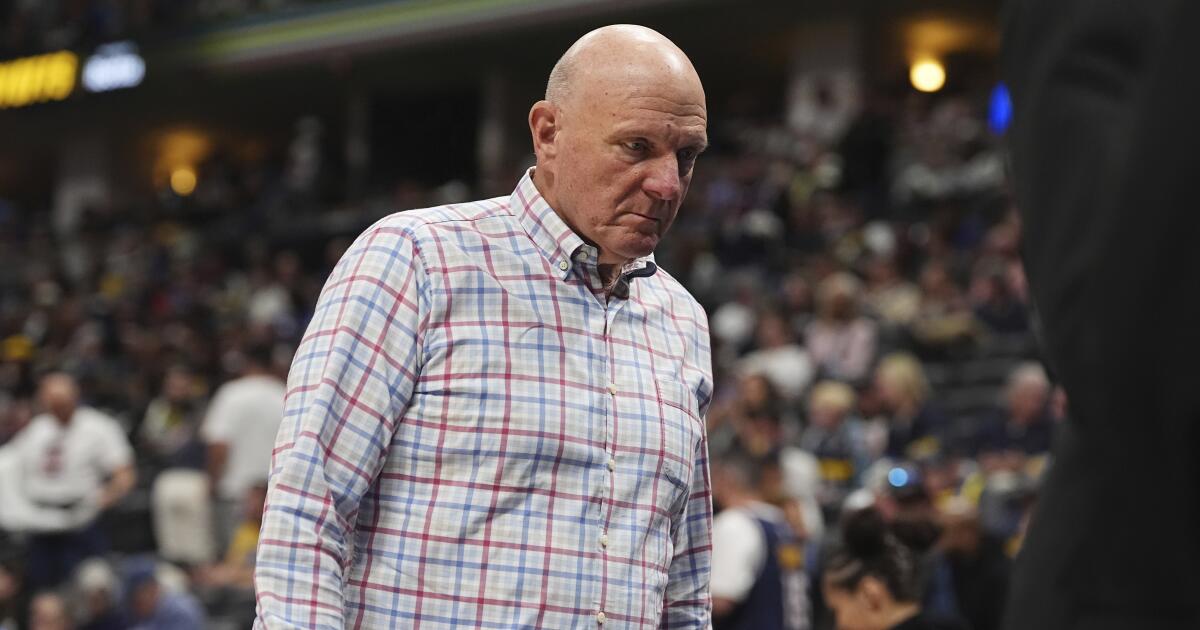

Clippers owner Steve Ballmer sued for fraud by Aspiration investors

Clippers owner Steve Ballmer is being sued by 11 former investors in the sustainability firm Aspiration Partners.

Ballmer was added this week as a defendant in an existing civil lawsuit against Aspiration co-founder Joseph Sanberg and several others associated with the now-defunct company. Ballmer and the other defendants are accused of fraud and aiding and abetting fraud, with the plaintiffs seeking at least $50 million in damages.

“This is an action to recover millions of dollars that Plaintiffs were defrauded into investing, directly or indirectly, in CTN Holdings, Inc. (‘Catona’), previously known as Aspiration Partners, Inc,” reads the lawsuit, which was initially filed July 9 in Los Angeles County Superior Court, Central District.

Attorney Skip Miller said his firm, Miller Barondess LLP, filed an amended complaint Monday that added the billionaire team owner and his investment company, Ballmer Group, as defendants in light of recent allegations that a $28-million deal between Aspiration and Clippers star Kawhi Leonard helped the team circumvent the NBA’s salary cap.

“Ballmer was the perfect deep-pocket partner to fund Catona’s flagging operations and lend legitimacy to Catona’s carbon credit business,” says the amended complaint, which has been viewed by The Times. “Since Ballmer had publicly promoted himself as an advocate for sustainability, Catona was an ideal vehicle for Ballmer to secretly circumvent the NBA salary cap while purporting to support the company as a legitimate environmentalist investor.”

Although Ballmer did invest millions in Aspiration, it is not known whether he was aware of or played a role in facilitating the company’s deal with Leonard. The Times reached out to the Clippers for a comment from Ballmer or a team representative but did not receive an immediate response.

CTN Holdings filed for bankruptcy in March and, according to the lawsuit, is no longer in operation.

In late August, Sanberg agreed to plead guilty in federal court to a scheme to defraud investors and lenders of more than $248 million. On Sept. 3, investigative journalist Pablo Torre reported on his podcast that after reviewing numerous documents and conducting interviews with former employees of the now-defunct firm, he did not find evidence of any marketing or endorsement work done by Leonard for the company.

That was news to the plaintiffs, according to their amended lawsuit.

“Ballmer’s purported status as a legitimate investor in Catona was material to Plaintiffs’ decision to invest in and/or keep their investments with Catona,” the complaint states.

It also says that “Sanberg and Ballmer never disclosed to Plaintiffs that the millions of dollars Ballmer injected into Catona were meant to allow Ballmer to funnel compensation to Leonard in violation of NBA rules and keep Catona’s failing business afloat financially. Sanberg and Ballmer’s scheme to pay Leonard through Catona to evade the NBA’s salary cap was only later revealed in 2025, by journalist Pablo Torre.”

Miller said in a statement to The Times: “A lot of people including our clients got hurt badly in this case. This lawsuit is being brought to make them whole for their losses. I look forward to our day in court for justice.”

The NBA announced an investigation into the matter in early September. Speaking at a forum that month hosted by the Sports Business Journal, Ballmer said that he felt “quite confident … that we abided [by] the rules. So, I welcome the investigation that the NBA is doing.”

The Clippers said in a statement at the time: “Neither Mr. Ballmer nor the Clippers circumvented the salary cap or engaged in any misconduct related to Aspiration. Any contrary assertion is provably false: The team ended its relationship with Aspiration years ago, during the 2022-23 season, when Aspiration defaulted on its obligations.

“Neither the Clippers nor Mr. Ballmer was aware of any improper activity by Aspiration or its co-founder until after the government instituted its investigation.”

Leonard also has denied being involved in any wrongdoing associated with his deal with the now-defunct firm. Asked about the matter Sept. 29 during Clippers media day to open training camp, Leonard said, “I don’t think it’s accurate” that he provided no endorsement services to the company. He added that he hadn’t been paid all the money due to him from the deal.