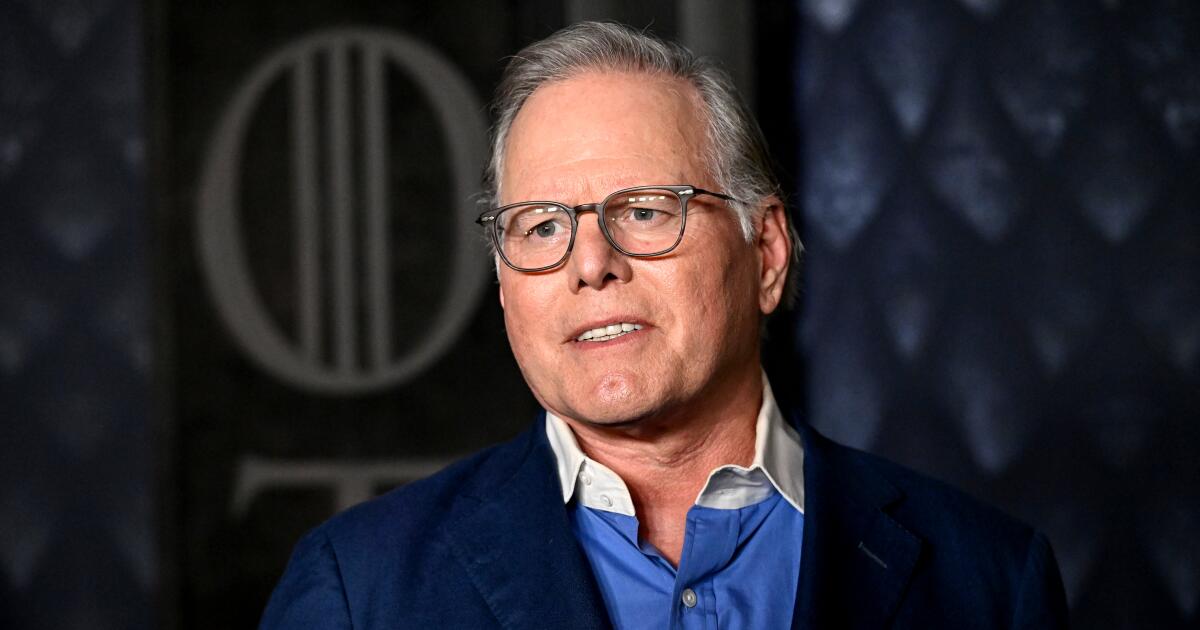

Warner Bros. Discovery has modified Chief Executive David Zaslav’s contract for a second time this year to prepare for the company’s proposed breakup.

This month’s alterations were outlined in an SEC filing on Thursday — a week before initial bids are due in the Warner Bros. Discovery auction. Industry sources expect Paramount, Comcast and Netflix to make offers for the embattled entertainment company that owns HBO, CNN, Food Network and the storied Warner Bros. movie and television studios.

Warner Bros. Discovery declined to comment.

The sale kicked off in September when David Ellison-led Paramount made an unsolicited offer for Warner Bros. Discovery — a month after Ellison and RedBird Capital Partners had acquired Paramount from the Redstone family in an $8-billion deal. The company since has made at least three bids — but all were unanimously rejected by the Warner Bros. Discovery board, which viewed them as too low.

Paramount’s most recent solicitation for Warner Bros. Discovery was for $23.50 per share, which would value the company at about $58 billion.

The external jockeying for Warner Bros. Discovery set the stage for Zaslav and the Warner board to amend his employment agreement. The contract was revised Nov. 7 to clarify that various spin-off configurations would result in the same incentives for Zaslav.

Previously, his contract was amended to outline his compensation and incentives should the Warner Bros. studios and HBO Max spin off from the parent company, as envisioned when Warner announced its breakup plans in June. At the time, Zaslav planned to stay on to run the studios and streaming company, which would be called Warner Bros. in a nod to its historic roots and the pioneering days of the movie industry.

The plan was for the company’s two dozen cable networks, including CNN, TNT, Animal Planet and TLC, to remain behind and the company renamed Discovery Global.

The company is forging ahead with its breakup plans. However, it now plans to spin off the cable channels (Discovery Global) and keep the studios, HBO and the HBO Max streaming service as the surviving corporate entity (Warner Bros.).

“The amendment clarifies that if the separation is achieved by retaining Warner Bros. and spinning off Discovery Global (a ‘Reverse Spinoff’) rather than spinning off Warner Bros. … the Reverse Spinoff will be treated in the same manner … for all purposes of the Zaslav arrangements,” the filing said.

Previously, the company had envisioned that the split would be complete by Dec. 31, 2026. But a full-blown auction could upset those plans — and the transaction could close at a later date.

Zaslav’s contract was modified to extend his employment through December 2030. Previously, his contract was set to expire in December 2027.

“This extension is intended to secure Mr. Zaslav’s leadership of WBD for the same period that we had contracted to have him serve as the chief executive officer of Warner Bros. following a separation,” the filing said.

The Wall Street Journal was the first to report that nonbinding preliminary bids for the company are due Nov. 20.