess their gains or losses from the merger and spin-off.

What makes them even murkier is the speculative nature of fusion as an electrical power source. Although numerous companies have leaped into the field — and TAE, which has been backed by Alphabet, the parent of Google, is among the oldest — none has shown the capability of generating electrical power at commercial scale with the elusive technology.

Although some researchers say that fusion could become a technically and economically feasible power source within 10 years, only in 2022 did fusion researchers (at Lawrence Livermore National Laboratory) achieve the goal of using fusion to produce more energy than is required to sustain a reaction. They were able to do so only for less than a billionth of a second.

Others working on the technology have expressed doubts that fusion could become a viable power source before the 2040s. The technical challenges, including how to convert the energy produced by a fusion reactor into electricity, remain daunting.

All this points to the fundamental question of what TMTG is supposed to be. TMTG’s original mission, according to its own publicity statements, was to build Truth Social into an alternative social media platform “to end Big Tech’s assault on free speech by opening up the Internet.”

Spinning off Truth Social would place that goal on the side. TMTG is on its way too becoming a hodgepodge of crypto, fusion and other investments selected without regard to whether they fit together or are even achievable. The only constant is Trump himself.

If you want to invest in him, TMTG may be the best way to do it. But judging from its latest financial disclosure, that’s not the same as being a good way to do it.