Article content

(Bloomberg) — Investors are warming up toward Asian emerging-market stocks as the dollar’s rally pauses and US President Donald Trump’s initial tariff onslaught proves less punishing than earlier envisaged.

Investors are warming up toward Asian emerging-market stocks as the dollar’s rally pauses and US President Donald Trump’s initial tariff onslaught proves less punishing than earlier envisaged.

(Bloomberg) — Investors are warming up toward Asian emerging-market stocks as the dollar’s rally pauses and US President Donald Trump’s initial tariff onslaught proves less punishing than earlier envisaged.

Article content

Article content

Money managers snapped up more than $700 million of shares in Asian developing nations outside China in the five days through Friday, ending seven straight weeks of outflows. An MSCI index of regional equities excluding China handed investors a return of 1.8% last week, trimming its decline over the past six months to about 12%.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

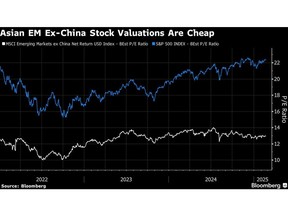

The uptick adds to signs the tide may be turning for regional equities after they underperformed their global peers last year due to the strengthening dollar and concern they would suffer from global trade tensions. Despite the recent gains, the MSCI Asia EM ex-China Index still looks relatively cheap, trading at some 15 times its one-year forward earnings estimates, versus 22 times for the S&P 500 Index.

“With slower and smaller ‘Trump Tariffs’ than expected, sentiment in these markets will likely improve and spur some rebound,” said Han Piow Liew, a fund manager at Maitri Asset Management Pte, a family office based in Singapore. “Less barriers to trade, coupled with a weaker dollar and rate cuts, sets up a more pro-growth global environment.”

Investors are increasingly taking the view that the tariff threats announced by Trump are mainly negotiating tactics.

The president, for example, said in early February he intended to impose 25% levies on imports from Canada and Mexico, but then agreed to postpone them after the countries acceded to some of his demands. He also delayed a plan to end tariff exemptions on some goods from China and Hong Kong.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Bloomberg’s gauge of the dollar has dropped more than 3% from its high in early February as tariff fears have cooled. A weaker dollar is seen as positive for Asia’s emerging economies as many of them rely on imports priced in the currency, and it also gives their central banks more scope to cut interest rates to support growth.

There are at least some signs the long period of dollar strength is nearing its end. Asset managers trimmed bullish dollar bets for four straight weeks through Feb. 11, according to the latest data from the Commodity Futures Trading Commission, although overall positioning remains long.

“Reduced trade tensions, even if not fully eliminated, can create a more stable environment for businesses and investors in emerging markets,” said Manish Bhargava, chief executive officer at Straits Investment Management in Singapore. “Moderation in tariffs would likely ease trade tensions, benefiting Asian economies heavily reliant on exports.”

The easing of tariff fears has helped power gains in export-driven economies such as South Korea, where the benchmark Kospi index has risen 5.5% this month, outperforming the 1.3% advance in the S&P 500 Index.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Regional equities have been given a further tailwind from the new artificial-intelligence app launched by China’s DeepSeek that has bolstered demand for technology firms across Asia. Part of that’s due to optimism the AI capability can be applied to range of industries, including automakers and e-commerce firms.

“We are excited by the opportunities that exist across the region as a result of a new technology product cycle,” said Andrew Swan, head of Asia ex-Japan equities at Man Group Plc in Sydney. “As AI becomes democratized, cheaper and more efficient, we expect to see a new cohort of beneficiaries as innovation moves downstream, an area where Asian companies have significant exposure.”

To be sure, there’s still every possibility Trump carries through on many of his tariff threats, leading to another leg higher in the dollar. The President upped his invective further last week, saying he would likely impose levies on automobile, semiconductor and pharmaceutical imports of around 25%, with an announcement coming as soon as early April.

For now though, emerging-Asian stocks are attracting buyers. William Yuen, an investment director at Invesco Hong Kong Ltd., said he’s added exposure to some Asean markets such as Indonesia and Philippines.

The underperformance of emerging-Asian shares caused by the strong dollar provided an opportunity to invest, said Yuen, whose consumer demand fund has beaten 92% of its peers over the past year. “These companies were sold down because of macro factors, but underneath we see growth and earnings delivery.”

—With assistance from Matthew Burgess.

Article content

Share this article in your social network