It was just last Friday that Netflix announced a blockbuster $72-billion deal to acquire Warner Bros. film and television studios, HBO and HBO Max — a tie-up that could fundamentally change Hollywood.

Yet on Monday, the stakes got even higher, as Paramount swooped in with a $78-billion hostile takeover bid it plans to take directly to Warner Bros. Discovery’s shareholders.

Paramount Chief Executive David Ellison called the Netflix deal an “inferior proposal,” saying in a statement that it “exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process.”

It all sets the stage for a long and potentially bruising fight. And the Netflix deal would have to overcome some significant regulatory hurdles, experts told me.

“This is a deal that never should have left the boardroom,” said David Balto, an antitrust attorney and a former policy director at the Federal Trade Commission during the Clinton administration. “The competitive concerns are profound. This is going to face a lot of opposition at the Justice Department.”

For one, antitrust regulators are expected to scrutinize the market share that would be controlled by a combined Netflix and HBO Max.

Netflix outlasted its rivals in the so-called streaming wars to become the dominant platform in a crowded space. That position has led to concern that gobbling up HBO Max would give Netflix outsized power in the streaming space — potentially more than 30% — which would cross a threshold under antitrust law, according to a recent letter from Rep. Darrell Issa (R-Vista) to Atty. Gen. Pam Bondi and Federal Trade Commission Chairman Andrew N. Ferguson.

Netflix executives have argued that analysis of its market share should include YouTube.

In a UBS investor conference Monday, Netflix Co-Chief Executive Greg Peters pointed to Nielsen data, which show Netflix’s shares of U.S. TV viewing is still behind YouTube‘s. Netflix represents just 8% of U.S. TV viewing in October, behind YouTube’s 12.9%.

If Netflix were to combine with Warner Bros. Discovery’s 1.3% share of U.S. TV viewing, its 9.2% would still be less than that of YouTube. (Other Nielsen data show that Warner Bros. Discovery channels have greater viewership, but Netflix is only interested in one channel, HBO).

“We think there’s a strong fundamental case here for why regulators should approve this deal,” Peters said. (The deal’s overall value is $82.7 billion due to the absorption of debt)

But who would regulators consider a competitor to Netflix? Is it YouTube, with its emphasis on shorter-form content? Or would the main competitors be other streaming services with films and series, like Disney+, Paramount+ and Peacock?

“The analytical issue there is, how do you define the market?” said George Hay, a professor of law at Cornell University and former director of economics in the Justice Department’s antitrust division. “What is their combined market share, what do they compete in and what are the alternatives available to consumers?”

The consumer angle would also invite involvement from the Federal Trade Commission. With a shrinking marketplace, the agency would likely investigate whether this could increase streaming prices for customers.

“What keeps Netflix honest is knowing there’s an HBO Max that’s right over its shoulder,” Balto said. “But once they get rid of that, they can lead the easy life, and the need to cut prices or provide better services or bid aggressively for film content — all of that will be diminished.”

Meanwhile, Hollywood unions and the Cinema United trade group have also raised concerns that a Netflix ownership of Warner Bros. would lead to fewer films being released in theaters, due to the company’s longstanding resistance to traditional movie releases. Netflix has said it would honor Warner Bros.’ theatrical release commitments and that future films without those existing deals will also go to theaters.

Beyond the U.S. concerns, Netflix would also need the blessing of regulators across the globe, and could be challenged by even state attorneys general who might have a significant number of entertainment workers in their areas who would question the effect on industry jobs.

Then, there’s the politics of it all.

President Trump himself has said he “would be involved” in his administration’s decision to bless any deal and that the combined market share of Netflix and Warner Bros. “could be a problem.”

As my colleagues Meg James and Stacy Perman have reported, Trump has openly favored Paramount’s bid for Warner Bros. Discovery, though word of Paramount backer Larry Ellison’s close ties with Trump dampened enthusiasm for the bid in Hollywood. Trump’s son-in-law, Jared Kushner, is now also one of the investors participating in the renewed Paramount bid.

Despite this involvement, the Trump administration may not have the final say on the deal, just as in the case of the AT&T deal for Time Warner.

For his part, Netflix Co-Chief Executive Ted Sarandos has also been trying to make his own case to Trump and ventured to the White House last month, Bloomberg reported.

“It’s a case in which the political issues are going to play a role,” Hay said. “They’re so front and center, and Trump has shown an inclination to get involved.”

About the only thing that’s clear is that it’s not going to be a quick process.

“This entire matter is not going to get resolved in a hurry,” said Corey Martin, managing partner at Granderson Des Rochers. “The resolution of this matter is very likely to take place over months and potentially years, and not days and weeks.”

