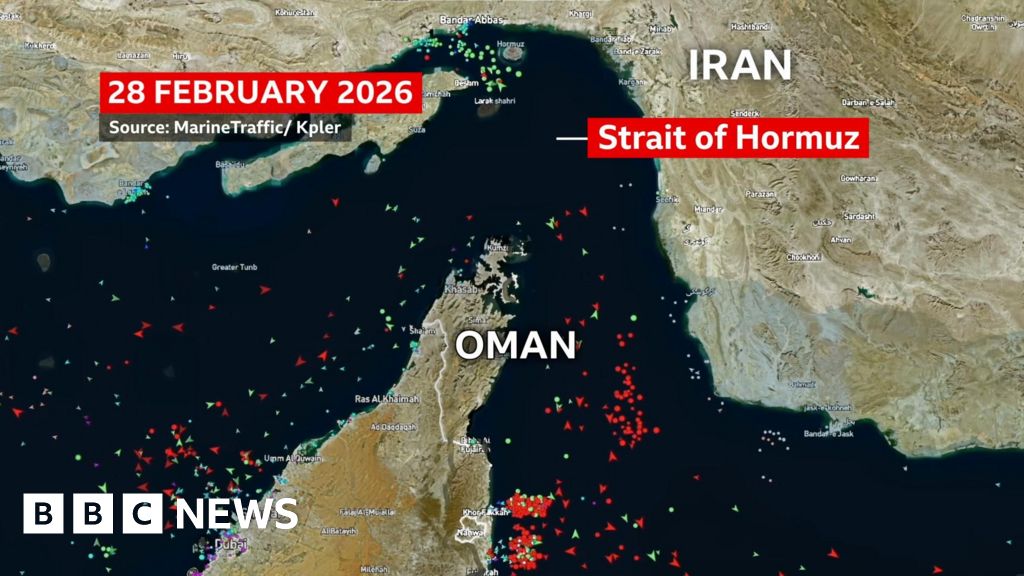

Timelapse shows change in the flow of ships in the Strait of Hormuz

The Strait of Hormuz is a key artery for the movement of global energy supplies.

Usually, about 20% of global oil and gas passes through the narrow shipping lane in the Gulf.

Iran’s General Sardar Jabbari said that Tehran will now “not let a single drop of oil leave the region”.

A timelapse of marine traffic showed the flow of ships has decreased in the strait since the US and Israeli coordinated military offensive against Iran began on 28 February 2026.

Blocking the strait could further inflate the cost of goods and services worldwide, and hit some of the world’s biggest economies, including China, India and Japan, which are among the top importers of crude oil passing through the waterway.