Russia Insists Su-75 Checkmate Fighter Will Fly Next Year

Russian officials claim that a prototype of the Sukhoi Su-75 Checkmate fighter could be in flight testing by early next year. Development of the single-engine aircraft, which first broke cover four years ago, is otherwise said to be ongoing with a heavy emphasis on potential export sales. There also continues to at least be plans, which currently look to be aspirational, for further variations on the design, including an uncrewed derivative.

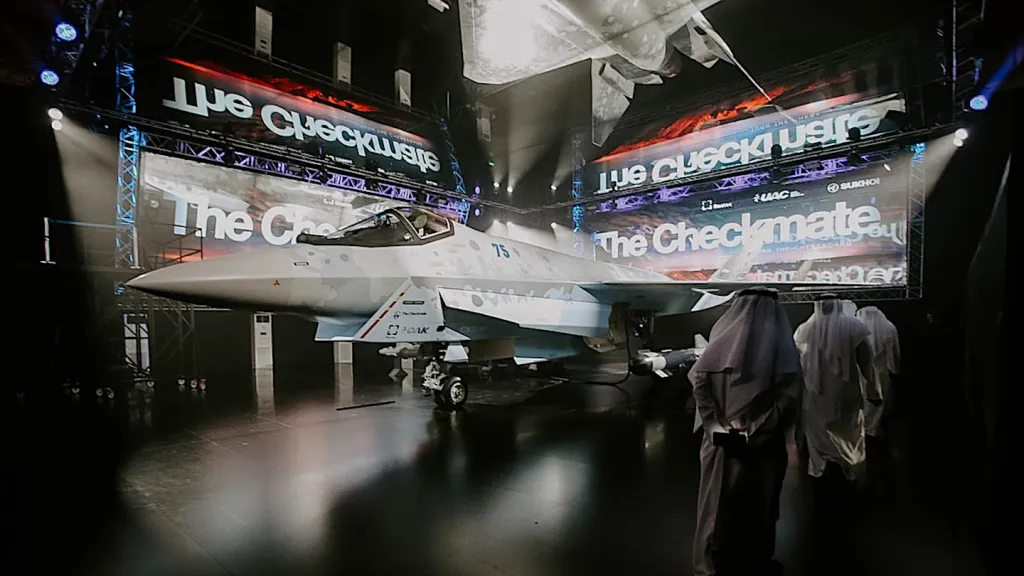

Russia’s United Aircraft Corporation (UAC) officially unveiled a Su-75, also known as the Light Tactical Aircraft (LTA), or LTS in Russian, at the 2021 Dubai Airshow. A full-scale mockup of the jet was shown at that event. Later that year, UAC said that work on an actual flying prototype was underway.

We’re “still working on development of this aircraft,” Sergey Chemezov, head of Russia’s state-run defense conglomerate Rostec, told TWZ and other outlets at this year’s Dubai Airshow on Tuesday, according to a translator. “We need some time to get the real prototype for the test flights.”

“Basically, we are almost at the stage of the testing flights, and in the near future, we will be launching it into production,” Chemezov added, again per the translator.

“I think this is the beginning of 2026,” Sergey Bogdan, Sukhoi’s chief test pilot, also said about the expected timeframe for the start of Su-75 flight testing in a separate interview with Russia’s state-run Channel One television station on Tuesday. “The aircraft is already on the shop floor, it is already being finalized, and there are already certain time plans. Therefore, with God’s help, it should take place soon enough.”

Specifications for the Su-75 that UAC has provided at this year’s Dubai Airshow say the design, at least in its present form, has a maximum takeoff weight of some 57,320 pounds (26,000 kilograms). The jet is said to be able to carry up to 16,314 pounds (7,400 kilograms) worth of air-to-air and/or air-to-ground munitions on an array of underwing hardpoints, as well as one inside three internal bays. UAC has stated the aircraft’s top speed to be between Mach 1.8 and Mach 2 with an engine in the 32,000 to 36,000-pound-thrust-class (14,500 to 16,500 kilogram-force). Size-wise, the design, as it was shown in 2021, is approximately 57 feet long and has a wingspan of 39 feet.

As TWZ has noted in the past, despite its LTA moniker, the Su-75 is really more of a middle-weight design. As a comparison, Lockheed Martin’s single-engine F-35A is 51 feet long and has a wingspan of 35 feet, and has a stated maximum takeoff weight in the “70,000 pound class.” As another reference point, Russia’s twin-engine Su-57 Felon, a heavyweight fighter design, measures 66 feet in length with a 46-foot wingspan, and has a stated maximum takeoff weight of 74,957 pounds.

Based on models and renderings that UAC has shown, the Su-75’s design has evolved since 2021. This includes the enlargement of the rear edges of both wings, with flaperons that now stretch all the way down both sides of the tail, and the extension of the wing roots at the nose end of the jet. The shaping of the wing tips, as well as parts of the nose and tail ends of the jet, has also changed. The cockpit canopy now has sawtooth edges at the front and back, as well.