Stuff We Wrote

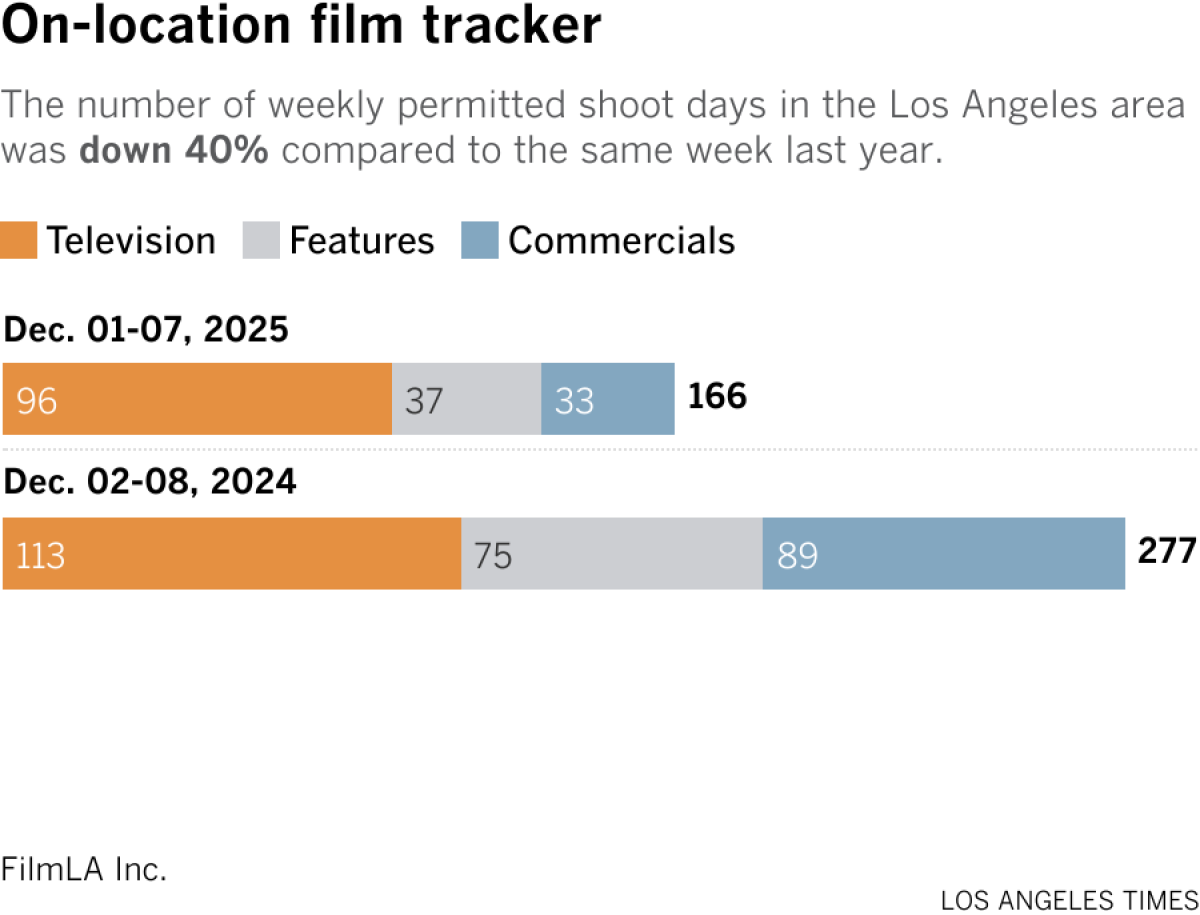

Film shoots

Number of the week

Universal Pictures and Blumhouse-Atomic Monster’s horror sequel “Five Nights at Freddy’s 2” ruled the domestic box office this weekend with a $63 million haul in the U.S. and Canada. While it doesn’t surpass the first movie’s $80 million opening weekend in 2023, it’s a massive boost for theaters, which have seen a string of slower months.

Menacing animatronic figures weren’t the only thing that brought moviegoers to theaters this weekend. Disney’s animated “Zootopia 2” brought in about $43 million domestically in its second outing. Globally, the sequel has now brought in a total of $915 million.

The strong recent showings for films such as “Zootopia 2” and “Wicked: For Good” have helped push 2025’s year-to-date domestic box office total to a little over $8 billion, up just barely — 0.8%, in fact — compared with last year.

Finally …

My colleague, Jeanette Marantos, wrote about the 105th anniversary of Altadena’s Christmas Tree Lane lighting ceremony and festival this past weekend, a bittersweet memorial for the community after a year of heartbreak.