Chess Is Giving Displaced Children Hope in Adamawa IDP Camps

A group of children gather on a Saturday morning in front of a three-block classroom at the Ekklesiyar Yan’uwa a Nigeria (EYN) displacement camp in Wurro-Jabbe, a community in Yola, Adamawa State, northeastern Nigeria. They run across the dusty fields, playing and chatting, but when a chessboard is laid in front of the closed classroom, the children fall silent and move closer to the scene. Their sudden silence and concentration do not come as a surprise because on the chessboard before them, new possibilities begin to unfold.

Seventeen-year-old Partsi David, one of the oldest players in the group, sets up the chessboard and gives instructions before the teachers arrive. She randomly selects the first team to play and urges the next group to be patient as each player is eager to demonstrate their moves first.

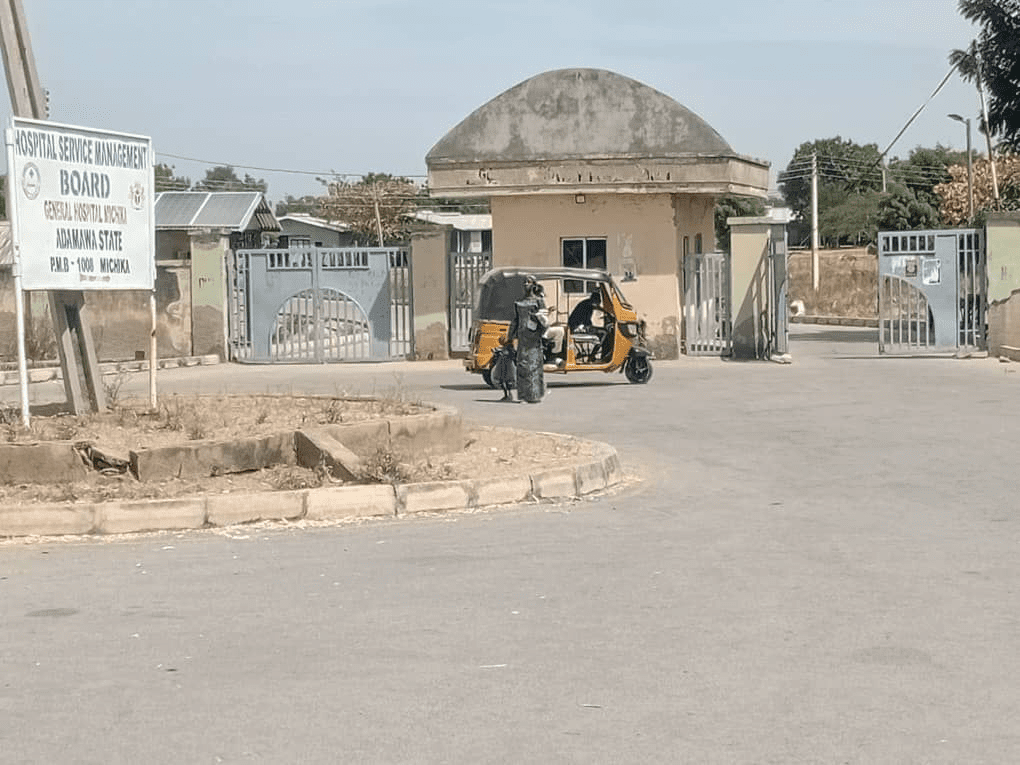

It has been a decade since EYN established the camp to accommodate displaced persons from Mubi, Michika, Madagali, and other communities attacked by Boko Haram. While most residents from Mubi have returned home following the restoration of peace in their communities, those from Madagali and other parts of Michika remain in the camp. Apart from relying on donations from EYN and other humanitarian organisations over the past decade, the displaced persons have also taken up farming and menial work to survive.

Survival became a priority over the years, pushing education down the list, and many children relied on the camp’s only primary school, run by older displaced persons who taught the younger ones basic English and numeracy. With barely enough chairs and tables inside the three-block classroom, the pupils bring mats from home to sit on.

According to the United Nations International Organisation for Migration, Boko Haram has displaced over 200,000 people in Adamawa State so far, with residents of Michika and Madagali being among the most affected populations. As of 2025, 69 per cent of children living in internally displaced persons (IDP) camps across Adamawa, Borno, and Yobe were said to lack access to education services.

However, through the Chess in IDP Camp Initiative, displaced children at the EYN camp are now being relocated to formal schools in Yola, where they have been receiving structured education over the past few years. The change came after a young woman, Vivian Ibrahim, introduced chess to the displaced children in 2023.

