In most years, Social Security retirees receive a cost-of-living adjustment (COLA), and that’s likely to happen in 2026. COLAs are critical because without them, benefits would remain unchanged while the price of goods and services increase over time. Retirees would be left with far less buying power, and many would struggle to make ends meet since Social Security is an important income source for seniors.

COLAs aren’t the same from one year to the next, though. While the 2026 COLA hasn’t been announced, there are good estimates of what it’s going to be. Based on the existing data, it looks like the amount of the benefits increase is going to be different from the raise retirees got in 2025.

Here’s what next year’s COLA is likely to be, compared with the benefits bump you got in 2025.

Image source: The Motley Fool.

How will next year’s Social Security COLA compare?

The 2026 COLA will officially be announced on Friday, Oct. 24, 2025. The Senior Citizens League estimates the cost-of-living adjustment will result in a 2.7% benefits increase.

A 2.7% increase would be a bit larger than the raise retirees got in 2025, when benefits rose 2.5%. However, it will be smaller than COLAs from recent memory, including the 3.2% benefit increase in 2024, the 8.7% raise in 2023, and the 5.9% COLA in 2022.

Unfortunately, while the COLA is on track to be larger in 2026 than in 2025, retirees may not see the full 2.7% increase in their payment because Medicare premiums are going to be rising as well — and by much more than they did in 2025.

In 2025, the standard premium for Medicare Part B rose $10.30, jumping from $174.70 in 2024 to $185.00 in 2025. In 2026, projections from the Medicare Board of Trustees suggest that Part B premiums will go up $21.50, from the current $185.00 all the way up to $206.50. This is one of the biggest year-over-year increases in the history of the program.

Unfortunately, since most people have Medicare premiums taken directly out of their Social Security checks, a good portion of the extra money that seniors get from the COLA will disappear.

For example, if someone had a $2,000 monthly benefit in 2024, this year’s 2.5% COLA would have given them around a $50 monthly raise, and they’d have lost $10.30 of it. Their check would have gone up by around $39.70.

Someone with a $2,000 check in 2025, on the other hand, could see their payments rise by 2.7% in 2026, or $54 per month. A $21.50 Medicare premium increase would leave them with only $32.50 extra each month.

This means the “bigger” benefits bump this year may be nothing but a mirage, and retirees could find themselves struggling to maintain buying power based on current levels of inflation.

Is a larger COLA good news or bad news?

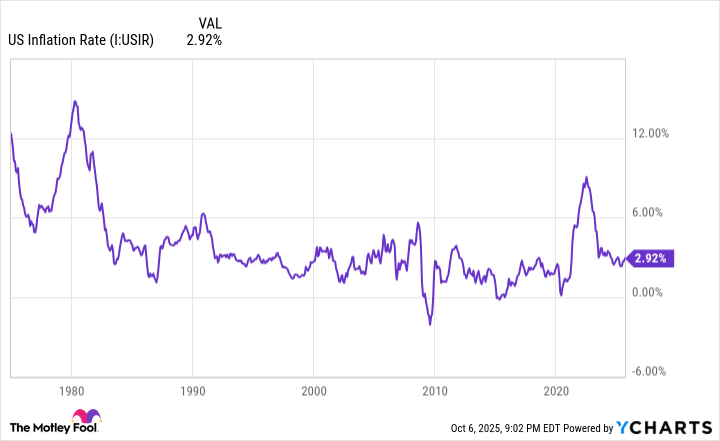

The reality is, even aside from the Medicare issue, it isn’t good news that Social Security retirees are on track for a bigger COLA. That’s because cost-of-living adjustments are directly tied to a formula that measures how much the cost of goods and services is going up. A bigger raise means there are higher levels of inflation, and inflation generally isn’t good for older people on fixed incomes.

Many seniors also have money saved in retirement plans, and since people tend to be conservative with their investments during retirement, their returns may not outpace inflation by much when inflation is high.

For now, seniors will need to simply wait and see what the official COLA announcement brings on Oct. 24. The news will offer insight into what their finances will look like in the coming year, but retirees should prepare for potential disappointment, even if the COLA amount looks good on paper.