It’s time to look well beyond your own borders for affordable opportunities worth plugging into.

If you’re hesitant to put $1,000 into a new trade in any of the stock market’s most popular picks right now, you’re not crazy. The S&P 500 (SNPINDEX: ^GSPC) is now priced at a frothy 25 times its trailing earnings, while data from Yardeni Research indicates the “Magnificent Seven” stocks that have led the market higher since 2023 sport an average forward-looking price/earnings ratio of more than 30. That’s a lot, leaving them — along with the overall market — vulnerable to weakness. Factor in the tariff wars that don’t appear to be cooling off, and it’s easy to justify staying on the sidelines.

The situation doesn’t require you to sit out altogether, though. It just means you should make a point of investing that $1,000 in growth companies with few (if any) direct ties to the United States, and stocks with more reasonable valuations relative to their potential growth.

One name worth a $1,000 investment comes to mind above all the rest.

What’s MercadoLibre?

If you’ve ever heard of MercadoLibre (MELI -3.18%), then there’s a good chance you’ve heard it called the “Amazon (AMZN -1.34%) of Latin America.” And it’s not an unfitting description. It isn’t a perfectly accurate one, though. Yes, MercadoLibre helps companies sell goods online. Unlike Amazon, though, this company also operates a major digital payments business that looks more like PayPal‘s, yet also manages a logistics arm that supports its e-commerce, provides a range of banking and bank-like services to merchants, and even helps brick-and-mortar stores handle inventory and payments. It’s a proverbial soup-to-nuts business.

And it’s growing. Last quarter’s revenue growth of 34% carried its top line to nearly $6.8 billion, accelerating long-established bigger-picture uptrends, and pumping up profits by almost as much.

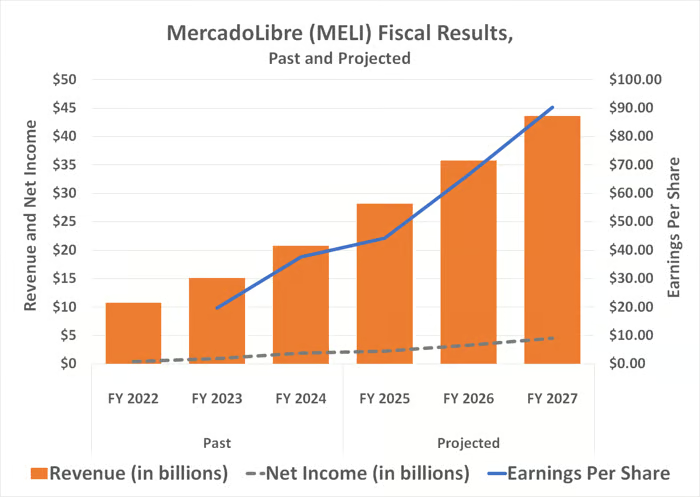

Data source: Simply Wall St. Chart by author.

All of it’s just happening in Latin America, with the bulk of its business taking shape in Brazil, Mexico, and Argentina.

The thing is, this is exactly where you’d want one of your holdings to focus right now in the way MercadoLibre is positioning itself for the future.

Plugging into the continent’s connectivity revolution

Getting straight to the point, where North America’s internet connectivity industry was 20 years ago is in many ways where South America’s is now. Although the internet has existed there since its infancy, it’s only now becoming commonplace. For perspective, whereas Pew Research says 96% of U.S. adults now have access to broadband internet, Standard & Poor’s reports that less than 60% of Latin American and Caribbean households are likely to even have the option of fixed broadband service before the end of this year.

There’s a geographically unique nuance worth noting, however. That is, a wide and growing swath of the region’s population uses their smartphones as their primary — and sometimes only — point of access to the World Wide Web. GSMA Intelligence suggests Latin America’s 2023 count of 418 million mobile internet users should reach 485 million by 2030. Even then, though, there’s room for continued growth. At 485 million, that would still only be a penetration rate of 72% of the region’s population.

And just like here, it’s not taking South America’s consumers very long to figure out that their handheld devices are great tools for shopping online, and even making digital payments. Industry research outfit Payments and Commerce Market Intelligence expects the continent’s e-commerce industry to grow 21% year over year in 2025, en route to nearly doubling in size between 2023 and 2027. Simultaneously, the research outfit reports 60% of consumer spending in Latin America is now facilitated by digital and electronic payments, led by Brazil — where MercadoLibre is a force.

The company is simply riding this growth trend. Analysts expect MercadoLibre’s top line to more than double between last year and 2027, more than doubling its bottom line with it.

Just focus on the bigger picture

There is some drama. Investors keeping tabs on this company may recall that shares tumbled in early August in response to the company’s disappointing Q2 profit. Despite the strong sales growth, per-share earnings of $10.39 fell short of analysts’ estimates of $11.93, falling 1.6% from the year-ago comparison. Blame free shipping, mostly. Taking a page out of Amazon’s playbook, MercadoLibre spent more on free shipping in Brazil than investors were anticipating.

Now, just take a step back and look at the bigger picture that most investors seem to be seeing again, nudging the stock higher as a result. The free shipping strategy worked out all right for Amazon. It might work out even better for MercadoLibre in the long run, given just how fragmented the region’s e-commerce market currently is. In this vein, eMarketer says MercadoLibre’s market-leading share of the region’s e-commerce business still only accounts for about one-third of the industry’s total sales, with no other player accounting for more than 5% of the regional market’s online shopping.

In other words, there’s an opportunity for an enterprise that’s willing and able to act on it. MercadoLibre seems to be that enterprise. Current and interested investors are just going to need to be patient, as the world was with Amazon.

This might help: Despite the added expense of free shipping that’s likely to linger for a while as a means of turning consumers into regular customers, the analyst community isn’t dissuaded. The vast majority of them still rate MercadoLibre stock as a strong buy, maintaining a consensus target of $2,920.91, which is 17% above the ticker’s present price. That’s not a bad tailwind to start out a new trade with if you have $1,000 available to invest.