After establishing the initiative in the EYN camp, Vivian replicated it in Malkohi, another Yola community where a displacement camp is situated. It was in this environment that chess began to take root.

The game of chess

The displaced persons in Malkhohi are from Askira Uba, Gwoza, Damboa, and other parts of Borno State. Having developed a passion for chess during her junior secondary school years, Vivian’s experience enabled her to teach the game to the children.

She recounted that barely a few minutes after she introduced the game to them, the children began to catch up. “The kind of moves and the thinking ahead that I saw some of them doing left me amazed, and I was like, these kids are very intelligent,” Vivian said.

On social media, she showcased how the children had embraced chess and how well they played.

People began reaching out with tokens of support for the initiative, and soon, more chessboards were acquired. As monetary donations kept flowing, Vivian conceived the idea to direct every penny donated to the campaign toward the educational development of children from the various camps. The initiative’s goal is to use chess as a tool to help displaced children access opportunities in life.

That same year, the initiative secured secondary school admission for five children at the Malkhohi IDP camp, and after she shared the success story on Facebook, the President of the Gift of Chess, an international chess club, reached out to her.

“He donated $500, so I used it to get more of them back to school. And we got books, school uniforms, sandals, school bags, and all of those things,” she said.

From the Malkhohi camp, Vivian began expanding her work to displacement camps in Yola alongside her younger brother, who was also skilled at the game and her only volunteer at the time. They held weekly chess lessons for the children after establishing chess clubs at Malkhohi and EYN camps. “We recently enrolled three-year-olds,” Vivian said with a smile.

As the years rolled by, the children’s skills steadily improved. She noticed a shift in their mindset, particularly in their career aspirations. She explained that many of them believed their future was limited to manual labour since they were displaced children, but after several chess lessons, many of them felt they were really good at something. Vivian believed that participating in tournaments outside the camp would help the children realise not only that they were capable, but also that they were deserving and worthy of every opportunity.

New opportunities

As the children’s confidence grew, the initiative organised a tournament between the two camps and later expanded it across the state, so the young players could showcase their skills. They competed in the state chess tournaments and emerged as champions. The children said their confidence was boosted, and their learning efforts doubled.

For twelve-year-old Timothy Hassan, it was an opportunity to shine.

“I love to calculate. I love mathematics,” he stated.

However, he never thought his dreams could come true, since he didn’t have access to secondary education; education at the EYN camp stops at the primary level. So when the game was introduced to his camp in 2024, Timothy was among the first group to show interest.

“I’ve participated in local tournaments within Adamawa and even travelled to Lagos and Delta states to compete,” he told HumAngle with a bright smile.

Timothy says the feeling he gets anytime he’s set to travel for a competition is indescribable because he never thought it would be possible for him to leave the camp or even travel outside the state. Now, he gets to compete with other chess players, and the initiative has enrolled him in a secondary school where he is continuing his education.

“The game has made me a more focused person. It has reduced the rate at which I play around the camp unnecessarily as I spend my free time practising with the chessboard,” Timothy said. “I want to be an engineer,” he added.

When preparations were underway for the National Sports Festival in 2025, the Chess in IDP Camp initiative seized the opportunity, as there was no group to represent Adamawa State in the chess section.

“I made contact with the Adamawa State Sports Council, and I presented the kids to them. They played a match. The people at the sports council were impressed,” Vivian told HumAngle.

The children were then selected to represent the state during the chess tournaments in Delta State. They competed against teams from other states in Nigeria and finished fourth.

Partsi, one of the chess players who represented the state at the National Sports Festival, says she’s getting better at the game with each passing day. She also participated in a secondary school tournament in Adamawa, where she emerged as the female winner.

While she wants to become a doctor, Partsi aspires to be a famous chess player.

“I want to be seen on TV, and I also want to be the winner in every competition. I want to win for Nigeria,” she said.

In 2024, Vivian noted that the Commander of the 105 Composite Group, Nigerian Air Force (NAF), who is a patron of the NAF Chess Club in Maiduguri, Borno State, reached out to the Chess in IDP Camp Initiative in Yola, requesting that the programme be introduced to some displaced camps in Borno. Led by Vivian and Tunde Onakoya, a Nigerian chess master and founder of Chess in Slums Africa, the initiative reached Maiduguri, with Tunde directly engaging players at the Muna and Shuwari IDP camps.

Tunde’s visit was said to have brought further media and public attention to the role that chess can play in healing, learning, and reimagining futures for children affected by conflict.

