China lowers GDP growth target to 4.5-5% amid economic slowdown

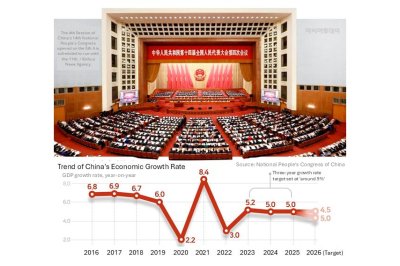

Delegates attend the opening session of the Fourth Session of China’s 14th National People’s Congress at the Great Hall of the People in Beijing on March 5, 2026, as China sets its 2026 GDP growth target at 4.5% to 5%. Graphic by Asia Today and translated by UPI

March 5 (Asia Today) — China has lowered its economic growth target to between 4.5% and 5% for 2026, marking the lowest level in about 35 years as the country grapples with deflation, weak domestic demand and mounting external pressures.

Chinese Premier Li Qiang announced the target Wednesday in a government work report at the opening of the Fourth Session of the 14th National People’s Congress in Beijing.

The new range represents a modest reduction from the government’s previous goal of growth of “around 5%,” which had been maintained for the past three years. The change signals that Chinese leaders acknowledge mounting economic challenges.

One of the biggest concerns is the prolonged downturn in the country’s real estate sector, which analysts estimate accounts for roughly a quarter of China’s gross domestic product. The continued slump has contributed to weakening consumer spending.

Youth unemployment, U.S. tariffs and technology restrictions and broader global uncertainty have also weighed on the outlook, making even the lower end of the target difficult to achieve.

Despite the slowdown, Beijing signaled plans to support the economy through fiscal stimulus. Authorities plan to issue 1.3 trillion yuan in ultra-long-term special government bonds to finance major infrastructure projects and consumption subsidies.

The government also plans to issue an additional 300 billion yuan in special bonds to strengthen the capital base of state-owned commercial banks.

China’s defense budget will rise 7% this year to 1.9096 trillion yuan, slightly lower than the 7.2% increases recorded annually over the past three years.

The continued growth in military spending underscores Beijing’s commitment to modernizing its armed forces ahead of the centennial of the People’s Liberation Army in 2027.

Li also outlined long-term goals tied to the country’s upcoming 15th Five-Year Plan for 2026-2030, saying China aims to maintain steady economic expansion and double per capita GDP by 2035 compared with 2020 levels.

The premier said China will increase research and development spending by more than 7% annually during the plan period.

In foreign policy remarks, Li said China “firmly opposes hegemony and power politics,” a phrase widely interpreted as criticism of the United States.

However, the tone of the criticism was relatively restrained. Observers in Beijing say the cautious language may reflect efforts to ensure a smooth visit later this month by U.S. President Donald Trump for talks with Chinese President Xi Jinping.

— Reported by Asia Today; translated by UPI

© Asia Today. Unauthorized reproduction or redistribution prohibited.

Original Korean report: https://www.asiatoday.co.kr/kn/view.php?key=20260305010001413