There have also been changes observed to what is easily one of the Su-75’s most striking visual features, its highly angular air intake that wraps around the underside of the nose section. The mock-up that was unveiled in 2021 had a divider in the middle of the intake, which has since disappeared in renders and models of the design. The underside of the intake has also gotten flatter. It still has a diverterless supersonic inlet (DSI) style of design, the benefits of which you can read about in more detail here. Lockheed pioneered DSI technology in the 1990s, with this becoming a key aspect of the F-35’s design. It has now appeared in various forms on a number of other crewed and uncrewed aircraft, especially ones developed in China.

Overall, like the Su-57, the Su-75’s design does look to have some low-observable characteristics, but appears to be mostly focused on reducing the radar signature from the frontal hemisphere, rather than any kind of all-aspect stealth. UAC claims that Checkmate will be effective in areas “protected by air defense systems” and “in a complex jamming environment” thanks to its sensor suite, including an active electronically scanned array radar and an infrared search and track (IRST) system, and other features.

As noted, since the Su-75 was first unveiled, UAC has talked about plans for an entire family of designs based on the single-seat LTA configuration. Models of a two-seat crewed version, as well as the aforementioned uncrewed derivative, have been shown over the years.

There is notably a more refined model of the uncrewed Checkmate design on display at this year’s Dubai Airshow. It shows an overall configuration in line with the revisions to the single-seat design.

The Checkmate drone model also notably features what looks to be an electro-optical targeting system (EOTS) underneath its fuselage that sits inside a windowed enclosure broadly akin to the ones seen on the U.S. F-35 and Chinese J-20, as well as other designs globally. There is what appears to be another electro-optical and/or infrared sensor system with a more fixed forward field of view on the underside of the fuselage, as well. A sensor aperture is also present on top of the nose. These latter two systems look to be part of a distributed aperture system (DAS) type arrangement that could also have a more capable IRST capability. Advanced combat drones have a particular need for an array of sensors around the aircraft to provide general situational awareness, especially if they are designed for more independent autonomous operations, as well as to help spot and track targets in the air and down below.

All of this being said, much about the Checkmate effort, especially plans for follow-on variations, crewed and uncrewed, currently look to be highly aspirational.

“Generally, it takes about 10 to 15 years to create the proper aircraft,” Rostec’s Chemezov said in Dubai on Tuesday about ongoing work on the Su-75, according to the translator. “You can have a baby born in nine months, but the aircraft will take a little longer than that.”

Chemezov’s remarks here are, broadly speaking, true. As a point of comparison, the first flight of a pre-production Su-57 prototype occurred in 2010 and it took another decade or so for serial production of that design to officially kick off. At the same time, this then points to UAC reaching a high level of maturity with the baseline Su-75 design, let alone putting it into large-scale production, sometime well into the next decade, at the earliest.

When it comes to the prospective first flight of the Su-75, it should be noted that, to date, there has been no imagery or other hard evidence of a real prototype under construction or any initial testing. This is in marked contrast to how images and other details highlighting progress on other advanced Russian aircraft developments, like the S-70 Okhotnik-B uncrewed combat air vehicle (UCAV), have emerged in the past.

The pressures of the ongoing war in Ukraine make it impossible not to question whether Russia is really willing to dedicate the resources necessary for a new fighter project. Though Rostec’s Chemezov was quick to downplay any concerns in Dubai earlier this week, there are also real questions about Russia’s current ability to produce combat aircraft, crewed or uncrewed, in general, after years of Western sanctions. The Russian defense industry chief also acknowledged the additional demands that conflict has placed on Russia’s defense industry to meet the immediate needs of the country’s armed forces. Deliveries of production Su-57s to the Russian Air Force have been notably sluggish, with the Russian Air Force having received around 18 of the jets between 2022 and 2024. The service has a standing order for 76 of those aircraft, and it is unclear when it might be fulfilled in full.

Earlier this year, authorities in Belarus, a very close Russian ally, announced that they were exploring a joint partnership on the continued development of the Su-75. This could help at least defray the costs of the Checkmate program.

Since 2021, UAC has also been very heavily pitching the Su-75 as a more advanced, but also lower-cost fighter option, especially for smaller air arms in the Middle East, Asia, Latin America, and Africa. In the ensuing years, there have been reports of interest from a host of countries, including India, the United Arab Emirates (UAE), Iran, Algeria, and Vietnam. To date, however, there have been no confirmed orders.

It is worth noting here that reports earlier said Algeria had become the first export customer for the larger Su-57. UAC also said just this week that it had delivered the first two export Su-57s to an unnamed foreign customer. No visual evidence of Su-57s entering service outside Russia on any level has yet to emerge.

Competition, in general, in the international fighter market only looks set to grow, as well. China has been making particularly pronounced inroads in this space globally, and export variants or derivatives of its J-35 stealth fighter could be on the horizon. The Su-75, which again has yet to even fly, faces additional challenges posed by the fact that any nation that buys Russian weapon systems runs real risks of triggering secondary sanctions, especially from the United States.

Altogether, it very much remains to be seen when a prototype Su-75 might take to the skies for the first time, as well as when, or if, any of the broader ambitions for the Checkmate program, including the drone derivative, become a reality.

Jamie Hunter contributed to this story.

Special thanks to Michael Jerdev, who you can follow on X under the handle @MuxelAero, for sharing additional imagery from the 2025 Dubai Airshow.

Contact the author: [email protected]