“This game makes me calm whenever I’m playing because chess doesn’t want your attention to be divided. It wants your full attention,” Partsi said.

After Tunde became affiliated with the initiative, Vivian explained that several chess players in the state, mostly young people, volunteered to teach the children. This increase in human resources helped the initiative to reach more children in the camps.

Vivian highlighted that the initiative teaches chess to over 200 IDP children from both camps, ranging from ages four to 18. The chess clubs operate on Saturdays for two hours during the school term, but during the holidays, volunteers visit two to three times a week to tutor the children.

Fifteen-year-old Emmanuel Paul, one of the players who joined the club in 2024, said he needed no persuasion to join.

“The game itself impresses me. The game requires a lot of calculation,” he told HumAngle.

The boy explained that the game makes him feel confident, and anytime there is a forthcoming tournament, he feels ready to play. Emmanuel said the hardest part of the game is the endgame when a tournament is drawing to a close.

“If you don’t strategise well during the endgame, your opponent will win,” he said.

Like many other chess players in the camp, Emmanuel has been enrolled in a secondary school by the Chess in IDP Camp Initiative.

Mary Zira, a renowned chess player from the EYN IDP camp, secured a scholarship for secondary education at a private school in Yola. This came shortly after she returned from an international competition in Georgia in 2025. There, she competed in the Chess Community Games, won a silver medal, and earned a chance to speak at the United Nations.

Impressed by her performance, an individual reached out to the initiative and offered to sponsor her secondary education. While Mary is currently in a private boarding school, her mother, Hannatu Victor, spoke to HumAngle about the achievement.

“I am a very proud mother,” Mary’s mother stated.

She explained that she had never imagined her daughter’s life would change overnight because of a game. “This game is helping us, especially our kids, in furthering their education. It also exposes them because they go out to meet other children when they play in different places,” she said.

From chessboards to classrooms

Following several tournament victories by the displaced children, the Chess in IDP Camp Initiative has gained widespread recognition. Although the initiative has not yet partnered with any local or international humanitarian organisation, Vivian remains grateful to individuals who have given the children the opportunity for a better life.

According to Vivian, about 70 young chess players from both the Malkhohi and EYN IDP camps have been enrolled in various private and public secondary schools in Yola, with the initiative covering their fees. The oldest student has recently completed secondary school and is now ready to pursue a university education. Scholarships have also been secured for some of the children.

Apart from chess, a group of young volunteers from the Modibbo Adama University, Yola, who recently joined the initiative, are incorporating AI and tech sessions into several chess classes. Their goal is to equip the children for a rapidly changing world.

Elisha Samson, one of the volunteers at the camp, told HumAngle that the children have shown noticeable improvement in STEM subjects integrated into their sessions. The volunteers have been teaching the children how to use Arduino, an open-source platform used for building electronics projects.

“I feel that, going further in the future, maybe we could have a lot of them build very cool tech on their own without us guiding them to do it,” Elisha said.

Elisha noted that the major challenges they face as volunteers are the lack of electricity in the camp, as some of the tech and AI concepts they are introducing to the children require electricity.

“Sometimes we have to come with a backup power supply from home, and then we use it for them. We also need more Arduino kits to be able to handle more students or show more students what we’re talking about and have lots of practicals because our practicals are limited, as the kits we have are very limited,” he added.

Jerry Sunday, another volunteer with the initiative, explained that sessions are more interaction-based.

“When we notice that a student is trying to lose interest or is not doing well, we break the concepts down into basic everyday examples, and they quickly understand and relate to it,” he said, adding that students who don’t do very well are often paired with better-performing colleagues who serve as their tutors.

Despite these efforts, sessions are sometimes disrupted.

“There is no consistency in attendance, especially during the rainy season, because most of them go to help their parents on the farm,” the volunteer said.

A 2024 fact sheet on Nigeria’s education, developed by the United Nations Children’s Fund (UNICEF), shows that rural and poor children across all levels have lower school completion rates than urban and wealthier children, whose completion rates are above average. The report further states that while 90 per cent of children from the wealthiest quintile complete senior secondary education, less than 16 per cent of children from the poorest quintile do so.

Against all odds, the children continue to excel.

Rebecca David, a displaced woman from Madagali whose daughters participate in the chess programme, noted that their confidence has improved since they enrolled.

“They are now smarter and more critical in doing regular things at home,” she said.

With a focus on long-term sustainability, the initiative aims to partner with local and international organisations to enrol more children in school, expand opportunities for the children, and ensure that displaced children have the chance to dream beyond the confines of their camps.