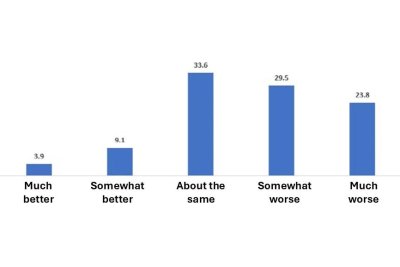

A chart shows South Korean small business owners’ views of the business environment in 2025. graphic by Asia Today and translated by UPI

Jan. 13 (Asia Today) — About 42.7% of South Korean small business owners expect the business environment to worsen this year, with most saying they need financial support, an industry group said Tuesday.

The Small Business Association said its “2026 New Year business conditions survey” found 53.3% of respondents rated their business environment in 2025 as poor, while 33.6% said it was average and 13.0% said it was good.

Respondents cited weaker domestic demand and reduced consumption as the top factor behind poor conditions, at 77.4%. Other reasons included higher financial costs tied to interest rates and rising debt, at 33.4%, increased raw material and supply costs, at 28.3%, and labor cost burdens and staffing difficulties, at 26.4%.

On business performance, 69.2% described results in 2024 as poor, down 15.9 percentage points from the previous year, the association said.

For 2025, the largest share of respondents, 20.5%, projected average monthly operating profit between 1 million won and less than 2 million won ($760-$1,520). Another 17.9% expected 0 to less than 1 million won ($0-$760) and 17.1% expected 2 million to less than 3 million won ($1,520-$2,280). Overall, 58.2% reported expected monthly operating profit below 3 million won ($2,280), including those posting losses.

By sector, the share earning less than 3 million won was highest in hair and beauty, at 67.7%. The figure was also high among businesses with no employees, at 69.9%, compared with firms that had workers.

For this year’s outlook, 29.7% said conditions would remain about the same, while 27.6% expected improvement. Wholesale and retail showed the highest expectation of deterioration, at 45.8%, and businesses operating for seven years or more also posted a high pessimism rate, at 46.9%.

Respondents said the most burdensome cost item this year would be financial costs such as interest, at 48.7%, followed by labor costs, at 38.1%, raw material costs, at 36.7%, and rent, at 33.5%.

On hiring, 57.3% said they plan to maintain current staffing levels, while 22.8% were undecided. Some 11.8% said they expect to reduce headcount and 8.0% plan to expand. Manufacturing showed a higher plan to add workers than other sectors, while firms with three to four employees more often anticipated cutting staff.

For funding conditions, 69.1% said access to financing is difficult. The most common concerns were high interest burdens, at 59.4%, insufficient loan limits, at 49.7%, and complicated administrative procedures, at 28.8%.

Looking ahead, respondents said the biggest risk to operations is weak domestic demand tied to low growth, at 77.7%. Other pressures included consumer price increases linked to exchange rates and import costs, at 36.7%, and minimum wage hikes, at 31.9%.

When asked what support is most needed, 71.9% chose financial support. Tax support followed at 39.0%, with marketing and sales channel support at 22.9% and efforts to reduce excessive or overlapping regulations by industry at 19.0%, the association said.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.