What caused Amazon’s AWS outage, and why did so many major apps go offline? | Internet News

A major outage at Amazon Web Services (AWS) on Monday disrupted a large portion of the internet, taking down apps, websites and online tools used by millions of people around the world, before services were eventually restored.

From banking apps and airlines to smart home devices and gaming platforms, the hours-long breakdown revealed how much of modern life depends on cloud’s infrastructure.

Recommended Stories

list of 1 itemend of list

Here is what we know:

What happened and what caused the AWS outage?

At about 07:11 GMT, Amazon’s cloud service experienced a major outage, meaning some of its systems stopped working, which disrupted many popular apps and websites, including banks, gaming platforms and entertainment services.

The problem started in one of AWS’s main data centres in Virginia, its oldest and biggest site, after a technical update to the API – a connection between different computer programmes – of DynamoDB, a key cloud database service that stores user information and other important data for many online platforms.

The root cause appears to have been an error in the update that affected the Domain Name System (DNS), which helps apps find the correct server addresses. A DNS works like the internet’s phone book, turning website names into the numeric IP addresses that computers use to connect to servers.

Because of the DNS issue, apps could not find the IP address for DynamoDB’s API and were unable to connect.

As DynamoDB went down, other AWS services also began to fail. In total, 113 services were affected by the outage. By 10:11 GMT, Amazon said that all AWS returned to normal operations, but there was a backlog “of messages that they will finish processing over the next few hours”.

At the time of publication, Downdetector, a website that tracks internet outages based on user reports, was still showing problems with platforms such as OpenAI, ESPN and Apple Music.

Updated look at the total impact of the AWS Outage up to this point!https://t.co/Bgpm1fFGtf pic.twitter.com/TAAxjagNl6

— Downdetector (@downdetector) October 20, 2025

What is a cloud and what exactly is AWS?

A cloud is a way of storing and using data or programmes over the internet instead of on your computer or other physical storage devices.

When people say something is “in the cloud”, it means the files, apps or systems are running on powerful computers (called servers) in data centres owned by companies like Amazon (AWS), Google or Microsoft, not on your personal device.

In this case, AWS allows companies to rent computing power and storage. It supplies the technology that runs websites, apps and many online services behind the scenes.

One of AWS’s core services is DynamoDB, a database that stores important information for companies, such as customer records. On Monday, Amazon reported that customers were unable to access their DynamoDB data.

