Shohei Ohtani the most popular player among gamblers? You bet

Wanna bet? If the wager involved Shohei Ohtani, the answer from gamblers was yes more often than it was for any other player in any sport last year, according to data from BetMGM.

When betting on game results in 2025, gamblers placed the most wagers on NFL games. However, when betting on individual athletes, gamblers placed the most wagers on Ohtani, the two-way superstar for the World Series champion Dodgers and National League most valuable player. Saquon Barkley, the running back for the Super Bowl champion Philadelphia Eagles, ranked second.

That data considered only BetMGM wagers that involved individual players — sometimes for awards such as MVP, a spokesman said, but most often for prop bets determined by individual performance.

By way of example from another sportsbook, Caesars Sports offered these World Series prop bets for Ohtani: Would he hit a leadoff home run? Drive in at least seven runs? Collect at least 10 hits? Hit a 470-foot home run? Hit at least five home runs? Deliver a walk-off hit? Hit two home runs and strike out 10 batters in the same game? Strike out 20 batters in the series? (Ohtani did not do any of those eight things.)

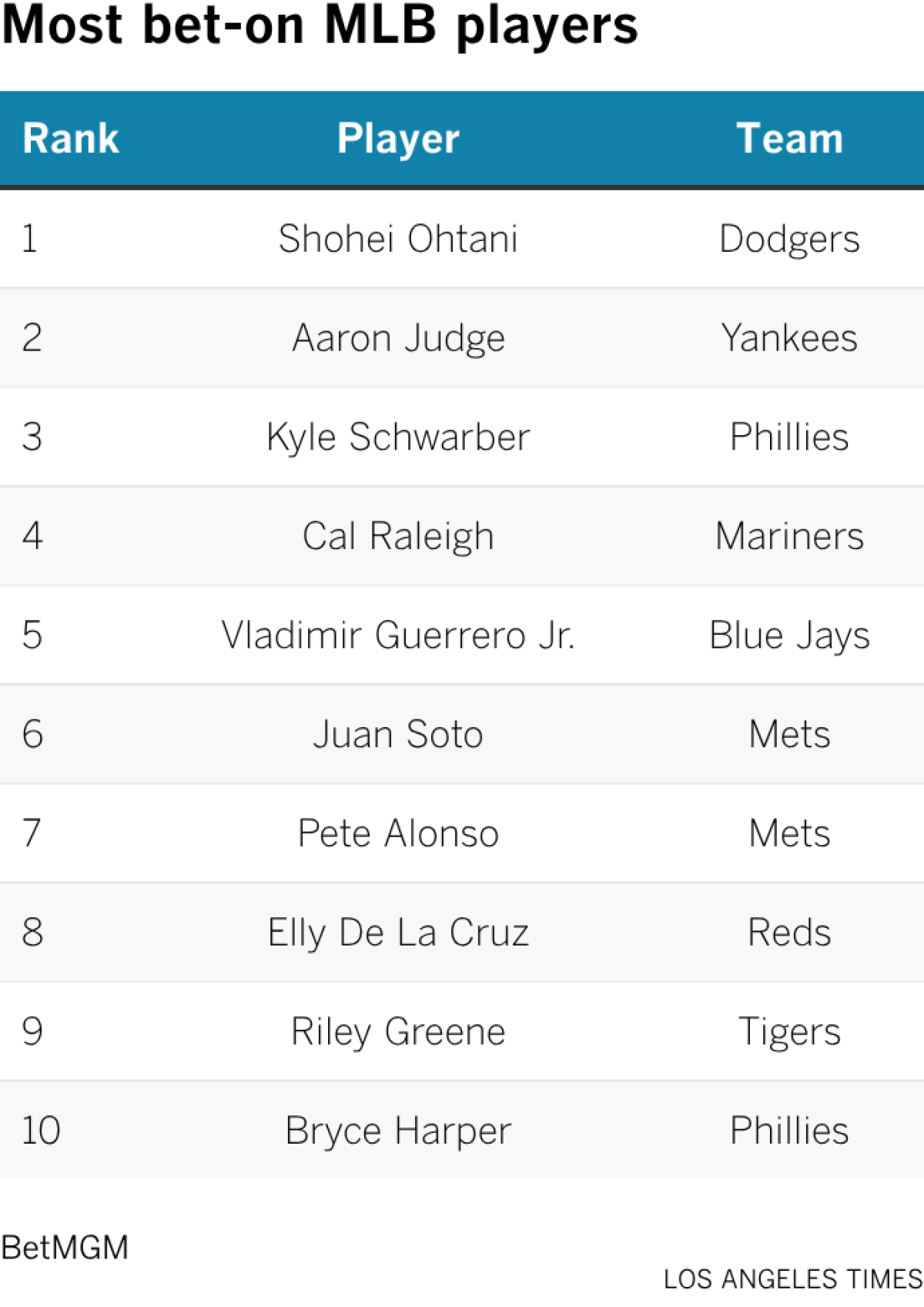

The most popular major leaguers beyond Ohtani among bettors, according to BetMGM, all were sluggers: Aaron Judge of the New York Yankees ranked second, followed by Kyle Schwarber of the Philadelphia Phillies, Cal Raleigh of the Seattle Mariners, Vladimir Guerrero Jr. of the Toronto Blue Jays, Juan Soto and Pete Alonso of the New York Mets, Elly De La Cruz of the Cincinnati Reds, Riley Greene of the Detroit Tigers and Bryce Harper of the Phillies.

Yet the most notorious MLB prop bets last year involved pitchers, not hitters.

In November, Cleveland Guardians pitchers Emmanuel Clase and Luis Ortiz were indicted on federal charges that they “rigged pitches” — that is, they tipped bettors about whether they would throw a pitch outside the strike zone in specified situations and how hard they would throw it. Prosecutors say bettors won hundreds of thousands of dollars for themselves and paid Clase and Ortiz thousands of dollars for their help.

The pitchers have pleaded not guilty, with a trial scheduled for May. Prosecutors told the court last month that Clase, a three-time All-Star, likely would face 87 to 108 months in prison under federal sentencing guidelines — that is, up to nine years — if convicted on each of the four counts in his indictment.

The pitchers also face a potential lifetime ban from baseball. Clase, 27, is under contract for $6 million this year; the Guardians hold a $10-million option for 2027 and another for 2028. Investors who pooled their money to support him in exchange for a percentage of his career earnings are at risk of losing their investment.

The types of prop bets placed on Clase and Ortiz may become even less popular next season.

On the day after Clase and Ortiz were indicted, Major League Baseball announced an agreement with sports book operators to cap such pitching prop bets at $200. The operators, MLB said, represented “more than 98% of the U.S. betting market.”

In its announcement, the league noted that most prop bets are not solely influenced by one person — that is, whether Ohtani hits a home run depends in significant part on how he is pitched.

“However, ‘micro-bet’ pitch-level markets (e.g., ball/strike; pitch velocity) present heightened integrity risks because they focus on one-off events that can be determined by a single player and can be inconsequential to the outcome of the game,” the league statement said. “The risk on these pitch-level markets will be significantly mitigated by this new action targeted at the incentive to engage in misconduct.”