Down 34%, Should You Buy the Dip on BigBear.ai Stock?

This AI software specialist’s recent results haven’t been great, but it is operating in a lucrative market.

BigBear.ai‘s (BBAI 4.16%) stock has been on a volatile ride on the market so far in 2025, but it still managed to clock impressive gains of 57% as of this writing. It’s worth noting that the stock is down 28.5% from the 52-week high it achieved in mid-February. For a company that is compared to Palantir Technologies thanks to their very similar business models, investors may now be wondering if the slide in BigBear.ai stock can be treated as a buying opportunity.

Let’s take a closer look at what BigBear.ai does and check if its prospects and valuation make it worth buying in the wake of its share price pullback.

Image source: Getty Images.

BigBear.ai stands to gain from a massive end-market opportunity

Just like Palantir, BigBear.ai is in the business of providing artificial intelligence (AI) software solutions to customers so that they can improve the efficiency of their operations and enhance productivity. It provides various kinds of tools related to data analytics, cybersecurity, enterprise IT solutions, digital twins, and digital identity.

The good part is that the demand for these AI software solutions is on track to grow rapidly. IDC projects that the AI software platforms market could generate a whopping $153 billion in revenue in 2028, up from $27.9 billion in 2023. The bad part is that BigBear.ai has been unable to make the most of this fast-growing opportunity.

The company’s recent results clearly indicate that it is missing the AI software opportunity. Its revenue was down by 18% on a year-over-year basis to $32.5 million. The gross margin shrank as well, which explains why its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss more than doubled to $8.5 million in Q2.

Of course, BigBear.ai reported a $380 million revenue backlog at the end of Q2 — up by 43% from the prior-year period — but it comes with a lot of caveats. The primary concern with BigBear.ai is that it gets the majority of its revenue from government contracts. That probably explains why a huge chunk of its revenue backlog is unfunded, or is up to customers’ discretion whether they want to purchase its services or not.

Just 4% of BigBear.ai’s backlog is funded, which refers to the remaining value of existing contracts that it has yet to fulfill. The remaining backlog is either unfunded or unexercised. So, despite reporting a healthy backlog, BigBear.ai doesn’t have solid revenue visibility going forward. Throw in the fact that BigBear.ai has reduced its full-year revenue forecast by 19%, and there is a good chance that the stock will remain under pressure until and unless there is a substantial turnaround in its fortunes.

The good part is that there have been some silver linings for BigBear.ai investors of late. The stock jumped recently on the news that it will support the U.S. Navy in a maritime exercise, giving investors hope that it could win more business. Additionally, BigBear.ai’s enhanced passenger processing (EPP) solution has been deployed at Nashville International Airport.

However, it remains to be seen if these developments are going to have a positive impact on the company’s financial performance.

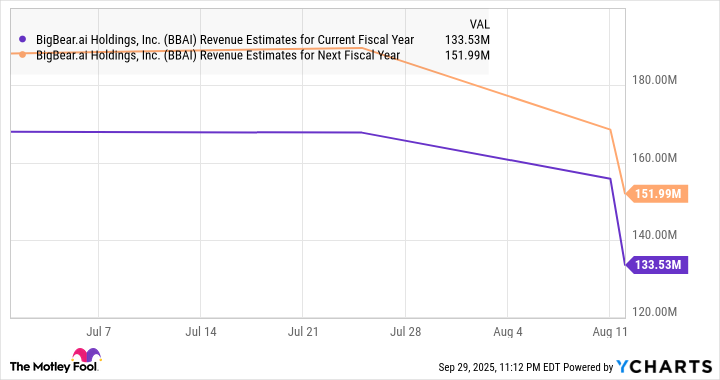

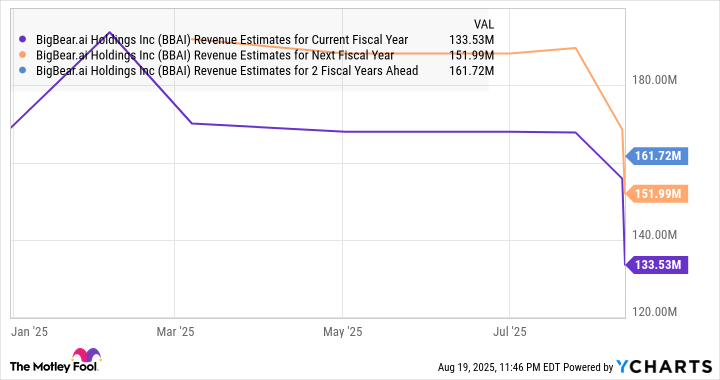

Analysts aren’t upbeat about the stock’s prospects

BigBear.ai’s median 12-month share price target of $6 points toward a potential drop of 7% from current levels. That’s not surprising, as the company’s growth estimates have taken a big hit.

Data by YCharts.

Moreover, BigBear.ai stock isn’t exactly cheap right now. It trades at 12 times sales. That’s well above the Nasdaq Composite index’s price-to-sales ratio of 5. With the company’s sales set to decline in double digits this year as per its updated guidance, its rich valuation isn’t justifiable. All this tells us that this AI stock isn’t worth buying even after its recent pullback, which is why investors would do well to take a closer look at other names that are clocking healthy growth and are trading at attractive valuations.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.