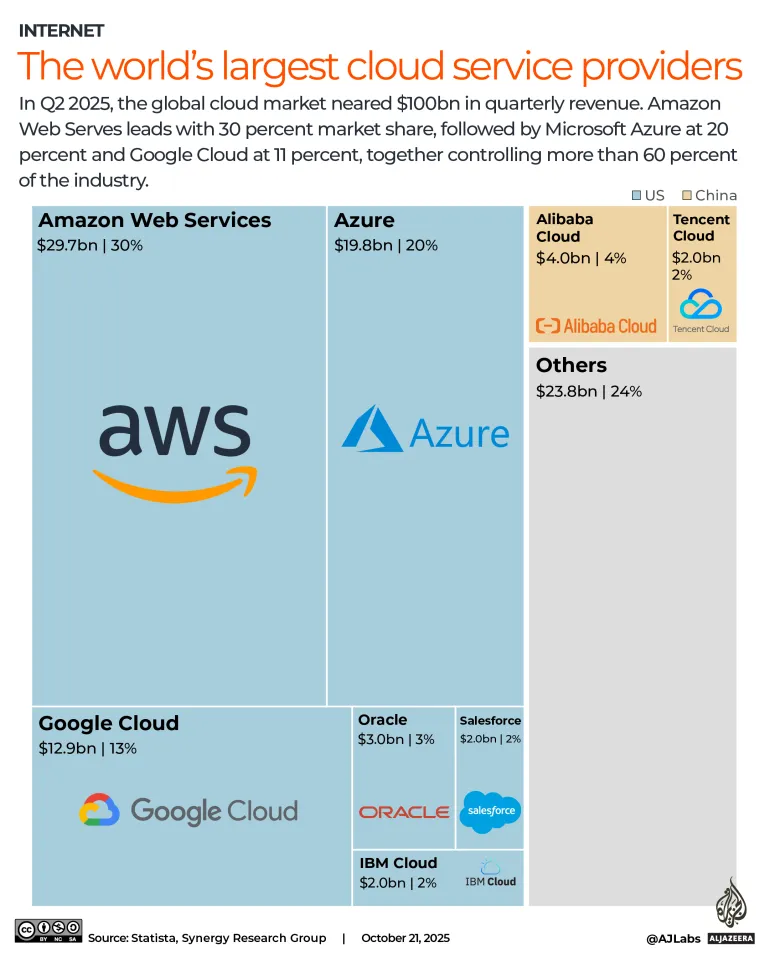

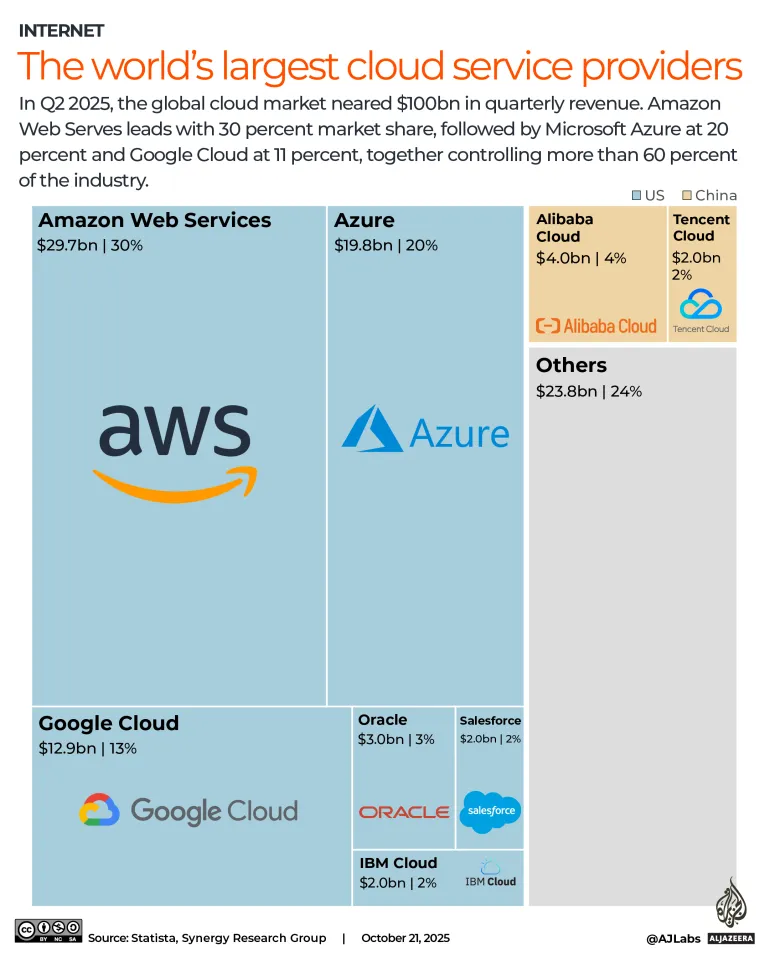

AWS is the biggest cloud service provider in the world.

Cloud outages are not rare, but they have become more noticeable as more companies rely on these services every day.

“The fallout impacted people across a number of different spheres,” Joshua Mahony, the chief market analyst at Scope Markets, told Al Jazeera. [But] of course this kind of comes with the territory with tech companies; the key is they can resolve it quickly, and it doesn’t cost them a lot of money.”

He said Amazon would likely weather the storm from the incident.

“You’re looking at something that is relatively contained,” he said. “Amazon Web Services has cornered 30 percent of the market alone. Their users are not going to suddenly jump ship. Their businesses are deeply ingrained.”

Which services and apps went down?

The outage affected dozens of websites, including Snapchat, Pinterest and Apple TV, according to Downdetector.

Other communication apps were also affected including: WhatsApp, Signal, Zoom and Slack; gaming services such as Roblox, Fortnite and Xbox; and places like Starbucks. Etsy also experienced issues.

In the United States, people were having issues with financial apps too, including Venmo.

Some users said their Ring doorbells and Alexa speakers stopped working, while others could not access the Amazon website or download books on their Kindles.

The language app Duolingo and creative tool Canva were among those reporting errors on their websites, and several media organisations were hit, including the Associated Press news agency, The New York Times and The Wall Street Journal.

Banks, the cryptocurrency exchange Coinbase, and AI firm Perplexity also reported issues, along with US airlines Delta and United.

Why did so many major apps go offline at once?

When AWS had its outage, it was not just Amazon’s tools that were affected. Thousands of other companies that use AWS for storage, databases or web hosting were also hit. These companies include many major apps that rely on AWS to run key parts of their systems.

“Whenever we see these headlines, the first thought that goes through everybody’s mind, that sends a shiver up the spine, is, ‘Is this one of those cyberattacks? Is this a military or intelligence-led thing that has led to this disruption?’ And in this case, it’s not,” Bryson Bort chief executive of the cybersecurity company Scythe told Al Jazeera.

“In fact, most of the time, it isn’t. It’s usually human error.”

How did Amazon respond?

AWS acknowledged the outage and said engineers were “immediately engaged” to fix the problem.

AWS said it worked on “multiple parallel paths to accelerate recovery”. It also reported that the main issue had been fully resolved, though some users continued to face minor delays as systems recovered.

The company also said it would publish a detailed post-event summary explaining what happened.