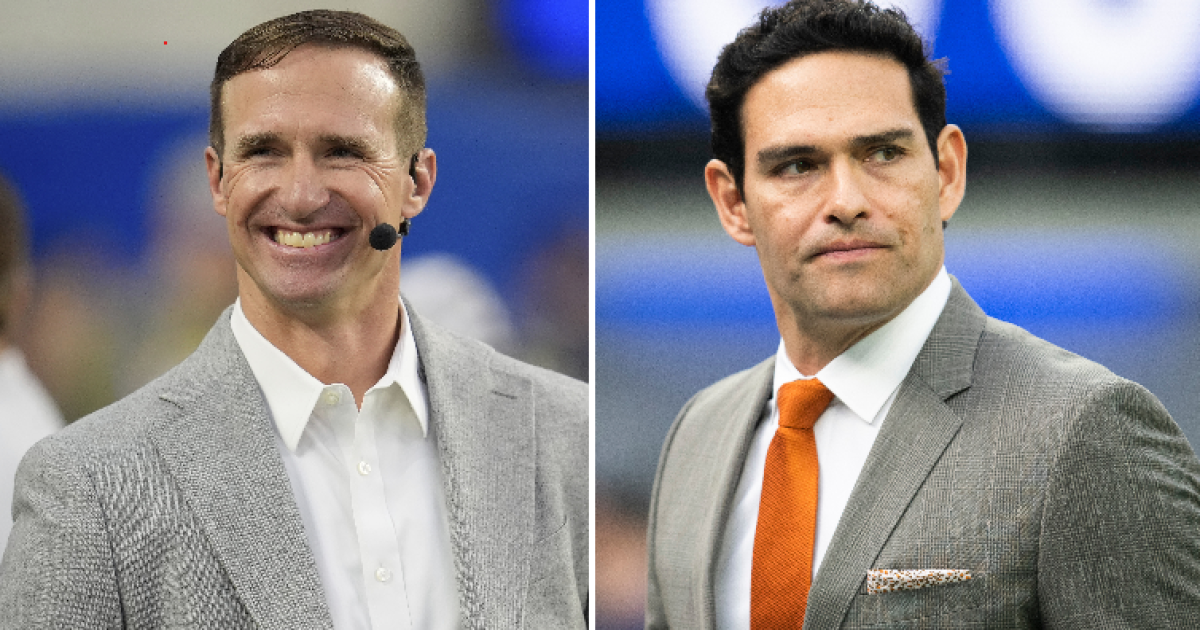

Fox Sports hires Drew Brees, confirms Mark Sanchez is gone

Drew Brees is in at Fox Sports.

Mark Sanchez is out.

The network announced Friday that Brees, the MVP of Super Bowl XLIV, has been hired as an NFL game analyst. He will join play-by-play announcer Adam Amin in the booth starting Nov. 16.

Amin had previously been paired with Sanchez, who is facing a felony battery charge after a physical altercation with a 69-year-old truck driver in Indianapolis last month. Sanchez, who was stabbed in the abdomen during the incident, has not been on the air since then, and a Fox Sports spokesperson told The Times on Friday that he “is no longer with the network.”

“There will be no further comment at this time,” the spokesperson added.

Sanchez has been charged with a level five felony of battery involving serious bodily injury as well as two misdemeanors — unauthorized entry of a motor vehicle and public intoxication — after an Oct. 4 scuffle with Indiana resident Perry Tole.

Sanchez was in Indianapolis that weekend to cover the Colts’ game against the Las Vegas Raiders. According to a probable cause affidavit filed by the Indianapolis Metropolitan Police Department, Sanchez threw Tole toward a wall and also onto the ground during the altercation, while Tole sprayed Sanchez with pepper spray and eventually stabbed him.

Tole spent two days in the hospital after suffering a deep laceration on his left cheek that his attorney said affected his ability to speak. On Oct. 6, Tole filed a civil lawsuit against Sanchez, alleging he had suffered “severe permanent disfigurement, loss of function, other physical injuries, emotional distress, and other damages” as a result of the 38-year-old former NFL player’s actions.

Fox Corp. was named as a co-defendant in the case.

Sanchez remained in the hospital for a week after the incident. He was excused from attending an Oct. 22 pre-trial conference for his criminal case, as his attorney said he was still recovering from his injuries. The trial is set to begin Dec. 11.

With Brees, Fox has replaced Sanchez with one of the NFL’s all-time greats at quarterback. Brees played for the San Diego Chargers and New Orleans Saints during his 20 years in the NFL and is second behind Tom Brady in many of the league’s passing records, including touchdowns and yards. In his first year of eligibility, he is among the 52 modern-era players under consideration for the 2026 Pro Football Hall of Fame class.

“Drew is one of the best to ever play the game, and we couldn’t be more excited to have his prolific credentials and unique insights as part of our coverage on Sundays,” Brad Zager, president of Production and Operations at Fox Sports, said in a statement. “We’re thrilled to welcome him to the Fox Sports family.”

Upon retiring in 2020, Brees called games on NBC for one season. More recently, he has appeared on in-studio shows on various networks and is slated to be part of Netflix’s coverage of Christmas Day games for the second year.

“I appreciate the opportunity Fox has given me in the booth and with their team,” Brees said in a statement. “I hope my passion for this game is reflected in the knowledge and insights I provide to the fans each Sunday.”