Nvidia shares rise after quarterly earnings, calming bubble anxiety

Published on

20/11/2025 – 7:32 GMT+1

Shares in Nvidia rose more than 5% in after-hours trading after the chipmaker beat analysts’ expectations in its quarterly earnings report, released Wednesday.

In the three months to the end of October, Nvidia said its revenue jumped 62% to $57 billion (€49.49bn). The company reported $51.2bn (€44.43bn) in revenue from data-centre sales, beating expectations of $49bn (€42.52bn).

The firm also placed a forecast for the current quarter at $65bn (€56.41bn), surpassing Wall Street expectations of $61bn (€52.94bn).

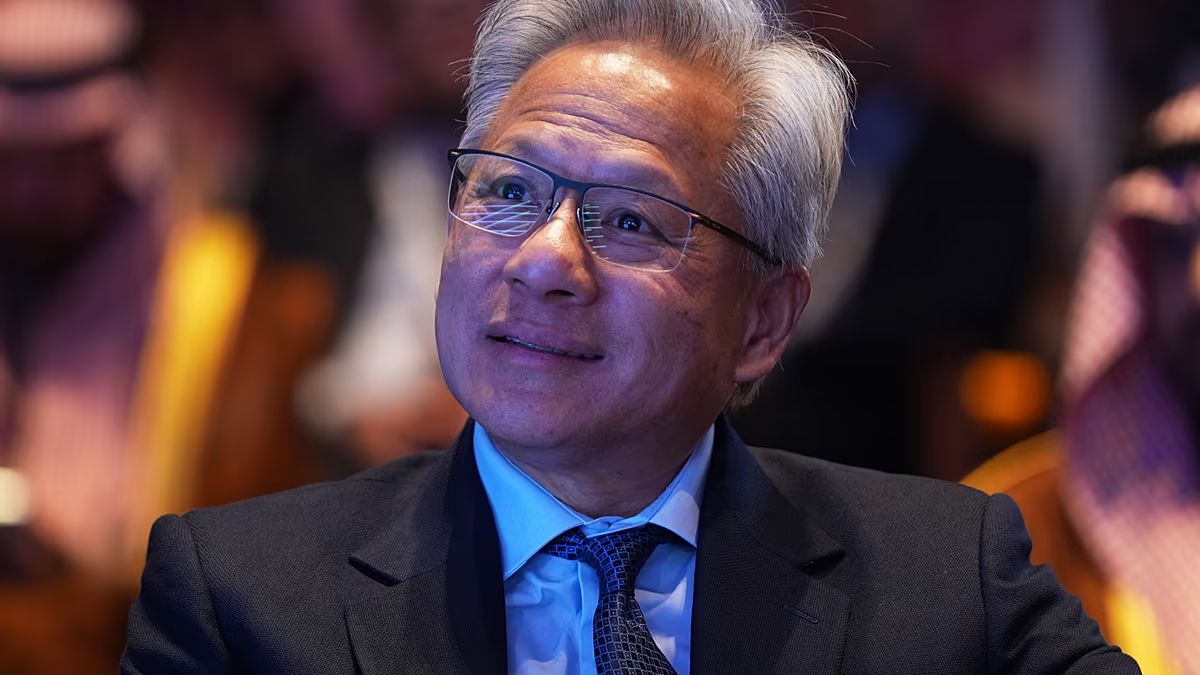

“There’s been a lot of talk about an AI bubble,” said CEO Jensen Huang during an earnings call.

“From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI from pre-training to post-training to inference.”

Nvidia is now the largest stock on Wall Street, having momentarily surpassed $5 trillion in value. That means it has an outsized influence on the S&P 500 and can make or break the market’s daily performance.

The firm has also become a bellwether for the broader frenzy around AI, notably because other companies rely on Nvidia chips for this technology.

AI stocks have taken a hit in recent weeks as investors questioned whether certain tech companies had been overvalued, driving fears of a market crash.

Before Wednesday’s earnings report, Nvidia’s chips had dropped 11% from their peak in early November.

CEO Huang sought to ease concerns of a bubble on Wednesday, claiming: “AI is going everywhere, doing everything, all at once.” He noted that Nvidia was focused on major transition areas, namely generative, agentic, and physical AI.

Generative AI can create things, agentic can accomplish a specific goal with limited supervision, while physical AI relates to the physical world — for example through robots.