Hugh Morris obituary: Cricketer and former ECB chief leaves stellar legacy

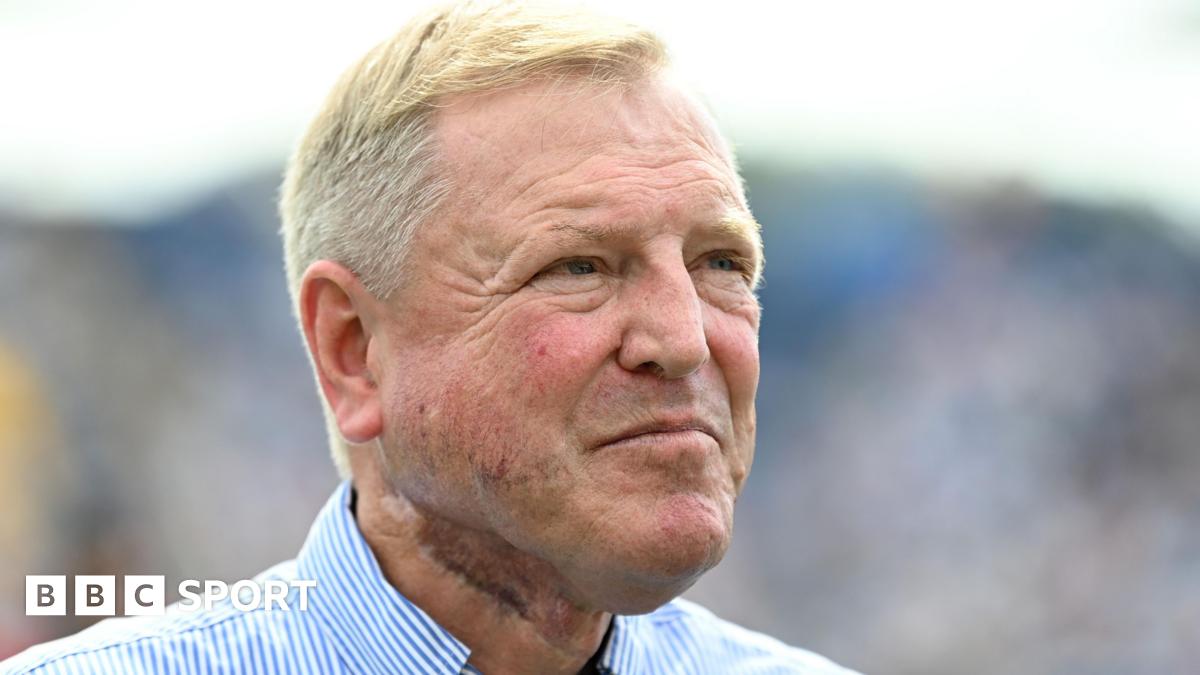

Despite his standing in the game, Morris was a friendly and unassuming presence around Glamorgan’s home ground in Cardiff, always happy to stop for a chat with supporters and occasionally helping ticket staff on busier matchdays.

He was a patron of Heads Up, a charity supporting research into head and neck cancer, after surviving throat cancer diagnosed in 2002, and was appointed MBE 20 years later for services to cricket and charity.

Morris was diagnosed with bowel cancer in January 2022 and, having returned to work later that year, left his role as Glamorgan chief executive in September 2023 to spend time with his family as he underwent treatment.

When he was inducted into the Welsh Sports Hall of Fame in 2024, Morris could not be at the ceremony because he was attending a family wedding.

When organisers surprised him by presenting him with the award at his local golf club, Morris was genuinely taken aback – an endearingly sincere reaction from a man who achieved so much yet remained so humble, warm and human throughout.