Venezuela’s Opposition Needs New Primaries for an Unprecedented Crossroads

Two months after January 3, the country has found itself at an unprecedented crossroads with three main political actors: the chavista regime, the government of the United States, and the Venezuelan opposition.

Chavismo now faces a historically unique situation after 27 years of political (as well as social and economic) control. It is under pressure from the US to move toward a transition, while at the same time trying to contain the tensions that exist within its own internal structures.

For its part, Washington is trying to steer a transition in Venezuela that is acceptable for both its domestic and foreign policy, leveraging the influence it gained from the capture of Nicolás Maduro and Cilia Flores over both the regime and the opposition.

And the opposition has entered a situation of undeclared conflict. In just a few days, the opposition landscape has shifted in unimaginable ways, with the perception of inaction from María Corina Machado, the sudden emergence of Enrique Márquez during the State of the Union address, and the rest of the opposition reassessing its options.

The inevitable amid uncertainty

The path toward a transition at this moment is uncertain. The regime is seeking a balance between satisfying US demands while avoiding, as much as possible, the deterioration of its own internal political and economic arrangements. At the same time, it continues to move quickly to consolidate control over the process, and more and more details are emerging about how it is setting the guidelines for the Rodríguez siblings. For instance, the visit this week by Secretary of the Interior Doug Burgum.

The opposition universe appears to be an earthquake, above all amid the practical disappearance of María Corina Machado from public debate and, more recently, the “Márquez effect,” whose medium or long-term impact remains uncertain. Where there is consensus, however, is on the need for a new election. Marco Rubio, María Corina Machado, and now Enrique Márquez are on the same page: there must be new elections that legitimize the political transition. As for the Rodrigato, we can imagine what it thinks about that.

A new election to choose the opposition’s presidential candidate would be a way to confront several elephants in the room.

Until just a few days ago, it would have been easy to argue that the opposition’s presidential candidate should be Machado. After all, the results of July 28, 2024 were fundamentally the result of her leadership, and she would have been the presidential candidate if the Maduro regime had allowed it.

But Márquez’s appearance in Washington DC and his subsequent press conference suggested that this Zuliano “black swan” could be acting with the acquiescence of both the Rodrigato and the Trump administration. Evidence of this includes Márquez being invited to Trump’s address, as well as his comments about a figure as close to the Rodríguez siblings as José Luis Rodríguez Zapatero.

For that reason, it now seems that there will be an election sooner or later. It also seems that, as things stand today, we could head into that election with at least two candidates on the opposition side.

That would be a good scenario for the Rodrigato.

New primaries

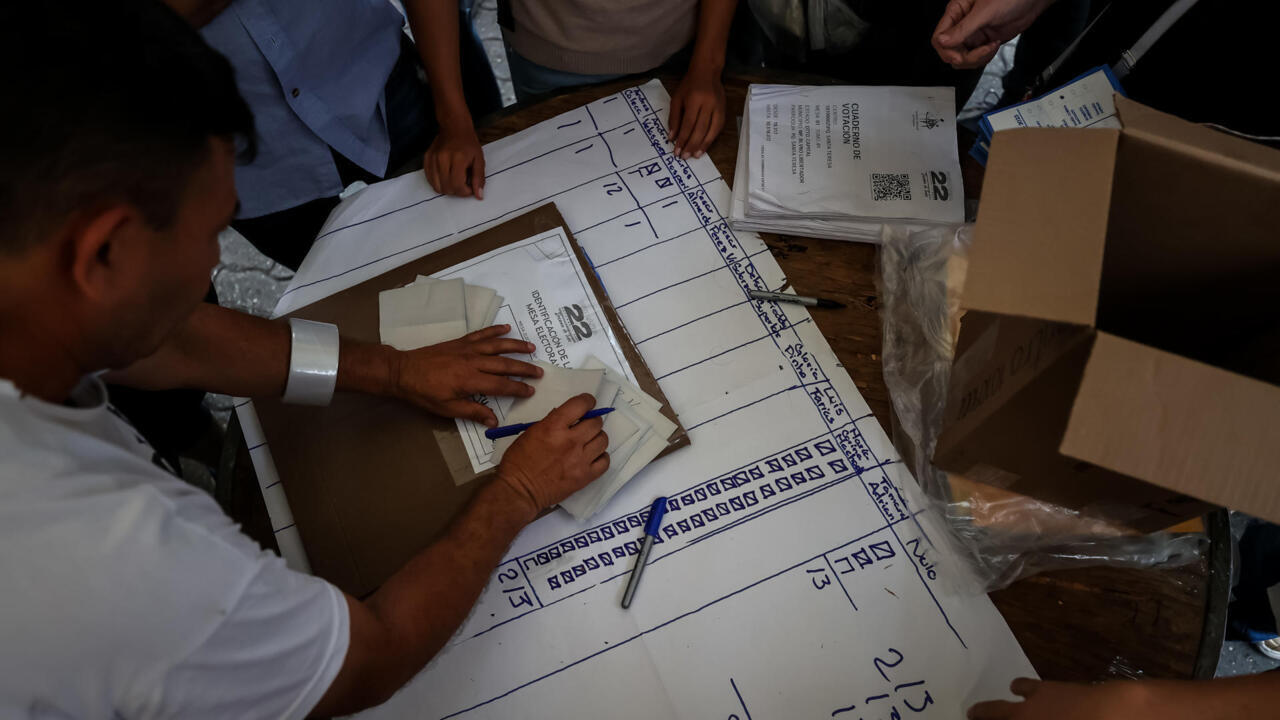

In times of legitimacy crisis, the proper course is to look to the sovereign. Given everything that has happened, it seems necessary to call a new primary vote to choose an opposition candidate—whoever the Rodrigato’s candidate may be—in the presidential election that must take place given Maduro’s absolute absence.

A new election to choose the opposition’s presidential candidate would be a way to confront several elephants in the room. The first is the need to present the other two actors (the regime and the United States) with an electoral calendar that should not be unnecessarily delayed. The second is the convenience of unifying and strengthening party structures. If the process is well managed, it could encourage a reunion of the different opposition forces around a common and higher objective.

Another elephant shaking Venezuela’s narrow public space is the urgency of restarting citizen mobilization around a concrete political initiative. Finally, those primaries could once again make it possible to go into a presidential election with a single candidate, preventing the regime from promoting multiple “opposition” candidacies to divide the electorate.

The primaries that chose Henrique Capriles as the candidate for the 2012 presidential election, and the primaries that selected María Corina Machado as the candidate for the 2024 presidential election, were good precedents for successfully resolving several political problems. Considering the sovereign is a good idea, or at least most of the time.