Article content

(Bloomberg) — A slowing economy and cheaper alternatives are likely to take the edge off China’s appetite for natural gas.

A slowing economy and cheaper alternatives are likely to take the edge off China’s appetite for natural gas.

(Bloomberg) — A slowing economy and cheaper alternatives are likely to take the edge off China’s appetite for natural gas.

Article content

Article content

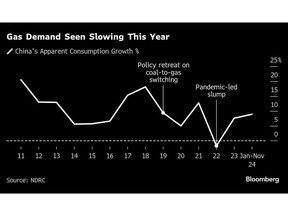

Consumption of the cleaner-burning fuel, billed as a crucial bridge to net zero, has regularly seen double-digit percentage growth in recent years. But that’s expected to subside to more modest levels as weakness in industrial usage and a surfeit of both dirty coal and renewable energy put the brakes on demand.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

or

Article content

Government policy isn’t helping. Beijing’s program of switching the country from coal to gas has lost momentum, while some provinces are ordering cuts in electricity prices to support their factories. All the while, increases in domestic output, as well as more supply of gas piped overland from Russia, are being encouraged. That bodes particularly ill for the seaborne tankers that carry pricier liquefied natural gas to China’s coastal terminals.

Gas imports climbed nearly 10% to a record of over 130 million tons in 2024, although the headline figure masks a drop off in demand in recent months for LNG, which is shipped from as far afield as Australia and the US and accounts for nearly 60% of China’s overseas supply.

China International Capital Corp. expects growth in apparent gas demand — or domestic production plus imports — to fall to 6.2% this year, from an estimated 9.4% in 2024, according to a note from the bank last month. Chinese consultancy Gastank also expects a drop to 6%.

Guangdong province, a coastal economic powerhouse that has rapidly expanded its gas consumption, is a case in point. The government there is reducing power bills to bolster its export-led industries ahead of a looming trade war with the US. Gastank estimates that fuel costs in the province may need to fall to about $7 per million British thermal units, which is around half the current price of LNG, according to chief information officer Rita Huang.

Top Stories

Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Thanks for signing up!

A welcome email is on its way. If you don’t see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox.

We encountered an issue signing you up. Please try again

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Guangdong is also in the forefront of developing market-based electricity trading, which allows consumers to choose their power options. So not only will factories be reluctant to raise output — and use more fuel — while the economy is weak, they’ll also be seeking the cheapest rates, said Zhang Xiaotong, an analyst at Chinese consultancy JLC.

That puts gas imports, especially LNG, at a steep disadvantage. The menu of alternatives starts with domestically produced gas, including coal bed methane. Then there’s China’s massive glut of coal, solar and wind generation that have expanded at an unprecedented pace, as well as the nation’s burgeoning nuclear power industry.

On the Wire

China’s oil demand and growth outlook could both darken amid persistent deflation and its declining credit impulse, according to Bloomberg Intelligence.

China exported a record amount of goods last year, swelling its trade surplus to almost $1 trillion and underscoring how global commerce remains unbalanced despite government protectionism and efforts by companies to diversify their supplier bases.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Lunar New Year is usually a pretty sleepy time for car dealerships in China, as people stop work and head home for the lengthy holiday. This year could be different.

This Week’s Diary

(All times Beijing unless noted.)

Tuesday, Jan. 14:

Wednesday, Jan. 15:

Thursday, Jan. 16:

Friday, Jan. 17:

Saturday, Jan. 18

Article content

Share this article in your social network