Hyatt Hotels chairman Thomas Pritzker steps down over Epstein ties | Donald Trump News

Pritzker steps down as Hyatt executive chairman, effective immediately, due to his relationship with the late sex offender.

Published On 17 Feb 2026

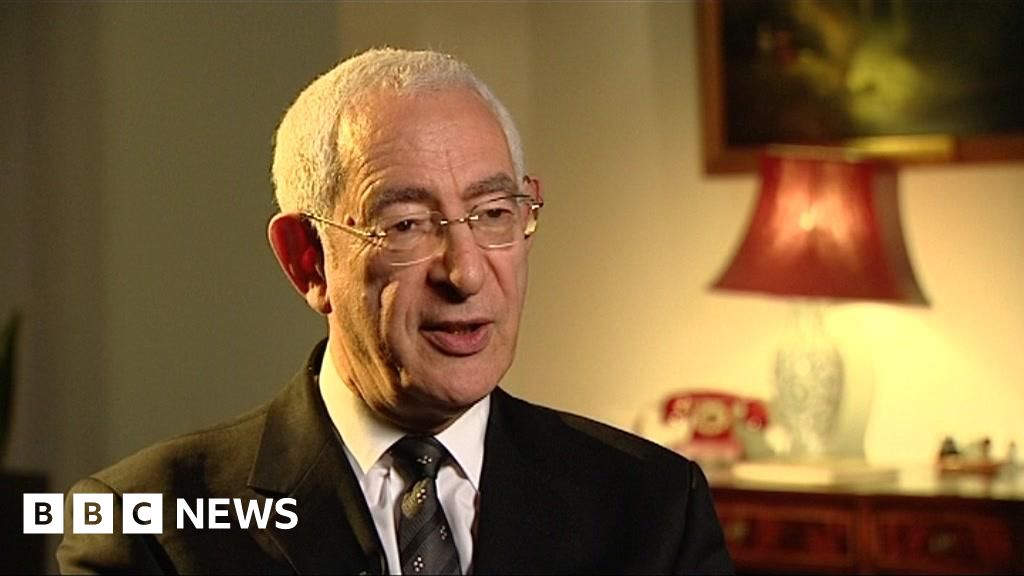

Billionaire Thomas J Pritzker has announced that he is retiring as executive chairman of Hyatt Hotels Corporation over his long association with sex offenders Jeffrey Epstein and Ghislaine Maxwell, which came to light in recently released US Justice Department files.

Pritzker, 75, who has served in the role of Hyatt Hotels’ executive chairman since 2004, also said on Monday that he will not seek re-election to the company’s board at its 2026 annual stockholder meeting.

Recommended Stories

list of 3 itemsend of list

In a letter to the Hyatt board and a related statement, Pritzker expressed deep regret over maintaining contact with Epstein, who took his own life in prison in 2019, and Maxwell, describing it as “terrible judgement”, with no excuse for not distancing himself sooner.

“Good stewardship also means protecting Hyatt, particularly in the context of my association with Jeffrey Epstein and Ghislaine Maxwell which I deeply regret,” he said in the statement.

“I exercised terrible judgement in maintaining contact with them, and there is no excuse for failing to distance myself sooner.”

Newly released documents by the Justice Department show that Pritzker had ongoing and regular contact with Epstein for years after the financier’s conviction on sex crime charges in 2008, according to The New York Times.

Pritzker is the latest powerful figure facing repercussions after the release of millions of pages of documents showing the depth of Epstein’s network of business, political and cultural elites in the US and around the world.

Goldman Sachs chief legal counsel Kathryn Ruemmler resigned last week over her ties to Epstein. Norwegian police said they had conducted searches of properties owned by former Prime Minister Thorbjorn Jagland as part of a corruption investigation into his connections with the late sex offender.

The head of DP Ports World, the world’s largest port operator, Sultan Ahmed bin Sulayem, was also replaced over his close friendship with Epstein, while economist Larry Summers resigned from the OpenAI board late last year.

Former United Kingdom ambassador to Washington, Peter Mandelson, has been asked to submit himself for an interview and answer questions as part of a US congressional investigation into Epstein.

In a letter sent to Mandelson by Democratic Representatives Robert Garcia and Suhas Subramanyam, both members of the US House of Representatives Oversight Committee, the lawmakers said it was “clear” that the former ambassador “possessed extensive social and business ties” to Epstein and requested that he make himself available for a transcribed interview.

Mandelson took up the prestigious post as the UK’s ambassador to the US in February 2025. He was removed from the role in September 2025 after UK Prime Minister Keir Starmer’s government said new information had come to light showing the much deeper nature of his longstanding ties with Epstein.

The Mandelson controversy has led to calls for Starmer to stand down as prime minister, with critics questioning his judgement in appointing him to the ambassador’s role.

Starmer’s chief of staff and cabinet secretary have also stood down due to the scandal .